Exploring the Reality of Financial Aid and Its Impact on Your Available Funds

When it comes to pursuing higher education, many people rely on various forms of support to lighten the financial burden of tuition, books, and living expenses. This support often raises questions about its purpose and how it can be utilized. Is it merely a helping hand, or does it open doors to additional resources that can transform a student’s experience? Understanding the intricacies of this support can clarify its true impact on academic journeys.

It’s essential to explore what these resources actually provide and how they can be managed. The perception is that such support predominantly serves to ease the immediate costs associated with education, yet the reality might encompass broader advantages. From enhancing a student’s purchasing power to alleviating stress related to financial constraints, the benefits can be far-reaching.

Every individual’s situation is unique, and interpretations of the opportunities presented vary. By examining different perspectives and experiences, a comprehensive view emerges, highlighting not only the practical aspects of such support but also the psychological and social implications it carries. This discussion will delve into these facets, shedding light on the interplay between financial assistance and the overall educational experience.

Understanding Financial Aid Basics

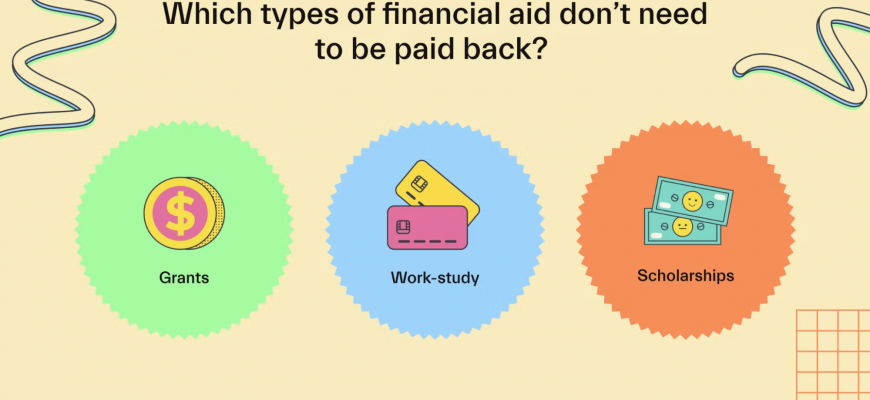

Getting support for education can seem confusing, but it doesn’t have to be. There are various types of assistance available, each designed to help students manage the costs associated with their studies. Whether it’s through grants, scholarships, or loans, the idea is to make schooling more accessible for everyone.

Essentially, these resources can play a significant role in alleviating the financial burden of tuition fees, textbooks, and living expenses. By grasping the fundamentals, you can better navigate your options and take full advantage of the opportunities that exist. Understanding the different forms of support can empower you to make informed decisions about your educational journey.

When considering these resources, it’s important to note that not all forms come with the same conditions. Some might require repayment, while others do not. Recognizing the distinction can help in planning your finances and ensuring you choose what best aligns with your situation.

Overall, exploring the world of educational support can open up doors and provide a more straightforward path toward achieving your academic goals. Being informed is the first step towards financial wellness in your scholarly pursuits.

How Grants and Scholarships Work

Grants and scholarships are an essential part of the educational landscape, serving as vital resources for many students. They come from various sources, including schools, foundations, and government entities, providing support to help individuals pursue their academic goals. The fascinating aspect of these funds is that they often don’t need to be repaid, setting them apart from loans.

When it comes to scholarships, they typically reward hard work, talent, or specific characteristics. Many organizations look for achievements in academics, sports, or community service to determine eligibility. On the other hand, grants are generally based on financial necessity, assessing the economic situation of the applicant and their family. This dual approach ensures that a wide range of students can access opportunities tailored to their needs and strengths.

The application process for both types of assistance can vary significantly. Scholarships may require essays, recommendation letters, and often an interview. Grants usually ask for financial information, which can be submitted through standardized forms like the FAFSA. Regardless of the path, students must navigate the process carefully to maximize their chances of receiving support.

Once awarded, these funds can cover tuition, fees, and sometimes even living expenses. In this way, they serve to alleviate the burdens of education, empowering students to focus on their studies rather than worrying about financial burdens. In the end, grants and scholarships not only help students afford education but can also open doors to a future brimming with opportunities.

Budgeting Your Financial Assistance Wisely

Managing your resources effectively is key to achieving your academic goals. It’s not just about obtaining support; it’s about knowing how to allocate those funds to cover essential expenses like tuition, books, and living costs. Developing a solid plan can help stretch every dollar and avoid unnecessary stress.

Start by making a list of all your anticipated expenses. This includes tuition, housing, transportation, and daily necessities. By identifying where the cash will go, you can prioritize your spending and ensure that the most critical needs are met first.

Next, consider creating a monthly budget. Break down your total amount into manageable portions, allowing for a clearer picture of how much you can use each week or month. This approach helps prevent overspending and keeps you on track through the semester.

The key is to remain flexible. Unexpected costs may arise, so having some room in your plan for unforeseen expenses can save you from financial strain. Regularly reviewing your situation lets you adjust as needed, ensuring you stay within your means.

Finally, be mindful of potential extras that can arise during the academic year, like events or trips. While it’s tempting to indulge, remember that staying within your budget will ultimately bring you peace of mind as you focus on your studies.