Exploring the Availability of Financial Aid for Certificate Programs

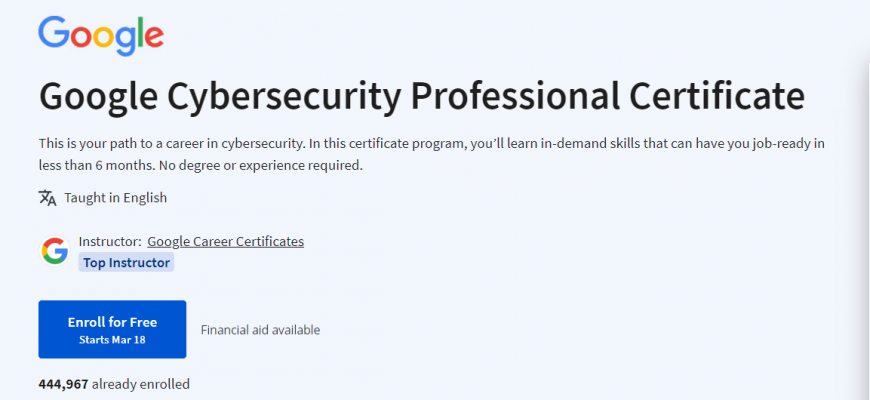

In today’s fast-paced world, many individuals are eager to enhance their skills or pivot their careers without committing to lengthy academic paths. Short-term learning opportunities have gained popularity for their ability to offer targeted training in specific areas. As these options become more accessible, the question arises about the types of assistance that can be utilized to make them financially feasible.

When exploring avenues for funding, it’s crucial to recognize that various resources and programs exist, each with its own eligibility criteria. While some might think that assistance options are limited to traditional education, there are actually numerous opportunities designed to support those seeking to level up their expertise through targeted training. A deeper look into these resources can reveal exciting possibilities for aspiring learners.

With the right information and guidance, individuals can navigate the landscape of support available for their chosen courses. Whether coming from government sources, private institutions, or nonprofit organizations, understanding how to tap into these options can open doors to new career paths and personal growth.

Understanding Funding Eligibility for Certificates

Navigating the world of financial resources for educational pursuits can be quite complex, especially when it comes to short-term qualifications. Many individuals are eager to enhance their skills without committing to extensive degree programs, but they often wonder about the availability of support options for these accelerated paths. Recognizing what types of assistance are available and who qualifies can make a significant difference in fulfilling educational ambitions.

Several types of assistance may be accessible for those seeking qualifications outside traditional degree tracks. It’s essential to explore grants, scholarships, and loans specifically designated for non-degree learners. Various institutions and organizations might offer funding tailored to skill-building opportunities, and these sources vary widely in their eligibility criteria. Understanding these distinctions is crucial for making informed decisions along your educational journey.

Application processes can also differ based on the type of funding you’re pursuing. Some may require comprehensive documentation while others may have more lenient prerequisites. Staying organized and informed will aid in your efforts to secure financial support, leading to a smoother pathway toward your career goals. Conducting thorough research can help you identify the most suitable options for your unique situation.

Types of Financial Support Available

When it comes to pursuing your educational goals, there are various resources to help ease the financial burden. Understanding the different options out there can make a significant difference in your journey. From various grants to specific scholarships, individuals have numerous avenues to explore for assistance.

One popular option is grants, which do not require repayment. These funds can come from the government, private organizations, or educational institutions themselves. They aim to support students with distinct financial needs or those pursuing specific fields of study.

Additionally, scholarships are awarded based on merit, talent, or specific criteria set by the donors. They can vary widely, from small amounts to full tuition coverage, providing a fantastic opportunity for many learners.

Another viable choice is loans. While these require repayment, they often come with lower interest rates, and some may offer flexible repayment options after graduation. It’s important to carefully review the terms before committing to any borrowing.

Lastly, work-study programs allow students to earn money while studying, providing them with hands-on experience in their chosen field while helping to offset educational costs. Utilizing a combination of these options can help alleviate some of the financial challenges associated with advancing your education.

Impact of Program Length on Support

The duration of a learning experience can significantly influence the type and amount of assistance available. Shorter courses often come with different funding options compared to more extended studies. This distinction primarily arises from the varying requirements and structures that institutions offer. Understanding how length affects your financial resources is crucial for making informed choices about your education.

Typically, brief training sessions may not be eligible for certain types of funding that are reserved for longer commitments. On the other hand, extended schooling could open up a range of opportunities, including loans or grants that are contingent upon enrollment length. This interplay between duration and funding can dictate the paths learners take, making it essential to consider how long you plan to study before enrollment.

Moreover, institutions might implement varying policies based on the length of the course. For example, a comprehensive program might qualify for federal assistance, whereas a concise workshop might not meet the same criteria. Consequently, applicants should carefully examine the specifics of each option to ensure they are maximizing potential resources available to them.

When budgeting for educational pursuits, recognizing the nuances of program duration can make a substantial difference. Potential participants should always explore all available choices and consult with advisors for guidance tailored to their specific situation. This proactive approach can help in identifying the most suitable funding avenues to make educational aspirations a reality.