Exploring the Availability of FAFSA Funding for International Students

Navigating the world of education financing can be quite the journey, especially for those coming from abroad. It’s common to wonder about the various forms of assistance available and how they apply to different backgrounds. As opportunities for learners have expanded globally, understanding what resources are accessible is crucial for planning an academic path.

One key aspect to consider is the financial aid system designed to assist those in pursuit of higher education. Many potential scholars may be uncertain about what forms of support they qualify for, including grants and loans. It’s essential to explore whether aid programs extend their reach to cover individuals who are not citizens or permanent residents.

Join us as we delve into the intricacies of financial assistance options available for scholars from around the globe. We’ll provide insights, clarify eligibility requirements, and help you discover the best ways to fund your educational aspirations.

Understanding Financial Aid Options for Non-Residents

Navigating the world of higher education funding can be quite a puzzle, especially for those who come from different countries. Many aspiring scholars often wonder what financial resources are available to them as they pursue their academic dreams in the United States. It’s important to understand the landscape of support and how it varies for those not holding citizenship or permanent residency.

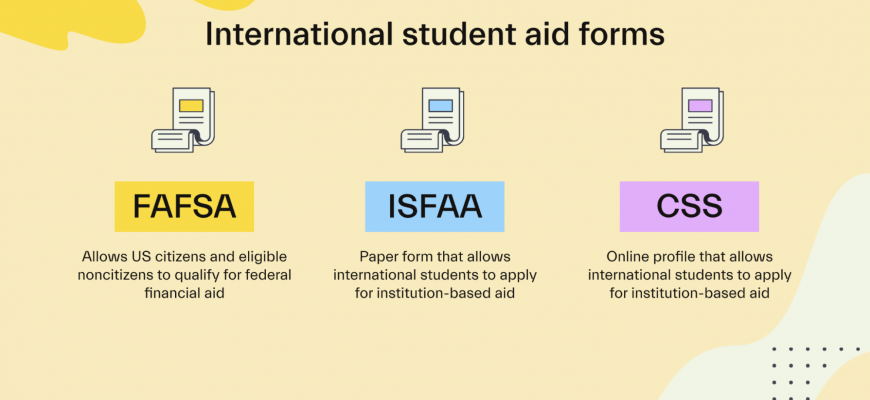

For individuals looking to finance their education, there’s a distinct difference between funding offered to domestic learners and that which is accessible to non-residents. While there may be restrictions on eligibility for certain aid programs designed for U.S. citizens, there are still various alternatives to consider. Many institutions have their own scholarships and grants that may be open to applicants from abroad, creating opportunities for talented individuals. Additionally, some private organizations provide financial assistance without the issue of residency status.

Understanding the specific requirements and options can help streamline the process and maximize the potential for receiving financial support. It’s recommended to research various sources of funding, including school-specific offerings and external scholarships tailored for non-resident applicants. By staying informed and proactive, ambitious learners can find the necessary resources to help ease the financial burdens associated with higher education.

Eligibility Criteria for Financial Aid

Understanding who qualifies for financial assistance is crucial for navigating options available for higher education. Various factors come into play when determining eligibility, including residency status, previous educational background, and specific circumstances regarding finances. Each institution may have its own set of requirements, so it’s essential to dive into the details and see what applies to your unique situation.

Generally, to be considered for monetary support, individuals must demonstrate a certain level of need based on their family’s financial situation. Documentation, such as income statements and tax returns, plays a significant role in this assessment. Additionally, the duration of anticipated enrollment and the chosen field of study can influence the ability to access funds.

Moreover, some programs may have particular prerequisites relating to academic performance or course selection. Meeting these guidelines is often necessary to qualify for assistance. International eligibility can vary widely, making it important to consult directly with institutions regarding their unique policies.

Alternative Funding Options Available

When it comes to financing education beyond borders, exploring various funding avenues can open up new opportunities. Many options exist that can help alleviate the financial burden, making it easier to achieve academic goals. From scholarships to private loans, it’s essential to consider every possible resource.

Scholarships often serve as the most sought-after choice. Numerous organizations offer merit-based and need-based awards, specifically aimed at those pursuing studies away from their home countries. Researching and applying for these can significantly reduce overall expenses.

Grants represent another promising avenue. Unlike loans, grants do not require repayment and can be awarded based on specific criteria, such as academic performance or area of study. It’s wise to seek out grants provided by educational institutions or external entities.

Additionally, private loans may be a viable option for some individuals. These loans typically offer more flexible terms compared to government funding. However, it’s crucial to thoroughly understand the repayment conditions before committing.

Lastly, consider crowdfunding. This approach allows individuals to articulate their educational ambitions and seek financial support from a wider community. Engaging with family, friends, and even social media can lead to unexpected sources of assistance.

In summary, pursuing education abroad doesn’t have to be solely reliant on governmental aid. A diverse range of funding sources can make a significant difference in achieving academic aspirations while mitigating financial stress.