Is FAFSA Really a Source of Financial Aid for Students

When it comes to funding education, many students and families find themselves at a crossroads of questions and choices. Understanding the various resources available can feel overwhelming, yet it’s crucial for navigating the landscape of financial support. One of the key elements in this journey involves a specific application that plays a significant role in the process.

Applying for financial assistance opens doors to potential funding options that can alleviate the burden of tuition costs and other expenses. However, many are left wondering how the system operates and what benefits they might receive. Clarifying these aspects can demystify the process and help individuals make informed decisions about their financial future.

In the quest for higher education, being equipped with the right knowledge about various financial resources can make all the difference. By delving into the intricate workings of these aid programs, students can uncover opportunities that may significantly impact their academic journey. Let’s take a closer look at what this means for learners seeking financial relief.

Understanding FAFSA and Its Purpose

When it comes to financing higher education, many individuals turn to a certain application that opens the door to a variety of financial resources. This process plays a crucial role in making college more accessible, especially for those who might need assistance. So, what is the true essence of this application and how does it function in helping students navigate their educational journeys?

The primary aim of this application is to assess a student’s financial needs and eligibility for various forms of aid. By gathering essential information regarding personal finances, it allows educational institutions and government bodies to determine the level of support necessary for each applicant. Notably, the outcomes can lead to grants, scholarships, or loans, all designed to ease the burden of tuition and related expenses.

Moreover, completing this form can unlock opportunities that might otherwise remain out of reach. Potential students should recognize that taking the time to fill it out may yield substantial rewards. While the process may seem daunting at first, it serves a vital purpose in the broader context of educational funding.

In essence, this application strives to create a more equitable environment for aspiring learners, enabling them to pursue their academic goals without being solely hindered by financial limitations. Understanding its importance can empower individuals to take the first step towards securing the resources they need for a successful college experience.

Types of Financial Aid Available

When it comes to paying for education, there are various forms of assistance that can lighten the financial burden. Understanding these options can help you navigate through the complexities of funding your schooling without getting overwhelmed.

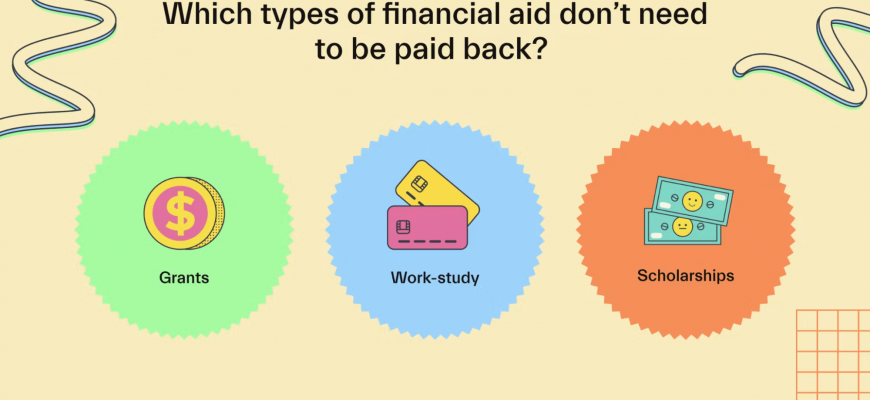

Grants are often considered the most favorable type of aid since they don’t require repayment. These funds are typically awarded based on financial need and can come from federal, state, or institutional sources. They are designed to make education more accessible for those who demonstrate economic hardship.

Scholarships are another excellent avenue. These are often merit-based, awarded for academic achievements, talents, or other specific criteria. Recipients don’t have to worry about paying back these funds, making scholarships an attractive choice for many students.

Loans provide the necessary funds upfront but come with the expectation of repayment after graduation or when education ceases. They can be federal or private, each with different terms and interest rates. It’s important to understand the implications of borrowing before deciding on this option.

Work-Study programs offer a unique approach by allowing students to work part-time while pursuing their studies. This not only helps generate some income but also provides valuable work experience that can be beneficial after graduation.

Each type of assistance plays a significant role in helping students manage the costs of their education. By exploring these resources, individuals can make informed decisions that align with their financial circumstances and educational goals.

How to Apply for FAFSA Funding

Navigating the process of securing financial assistance for higher education can feel overwhelming, but with the right steps, it becomes much more manageable. This section outlines how to embark on the journey toward receiving support for your academic pursuits. Understanding the proper procedures can open doors to various forms of funding that ease the financial burden.

First off, it’s essential to gather all necessary documents before starting your application. You’ll typically need information such as tax returns, W-2 forms, and details about your family’s financial status. Having these ready will streamline the process and help ensure accuracy in your submission.

Next, visit the official website where the application is hosted. Creating an account is usually the first step. Make sure to use an email address that you check regularly since you’ll receive important updates there.

Fill out the application carefully, providing all required details accurately. It’s wise to double-check your entries, as mistakes can lead to delays in processing your request. Once everything is filled out, submit your application before the deadline, as this can significantly affect your eligibility.

After submission, keep an eye out for any correspondence. You might be asked to provide additional information or verification documents. Responding promptly will help keep your application on track.

Finally, once you receive your eligibility results, make sure to review all available options. Different types of aid might be offered, so explore grants, scholarships, and loans, and determine what best suits your situation. Taking the time to understand your choices will empower you to make informed decisions about funding your education.