The Importance of Credit Scores in Australia and Their Impact on Financial Opportunities

Understanding your financial standing can significantly impact your life, especially when it comes to securing loans or entering into agreements. Many folks might not realize how their financial history plays a crucial role in everyday decisions, from applying for a mortgage to renting a new apartment.

In the competitive landscape of lending and financing, one’s financial credibility can determine not just eligibility for funds, but also the terms and conditions that come along with it. This means that having a good reputation can lead to favorable interest rates and better opportunities. On the flip side, a less-than-stellar history may bring about challenges that can seem overwhelming.

Throughout this article, we will unravel the various aspects of financial reputations and delve into why understanding this concept is vital for everyone. We’ll explore how it influences borrowing options and what steps can be taken to improve one’s standing.

The Importance of Credit Ratings

Navigating the world of personal finances often brings us face-to-face with the concept of financial reputations. These ratings play a crucial role in determining how lenders perceive you and can significantly influence your ability to secure loans or favorable interest rates. Understanding the weight these evaluations carry is essential for anyone looking to achieve financial stability.

Using a strong financial reputation can open doors to various opportunities such as mortgages, car loans, or even rental agreements. When lenders assess potential borrowers, they typically rely on these assessments to gauge reliability and the likelihood of timely repayments. Consequently, maintaining a solid standing can make your journey to financial success much smoother.

Moreover, positive evaluations frequently lead to lower interest rates, ultimately saving you money over time. Lenders are more inclined to offer attractive terms to those with solid reputations, as it reflects responsible financial behavior. This can translate to significant savings, especially for long-term commitments like home loans.

Lastly, regular monitoring of your financial reputation is key. Mistakes can happen, and keeping track allows you to address any discrepancies promptly. By staying informed, you can take proactive steps to enhance your standing and ensure a bright financial future.

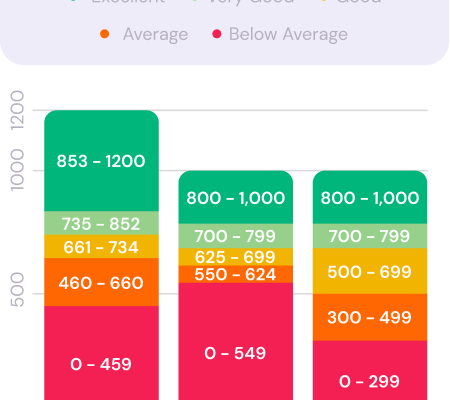

Understanding Ratings in Australia

Grasping the nuances of financial assessments is crucial for anyone looking to navigate the lending landscape. These evaluations can significantly influence the opportunities available to individuals when it comes to securing loans, rentals, or even employment in some cases. Knowing how these assessments work can empower you to make informed decisions and improve your financial health.

What influences these assessments? A variety of factors contribute to the final assessment, including payment history, the amount of available credit, and overall financial behavior. Each of these elements plays a vital role in shaping how lenders perceive risk and trustworthiness.

How can one improve their standing? Simple practices, such as consistently making payments on time, keeping credit utilization low, and regularly reviewing financial reports, can lead to positive changes. Additionally, building a history with different types of financial products can showcase reliability to potential lenders.

Understanding this evaluation process is not just about achieving a higher number; it’s about fostering a healthier financial profile. Being proactive and informed can open doors to better financial opportunities and conditions in the long run.

Impact on Financial Opportunities

The numerical representation of an individual’s creditworthiness plays a crucial role in shaping various financial prospects. It acts as a key that unlocks doors to numerous lending options and can influence the terms of borrowing significantly. When considering loans, landlords, and even potential employers often glance at this figure to gauge reliability and financial responsibility.

A solid numerical evaluation can lead to lower interest rates and more favorable loan conditions, making it simpler for individuals to attain mortgages or personal loans. Conversely, a less favorable evaluation may result in higher rates or even denial of applications, limiting choices and increasing financial strain.

Understanding how this measurement impacts various aspects of life is essential for anyone looking to make informed decisions. Being proactive about managing one’s financial standing can enhance opportunities and pave the way for a more secure financial future.