Exploring the Effectiveness of Credit Repair Services in Improving Financial Health

The journey towards improved financial standing often raises numerous questions, especially when it involves the assistance of specialized services. Many individuals find themselves pondering the effectiveness of these offerings in enhancing their monetary reputation. It’s a common concern, as the stakes are high when it comes to securing loans or favorable interest rates.

In this exploration, we’ll delve into the nuances of these services, examining their promises and the actual outcomes they deliver. With myriad options available, it’s essential to dissect what truly lies behind the marketing buzzwords and claims, allowing individuals to make informed choices about their financial futures.

Understanding the potential benefits and limitations can empower you on your path to financial freedom. Whether you’re considering seeking help or navigating the process on your own, being well-informed is key to achieving your financial goals. Join us as we uncover the realities behind the promises and provide insights into how one can effectively navigate this complex landscape.

Understanding Credit Repair Services

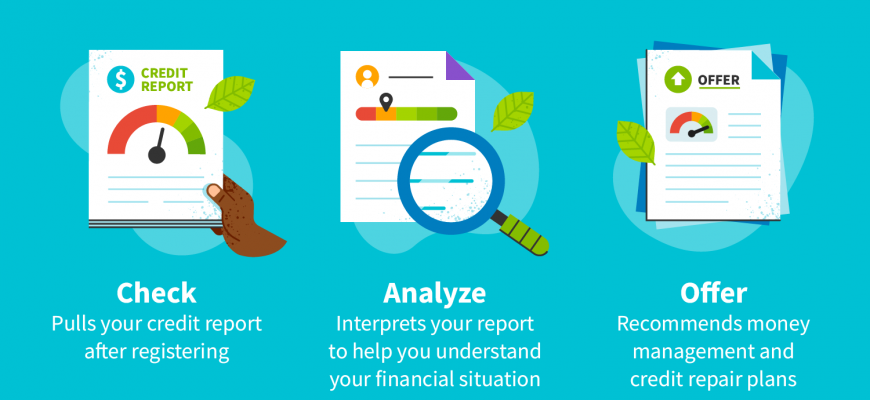

When it comes to enhancing one’s financial standing, many individuals explore various services designed to improve their situation. These offerings often aim to address inaccuracies, miscommunications, or simply to provide guidance on how to manage financial responsibilities more effectively. Understanding what these services entail can help you navigate through your options and make informed decisions.

At the core of these services lies an emphasis on reviewing personal financial histories. Professionals in this field analyze reports, identify discrepancies, and assist in the process of rectifying issues that may be affecting overall financial health. Their expertise can provide valuable insights that individuals may not have considered, ultimately leading to better financial choices.

Aside from addressing erroneous entries, these services often educate clients on best practices related to financial management. This encompasses a range of strategies that can contribute to future stability, such as budgeting techniques and understanding how various financial products work. By empowering individuals with knowledge, the aim is to foster long-term improvements rather than simply temporary fixes.

Investing in such services can be a double-edged sword; while some may find them beneficial, others may feel overwhelmed by the options available. It’s essential to approach this journey with a critical mindset, assessing the potential impact on your personal finances and ensuring the legitimacy of any service provider.

Myths and Facts About Credit Repair

When it comes to improving your financial standing, there’s a lot of information floating around, and not all of it is accurate. Many people believe certain misconceptions that can lead them down the wrong path. In this section, we’ll debunk some common myths and provide the facts to help you better understand what really happens when you seek assistance in enhancing your financial profile.

One popular belief is that seeking help guarantees immediate results. In reality, while professionals can guide you in the right direction, meaningful changes often take time and effort. Another myth suggests that inquiring about your financial status negatively impacts your score. On the contrary, checking your own status is considered a soft inquiry and won’t have any adverse effects.

Many think that once negative items are on their report, they are there for good. This isn’t necessarily true; certain entries can be challenged and potentially removed if inaccuracies are found. Additionally, it’s a common misconception that all companies provide the same level of service. In truth, quality can vary significantly between providers, so it’s essential to research and choose wisely.

Understanding these misconceptions can help you navigate the complexities of improving your financial reputation. By separating fact from fiction, you can make informed decisions and ultimately take control of your financial future.