Understanding Whether Your Credit Limit Resets After Making a Payment

Have you ever wondered how making a transaction influences your financial capacity with a lending institution? It’s a common curiosity among many individuals who manage their budgets and explore various financial products. When funds are disbursed for obligations, you might be interested in how it affects future borrowings and available resources.

In this discussion, we will dive into the mechanisms that govern your accessibility to further resources following a monetary transaction. Not all financial arrangements function identically, and understanding these nuances can empower you to make informed choices about your finances. It’s essential to grasp the potential changes that occur within established parameters when you fulfill obligations.

Stay tuned as we navigate the implications of fulfilling financial commitments, highlighting factors that can enhance or diminish your capability to utilize resources in the future. This knowledge might just change how you approach your financial planning and help you maintain better control over your spending habits!

Understanding Credit Limit Mechanics

When you use a financial product that allows you to borrow within a certain threshold, it’s essential to grasp how this system functions. Many people have questions about what happens when they make a repayment and how it influences their ability to borrow again. Let’s dive into the inner workings of this process and clarify some common misconceptions.

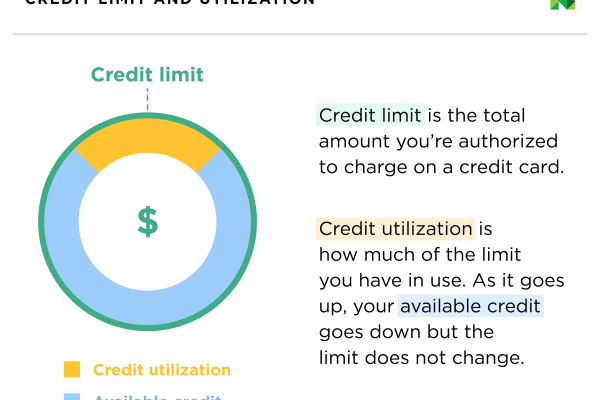

The concept behind borrowing is fairly straightforward: you are allocated a maximum amount that you can spend without incurring penalties. Each time you make a purchase, you consume part of that allotted amount. The intriguing part comes into play once you settle your dues. What happens next is often misunderstood.

Many believe that as soon as they transfer funds to settle their balance, their borrowing ability is immediately reinstated to the original amount. However, this isn’t always the case. Various factors can influence how quickly you regain access to those funds. Financial institutions often evaluate your history, outstanding balances, and even your overall financial health before deciding on the extent to which you can utilize the service again.

Additionally, timing can play a significant role. It’s important to note when your repayment is processed and how that interfaces with your billing cycle. Understanding these nuances can empower you to manage your finances more effectively and avoid surprises.

The Impact of Payments on Credit Limits

When you make a financial contribution towards your outstanding balance, it can have a significant effect on the available borrowing capacity extended to you. Each time you fulfill your obligations, your potential for future expenditures can change, creating a dynamic relationship between your payments and the resources at your disposal.

In essence, timely remittances signal responsible behavior to lenders, often leading to an enhancement in your overall capability to borrow. This shift not only reflects your reliability but also nurtures a positive credit profile, making you a more attractive candidate for higher amounts in the future.

Furthermore, when you consistently meet your financial responsibilities, institutions may reassess your situation and grant additional access to funds. This process can contribute to greater financial flexibility, allowing for more significant investments or unexpected expenses without the burden of excessive interest.

Ultimately, it’s essential to remember that staying on top of your obligations plays a vital role in shaping your financial journey. By managing your expenditures wisely, you pave the way for more opportunities ahead, enjoying the benefits of a healthy financial standing.

How to Manage Your Finances Effectively

Keeping track of your borrowing capacity is essential for maintaining a healthy financial life. Understanding how to utilize your available resources wisely can help prevent unnecessary stress and improve your overall money management skills.

Here are some practical tips to help you navigate your financial journey:

- Set a Budget: Outline your income and expenses. Knowing where your money goes can prevent overspending.

- Make Timely Repayments: Avoid late fees and negative impacts on your financial record by ensuring that you meet your obligations on time.

- Monitor Your Usage: Keep an eye on how much you spend relative to what you can comfortably manage. This helps maintain a good balance.

- Know Your Terms: Familiarize yourself with the specifics of your financial tools to avoid surprises.

- Limit New Applications: Too many requests for funds can affect your standing. Apply only when necessary.

By following these steps, you can handle your financial resources in a more effective way, leading to greater stability and peace of mind.