Exploring Whether Credit Karma Offers Budgeting Tools and Resources

In today’s world, managing your finances is more crucial than ever. With all the expenses that come our way, having a system to track income and outflow becomes a necessity. Many people seek out resources that can simplify this process, and some platforms are designed specifically for that purpose. They aim to assist individuals in taking control of their monetary situation and achieving their financial goals.

One intriguing aspect of these platforms is their ability to aid users in understanding their spending habits and making informed choices. By utilizing technology, they provide insights that can empower users to reclaim their financial independence. Such tools not only bring clarity but also help foster smarter decision-making in everyday financial matters.

As you explore the various options for overseeing your financial health, it’s essential to recognize the features and benefits these platforms offer. It’s not just about keeping track of numbers; it’s about creating a holistic view of your financial landscape. Stay tuned as we delve deeper into whether a popular tool includes functionalities that support users in managing their expenses effectively.

Understanding Features of the Financial Management Tool

When it comes to managing your finances, having the right tools at your disposal can make all the difference. One particular platform aims to assist users in understanding their financial health while offering valuable insights and resources. By providing various functionalities, it helps individuals take control of their monetary situation and make informed decisions.

This utility encompasses a range of services, making it a comprehensive option for those looking to improve their financial habits. Users can track their expenses, analyze spending patterns, and receive personalized recommendations based on their financial behavior. With the goal of promoting fiscal responsibility, this platform can help individuals establish more effective spending strategies.

Additionally, the service offers resources for checking credit ratings and learning how to enhance them over time. By incorporating educational elements, it empowers users with the knowledge needed to navigate the often-complex world of finances. It’s about more than just monitoring; it encourages proactive engagement with one’s individual financial landscape.

In a nutshell, this platform serves as a versatile resource, designed to simplify the financial management process while offering valuable insights into spending and credit. With the right tools and guidance, users can set themselves on a path to financial stability and success.

Exploring Budgeting Tools Available

When it comes to managing finances, various tools can assist users in organizing their expenses and tracking their spending habits. These resources aim to empower individuals by providing insights into their financial situations, thereby guiding them toward more informed decisions.

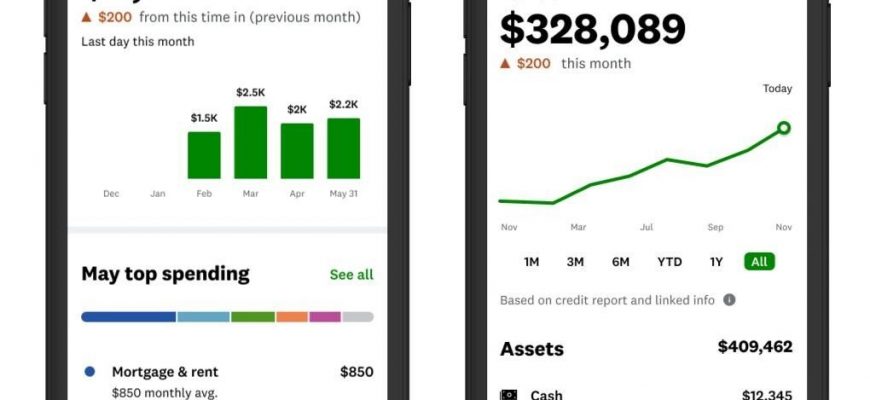

One of the most notable features that these platforms offer is the ability to create financial plans tailored to personal goals. Users can set limits on different categories, track how much they are spending in real-time, and even receive alerts when they approach their set thresholds. This functionality encourages mindful spending and helps in developing better financial habits.

Additionally, many of these applications consist of sophisticated analytics that break down expenditure into easily understandable graphs and charts. Such visual aids allow individuals to quickly grasp where their money is going and identify areas where adjustments can be made. The integration of this technology often leads to more effective financial management.

Security is another crucial aspect of these tools. Many leading platforms ensure that user data is safeguarded with advanced encryption techniques. This focus on privacy allows individuals to feel secure while navigating their financial journeys without worrying about unauthorized access.

Overall, the availability of diverse resources makes it easier than ever to take charge of one’s finances. With the right tools, anyone can streamline their financial management and work towards achieving their monetary aspirations.

How to Maximize Your Financial Management

Effective management of your financial health can significantly influence your overall well-being and future opportunities. By staying organized and making informed decisions, you can pave the way for a more secure and prosperous financial future. It’s all about creating a strategy that works for you and helps you navigate the complexities of your finances.

First, consider keeping track of your expenses. By monitoring where your money goes, you can identify patterns and areas to cut back. Whether it’s a mobile app or a simple spreadsheet, having a clear picture of your spending habits allows you to make smarter choices. Don’t forget to categorize your expenses to see which ones are essential and which can be trimmed.

Next, set clear financial goals. Having specific targets will keep you motivated and focused. Whether it’s saving for a vacation, paying off debt, or building an emergency fund, clearly defined goals give you direction and purpose. Break these down into manageable milestones to celebrate your progress along the way.

Another important aspect is understanding your financial obligations. Keep an eye on your due dates and the total amount owed. This helps you avoid late fees and penalties, which can derail your progress. Consider setting reminders or automating payments to ensure you never miss a deadline.

Moreover, regularly reviewing your financial situation is essential. Schedule periodic check-ins to evaluate your progress and adjust your strategy as needed. Life circumstances change, and being adaptable ensures that you remain aligned with your goals, even if your situation shifts.

Lastly, don’t hesitate to seek advice when needed. Whether from friends, family, or professionals, gathering insights can provide new perspectives and tools to help you better manage your finances. Collaborating with others can open up new avenues for improvement that you might not have considered.