Exploring the Impact of Credit 9 on Your Credit Score and Financial Health

When it comes to managing one’s finances, many people are often concerned about the repercussions their decisions might have on their overall financial standing. Navigating the intricate world of loans, repayments, and the effects of seeking assistance can be quite a puzzle. It’s essential to have a clear grasp of how various tools and services can influence future borrowing potential.

In this section, we will delve into a specific financial service that some individuals might consider. The intention is to break down the nuances involved and clarify whether this option carries any negative consequences for one’s financial profile. Knowledge is key, and understanding the ins and outs can empower individuals to make informed decisions.

Join us as we explore the various facets of this topic, shedding light on common misconceptions and providing valuable insights. By the end of this journey, you’ll be better equipped to determine the best path forward, ensuring your financial health remains strong and stable.

Understanding Scoring Impact

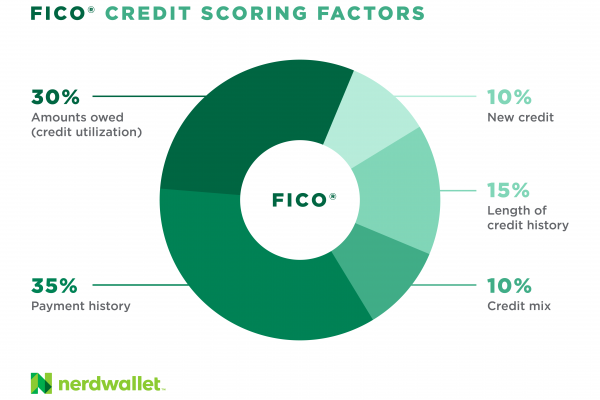

When it comes to managing financial health, it’s crucial to recognize how various actions affect your numerical assessment. Every time you apply for a service that involves a review of your financial background, it can leave a mark on that evaluation. Understanding this process can help you make informed decisions, whether you’re considering taking out a loan or simply exploring different financial products.

Various elements contribute to that numerical representation, and knowing how they interact will better prepare you for future endeavors. Each inquiry, especially multiple ones in a short time, can signal potential risk to lenders. It’s fascinating how a single decision can ripple through your financial profile, impacting opportunities for favorable terms in the long run.

Additionally, observing patterns such as payment history and utilization rates can shed light on areas that require attention. Taking proactive measures, such as timely payments and maintaining low balances, plays a significant role in enhancing that overall score. It’s all about strategy and awareness, allowing you to navigate your financial landscape with greater ease and confidence.

How Inquiries Impact Ratings

When it comes to understanding how your ratings are calculated, it’s essential to consider the role of inquiries. These checks occur whenever a lender, credit card company, or other financial institutions assess your creditworthiness. Unbeknownst to many, these assessments can have varying effects on overall scores, depending on the type and frequency of these requests.

There are two main types of inquiries: soft and hard. Soft inquiries, like those you might see during routine background checks or personal reviews, generally don’t affect scores at all. On the other hand, hard inquiries, often triggered by applying for new loans or credit lines, may lead to a slight drop in your ratings. This reduction can vary widely but usually fades away after a few months.

One crucial element to keep in mind is that a single hard inquiry typically has a minimal impact. However, numerous requests within a short period can raise red flags for potential lenders, signaling that an individual may be in financial distress. As a result, even if your score dips, it’s not necessarily a permanent issue. Maintaining a healthy pattern of borrowing and checking can help you manage how these inquiries play into your overall financial picture.

Long-Term Effects of Financial Management

Managing financial responsibilities wisely can significantly influence an individual’s economic future. When approached with care, the choices made today can lead to favorable outcomes down the line. It’s all about understanding how various decisions may impact you over time.

In the long haul, the effects of how one navigates their finances often accumulate, shaping overall financial health. Responsible borrowing and timely payments build a foundation for future opportunities, while poor management can result in setbacks that linger for years. It’s essential to keep in mind that each small choice contributes to a larger picture.

People often overlook how past actions influence future possibilities. A strong record of managing obligations can open doors to better terms and greater amounts in the future. Conversely, missteps in oversight might restrict options. The key is to cultivate habits that reinforce positive outcomes over time.

Ultimately, understanding the implications of past financial decisions encourages a more thoughtful approach to future actions. Consistency, awareness, and informed choices lead to a healthier financial journey, allowing individuals to take control of their economic destinies.