Understanding the Implications of Available Credit

When navigating the world of personal finances, many encounter terms that can often seem confusing or technical. It’s essential to grasp the nuances behind these expressions, as they play a significant role in managing one’s economic well-being. The concept we’re diving into here revolves around how institutions evaluate and allocate resources for individuals looking to make purchases or investments.

It’s crucial to recognize that the extent to which one can tap into funds reflects not just purchasing power but also the relationship between personal financial health and institutional policies. Most individuals may not fully appreciate what this signifies for their day-to-day transactions and long-term goals. Unpacking this idea can shed light on how financial decisions impact future opportunities.

As we explore this topic, we’ll unlock the intricacies of financial potential and how it influences everything from making that big purchase to enhancing overall financial security. By interpreting these elements thoughtfully, individuals can better position themselves to make informed choices that align with their aspirations.

Understanding Available Credit

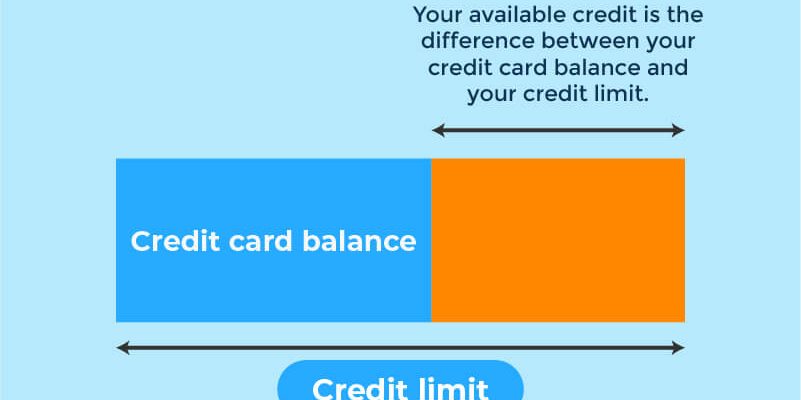

When it comes to financial management, grasping the concept of your spending limit can play a pivotal role in maintaining a healthy budget. It’s essential to know how much you can utilize before hitting your maximum threshold, as this allows for better planning and prevents unexpected pitfalls.

Unpacking this idea, it’s crucial to recognize the significance of your threshold. This figure offers insight into your financial flexibility and can affect everything from daily purchases to long-term investments. Knowing the exact amount at your disposal helps you make informed decisions without overextending your resources.

Additionally, comprehension of this element can enhance your financial health. By keeping track of your restrictions, you can avoid unnecessary fees and potential debt accumulation. Essentially, familiarizing yourself with your spending capacity empowers you to navigate your finances with confidence.

In summary, understanding how much you can spend without risking financial strain is vital. It not only contributes to better decision-making but also supports overall fiscal wellness.

The Impact of Credit Limits

When it comes to personal finance, the boundaries set on how much one can borrow play a crucial role in shaping financial behavior. These thresholds not only influence spending habits but also affect overall financial health. Understanding how these limitations work can empower individuals to make informed decisions and manage their finances more effectively.

A higher threshold can offer flexibility, allowing individuals to make larger purchases without the immediate need for savings. However, this luxury can sometimes lead to overspending or accumulating unnecessary debt. Conversely, a lower limit might encourage more disciplined spending, but it can also limit opportunities for larger transactions or emergency expenses.

Moreover, the way these thresholds are perceived can vary. Some view them as a badge of financial responsibility, while others see them as a gateway to potential pitfalls. How one navigates this landscape can significantly impact their financial journey, affecting everything from credit scores to long-term savings goals.

Being aware of personal spending habits and the effects of these boundaries is essential. It invites a deeper reflection on financial priorities and encourages the development of a strategy that aligns with one’s goals, ensuring that one maintains control over their fiscal landscape.

Using Available Credit Wisely

When it comes to managing your financial limits effectively, making informed choices is key. Having the opportunity to utilize funds can be beneficial, but it also requires responsibility and planning to ensure it works to your advantage.

Here are some practical tips to help you navigate the usage of your financial resources:

- Set a Budget: Always establish a clear budget before spending. Know exactly how much you can allocate without overstretching your finances.

- Prioritize Needs Over Wants: Focus on essential expenses first. This helps avoid impulsive purchases that can lead to unnecessary debt.

- Monitor Your Spending: Keep track of where your funds are going. Regularly review your transactions to identify any patterns or areas for improvement.

- Pay Off Balances Promptly: Aim to pay off any outstanding amounts as soon as possible. This helps you maintain a healthy financial standing and avoid interest charges.

- Utilize Rewards Programs: If possible, take advantage of rewards or cash-back programs. This way, you can make your spending work for you.

By incorporating these strategies into your financial habits, you can make the most of the resources at your disposal while ensuring long-term stability and growth. Remember, wise management starts with informed decisions!