Exploring the Range of Financial Services Offered by Amazon

In recent years, we’ve witnessed a fascinating evolution where global online retailers are extending their reach beyond traditional commerce. As they explore uncharted territories, these companies are stepping into realms that were once the exclusive domain of banks and financial institutions. This shift is sparking discussions about the role these behemoths might play in personal and business money management.

Consumers are increasingly looking for convenience, and it’s becoming clear that the intersection of technology and finance is a key area of interest. With the capability to leverage vast amounts of data and a tech-savvy customer base, it’s no surprise that these retail giants are eager to delve into providing an array of economic tools and products. The implications of this trend are significant, affecting everything from payment processing to lending.

As we navigate this transformation, it’s essential to consider how these large players can enhance or disrupt the financial landscape. The blend of retail and economic solutions promises not only innovation but also competition that could shape the future of how individuals and businesses interact with their finances. Exploring this dynamic realm opens doors to a multitude of possibilities, prompting us to rethink the established norms of banking and finance.

Expansion into Financial Solutions

In recent years, a well-known tech giant has been making significant strides into the world of banking and payment options. This move aims to provide customers with a seamless experience that integrates shopping and monetary transactions, creating a more cohesive ecosystem for users. The venture not only focuses on convenience but also on enhancing loyalty and engagement among users.

The introduction of various products targeting loans, payment processing, and budget management reflects a strategic shift towards a more comprehensive approach in serving the needs of both consumers and small businesses. This endeavor opens up numerous possibilities, from simplified payment methods to innovative lending solutions that cater to diverse financial needs.

By diversifying into this arena, the company is well-positioned to leverage its vast customer base and technological expertise. The aim is not merely to compete with traditional banks but to redefine how individuals and enterprises manage their finances in a digital age. As this trend unfolds, it will be fascinating to observe how this company continues to shape the landscape of monetary interaction.

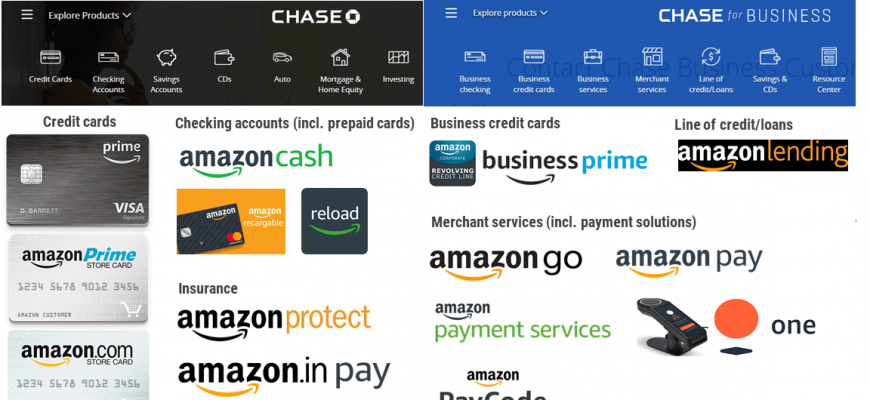

Types of Financial Products Offered by Amazon

When looking into the array of monetary solutions available through this giant retailer, you’ll find a diverse selection tailored to meet various needs. From facilitating purchases to providing support for small businesses, the range is both practical and accessible.

Credit Options: One of the standout offerings includes credit facilities aimed at enhancing shopping experiences. These lines of credit not only provide purchasing power but also come with attractive rewards and benefits, making every transaction more rewarding.

Loan Solutions: For individuals and enterprises alike, there are tailored lending arrangements designed to offer quick access to funds. Whether it’s for a personal finance project or a business expansion, these loan options can help ease cash flow concerns.

Payment Services: The platform also features efficient payment processing alternatives that simplify transactions. These services are especially beneficial for sellers looking to streamline their operations and manage their finances effectively.

Investment Tools: For those interested in growing their wealth, there are innovative investment products available. These tools empower users to make informed decisions while exploring new avenues for financial growth.

Overall, the offerings encompass a wide spectrum aimed at enhancing user experience, fostering convenience, and promoting financial well-being in various facets of life.

Impact of Amazon on Traditional Banking

The emergence of tech giants in the economy has started to reshape the landscape of financial institutions in significant ways. These companies are introducing innovative solutions that challenge conventional banking practices. As they expand into various domains, they bring new efficiencies and conveniences that traditional institutions struggle to match.

One major consequence of this shift is the increased competition that banks now face. Consumers have begun to expect seamless, user-friendly experiences when managing their finances, much like what they encounter in their everyday online shopping. This demand has pressured traditional establishments to rethink their approaches and enhance their offerings.

Furthermore, these tech firms are leveraging vast amounts of data to provide personalized experiences, creating a more tailored approach to monetary management. This understanding of consumer behavior has led to heightened expectations regarding service delivery, pushing banks to adapt or risk becoming obsolete.

Additionally, the rise of alternative payment systems demonstrates a fundamental change in how transactions are processed. With the convenience of mobile payments and digital wallets, many individuals are bypassing traditional banking services altogether, prompting financial institutions to innovate or lose relevance.

As we look to the future, it’s clear that traditional banks need to evolve alongside these new players to maintain their foothold in the industry. Collaboration may be one path, harnessing technology to improve their own offerings and meet modern demands head-on.