Understanding Whether a Credit Report Reveals Collection Accounts

When it comes to assessing a person’s financial reliability, many factors are taken into consideration. One crucial element in this evaluation process is a detailed assessment of outstanding debts and repayment behavior. The inquiry into such matters helps lenders and service providers gauge the trustworthiness of an individual in fulfilling their financial obligations.

As individuals navigate their financial journeys, situations may arise that lead to overdue payments, resulting in third-party involvement. It raises the question of how these unpaid amounts are documented and what implications they have on one’s financial reputation. It’s essential to grasp how these factors are recorded and the potential impact they might carry for future credit opportunities.

In exploring the nuances of financial assessments, it’s vital to seek clarity on which specific elements are documented and how they influence one’s overall credibility. Understanding what details are available in this context can empower individuals to take control of their financial narratives and make informed choices moving forward.

Understanding Financial Histories and Debt Records

When navigating the world of personal finance, it’s essential to grasp how your financial behavior is documented over time. This documentation plays a crucial role in your overall financial health, influencing everything from loan applications to interest rates.

Insights into your financial actions can provide lenders with a comprehensive view of your repayment habits and any overdue accounts. These records encompass various elements, revealing a timeline of your financial decisions and how they have impacted your monetary standing. It’s important to recognize that any missed payments or delinquent accounts can surface in these documents, potentially affecting your opportunities in the future.

Furthermore, understanding how these specific debt occurrences are recorded is vital. They typically remain visible for several years, which can significantly shape your financial prospects. Being aware of this can help you take proactive steps towards managing any existing debts and enhancing your financial image.

Ultimately, knowledge is power. Familiarizing yourself with how your financial habits are tracked can enable you to make informed decisions, maintain good standing, and work towards a healthier financial future.

How Collections Impact Your Score

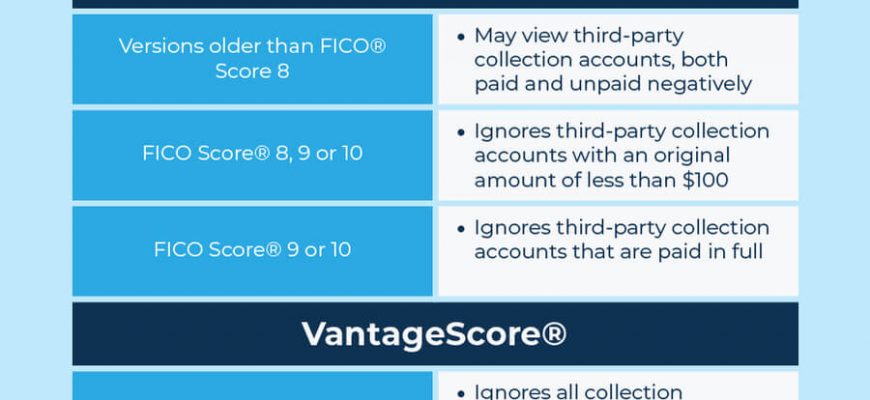

When it comes to your financial health, outstanding debts can weigh heavily on your overall standing. It’s crucial to understand how these unpaid balances can affect your numerical representation of trustworthiness. The presence of delinquent accounts can lead to a decrease in that important figure, making it harder for you to secure loans, credit lines, or even favorable interest rates.

When lenders evaluate your financial profile, they often consider any negative marks reflecting late or missed payments. These blemishes signal a potential risk, suggesting that you might struggle to meet future obligations. Consequently, the more recent and severe the delinquencies, the greater the impact on your standing.

Additionally, the duration for which these setbacks remain in your records plays a significant role. While time can help lessen the weight of these issues, they can linger for quite some time, influencing the way lenders perceive you. Therefore, it’s in your best interest to address any outstanding debts and work towards rebuilding your image. Doing so not only helps in boosting that all-important number but also opens doors to better financial opportunities down the line.

Accessing Your Credit Report for Free

Have you ever wondered how to check your financial standing without spending a dime? Fortunately, there are methods available that allow you to view your financial history at no cost. This access is crucial for everyone who wants to stay informed about their financial health and ensure everything is accurate.

One of the best places to start is by utilizing official resources. Many countries provide residents with the ability to obtain their financial summaries for free on a regular basis. This helps you get a clear picture of your overall financial situation without any hidden fees.

Make sure to visit the appropriate websites that offer these services. They often have user-friendly interfaces that guide you through the process. By following the prompts, you can easily request your financial details and review any important information, including past transactions and outstanding obligations.

Additionally, monitoring your financial history allows you to spot any discrepancies or fraudulent activities early on. Taking advantage of free access not only keeps you updated but also empowers you to make informed decisions regarding your financial future.