How a Credit Memo Impacts Revenue and Financial Reporting

When businesses engage in transactions, they often find themselves in situations where previous agreements need to be altered. This can happen for various reasons, such as returns, discounts, or price modifications. These adjustments play a pivotal role in maintaining accurate financial records and ensuring the integrity of business operations.

One common question that arises in this context is how these adjustments impact the overall financial health of an organization. It’s crucial for business owners and accountants to grasp the implications of these financial adjustments on their financial statements. The way these corrections are handled can make a significant difference in how the company’s performance is reported and perceived.

As we delve deeper into this topic, we will explore the nuances surrounding such modifications and their effects on financial figures. Understanding this concept will provide valuable insights for anyone involved in managing finances, helping them navigate the complexities of accounting and reporting effectively.

The Impact of Credit Memos on Sales

When a business encounters situations where adjustments are necessary for past transactions, it’s essential to understand how these changes influence overall sales figures. These adjustments can stem from various reasons, such as customer dissatisfaction, product returns, or billing errors. Each situation demands careful consideration as it reflects on the company’s financial health.

First and foremost, when a customer returns a product or raises a concern regarding an earlier purchase, issuing an adjustment document is often the best course of action. This not only fosters goodwill and trust but also plays a crucial role in accurately representing the company’s income. Failure to account for these changes could lead to inflated sales numbers, which paints an unrealistic picture of business performance.

Furthermore, it’s important to recognize that such adjustments can also impact future sales relationships. Customers who feel heard and valued are more likely to return, whereas those who experience obstacles in resolving issues may choose to take their business elsewhere. In essence, the implications of these adjustments extend beyond mere figures; they play a pivotal role in customer loyalty and the overall reputation of the company.

In conclusion, understanding the influence of these documents on sales goes hand-in-hand with grasping the nuances of maintaining strong customer relationships. Keeping precise records not only maintains transparency but also helps a business enhance its strategy for interacting with its clientele.

Understanding Revenue Adjustments in Accounting

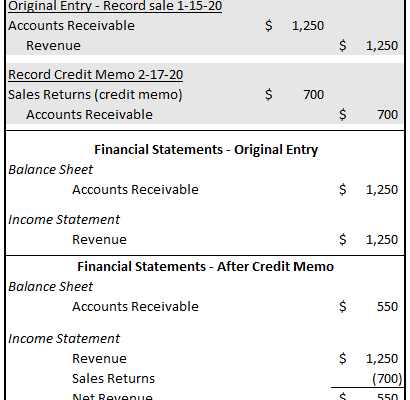

When it comes to managing financial records, it’s essential to grasp how certain adjustments can impact reported income. As businesses navigate their transactions, there are instances when corrections or modifications are necessary. These adjustments can arise from various scenarios, such as returns, discounts, or billing errors, all of which play a significant role in presenting an accurate financial picture.

In accounting, these alterations can seem a bit complex at first glance. However, they serve to reflect the true economic reality of a company’s performance. When adjustments are made, they essentially recalibrate the figures to ensure that stakeholders have a clear understanding of the actual financial position. This means keeping the books in alignment with what’s genuinely being transacted.

Furthermore, it’s vital to acknowledge the implications these modifications carry for reporting purposes. Accurate financial reporting hinges on the transparency of these changes. While it may seem straightforward, the process involves meticulously documenting every alteration to maintain integrity in the records. This diligence reassures investors and management that the financial statements present a fair view.

In summary, understanding how these financial tweaks work is key for anyone involved in accounting. Being aware of what leads to these adjustments and how they affect overall financial representation can greatly enhance decision-making and strategic planning in any organization.

When to Issue a Credit Note

Understanding the right moments to provide a financial adjustment can be crucial for maintaining good relationships with customers and keeping your business’s finances in check. These instances usually arise when clients experience dissatisfaction or when there are discrepancies in transactions. Identifying these situations early on can help in resolving issues efficiently and ensuring customer loyalty.

One common scenario for issuing such documents occurs when a product is returned due to defects or errors. If a customer receives an incorrect item or a damaged good, promptly acknowledging their concern and providing a suitable solution is essential. This not only alleviates frustration but also reinforces your brand’s commitment to quality service.

Another situation arises when a billing error is discovered. Whether it’s an overcharge or a miscalculation, correcting these mistakes swiftly demonstrates professionalism. Clear communication about the rectification process makes clients feel valued and respected, preventing potential disputes.

Additionally, if a service fails to meet the outlined standards, offering this financial adjustment can assist in upholding customer satisfaction. Addressing their complaints and compensating them effectively can turn a negative experience into a positive one, helping to foster long-lasting relationships.

In some cases, such documents can also be issued as part of a promotion or discount strategy. If a customer becomes eligible for a special offer after their purchase, providing a retroactive adjustment can enhance their buying experience and encourage repeat business. This proactive approach can significantly contribute to building trust and ensuring customer retention.