Understanding the Monthly Renewal Process of Credit Lines

When it comes to financial flexibility, many individuals and businesses often seek options that offer a safety net for their expenses. One popular choice among these is a system that allows access to a specified sum of money. However, the mechanics behind how this system operates can be somewhat unclear, especially regarding its periodic availability.

Many people wonder if the access to these funds resets at regular intervals, providing them with a fresh start each time. This concept is crucial for anyone looking to manage their finances effectively, as it influences budgeting decisions and overall spending habits. The terms of use can vary greatly, making it essential to grasp the nuances involved in this financial tool.

In this article, we’ll explore the various aspects of this financial arrangement, shedding light on how it operates and what you need to know to take full advantage of the flexibility it offers. By understanding the process behind the scene, you’ll be better equipped to navigate your financial landscape with confidence.

Understanding Monthly Access Terms

When it comes to financial agreements, it’s essential to grasp how certain arrangements function over time. Many individuals are curious about the dynamics involved in accessing funds and how often they can utilize these resources. This section aims to clarify the nuances surrounding these types of financial products, helping you make informed decisions.

Typically, such agreements offer a set amount that individuals can borrow as needed within a specified timeframe. It’s important to recognize that the available sum may change based on your usage and repayments. Staying informed about when you can re-access these funds is crucial for effective financial planning and management.

Additionally, some agreements may have specific criteria that determine how often you can tap into the available resources. Understanding these conditions can help you optimize your financial strategy, ensuring that you make the most of the opportunities provided. Learning the details surrounding your borrowing capabilities is a key step toward maintaining financial health.

Impact of Credit Utilization on Limits

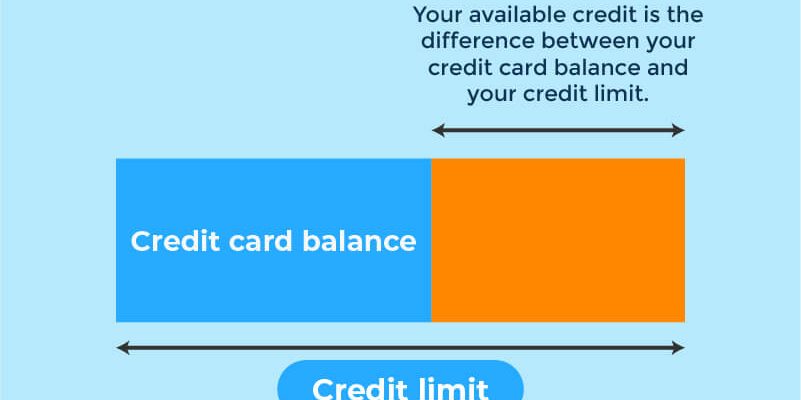

Understanding how the usage of available funds influences your financial boundaries is crucial for maintaining a healthy fiscal profile. The way you manage your expenditures can significantly affect your future borrowing potentials and the conditions associated with them.

Utilization rate plays a pivotal role in determining your financial limits. It’s all about how much of your available borrowing capacity you’re using at any given moment. Keeping this in check can lead to more favorable assessments from lending institutions.

High utilization can raise red flags for creditors, signaling risk. When you’re constantly using a large chunk of your available resources, lenders may perceive you as being heavily reliant on borrowed funds, which could lead to decreased limits or stricter terms in the future. Conversely, maintaining a lower utilization percentage communicates responsible financial behavior, often resulting in higher thresholds and better overall terms.

Creating a balance is essential. Monitoring your spending habits and ensuring that you aren’t overextending will not only safeguard your purchasing power but also uphold a favorable relationship with financial providers. A little attention here can go a long way toward securing advantageous opportunities down the line.

Renewal Processes for Credit Facilities

When we think about financial resources, it’s essential to understand how the management of these resources plays a significant role in personal and business finance. Many individuals and organizations rely on various instruments to access funds as needed. The mechanisms that govern how these tools continue to provide support over time can vary widely. Understanding these procedures can empower users to make informed decisions about their financial strategies.

Typically, the continuation of such financial products involves a structured approach where users must meet certain criteria or benchmarks set by the lending institution. These criteria might include maintaining a good payment history, demonstrating consistent income, or undergoing periodic reviews. In many cases, institutions send out notifications when it’s time for a review or assessment, allowing users to prepare accordingly.

Moreover, periodic evaluations not only ensure that the facilities remain accessible but also provide opportunities for adjustments. If a user’s financial situation changes, whether positively or negatively, these assessments could lead to increased limits or, conversely, a need for caution. Thus, staying engaged with the lender can enhance the likelihood of favorable outcomes.

Additionally, maintaining an understanding of the fees and interest associated with these financial products is vital. Users should be aware that as circumstances evolve, so too might the terms of their agreements. Regular communication with financial institutions can illuminate possible shifts in conditions, allowing for proactive management of personal or company finances.