Understanding the Expiration of Credit Cards and What It Means for Consumers

We’ve all been there: standing at the checkout, ready to make a purchase, only to be met with the sinking realization that our beloved plastic companion might be nearing its limit. This section dives into the nuances surrounding the validity of financial tools, shedding light on how long they truly remain useful before needing a refresh.

While many rely on these essential instruments for everyday transactions, few stop to think about their longevity. Various factors come into play, from issuing institutions to personal usage habits. Understanding these aspects can save you from the hassle of an unexpected interruption in your spending capabilities.

In the following paragraphs, we’ll explore when it’s time to replace your trusty plastic piece, what it means for your spending power, and how to avoid those awkward moments at the register. So, let’s unwrap the mystery and ensure you’re always prepared when it’s time to make a purchase!

Understanding Expiration Dates on Financial Plastics

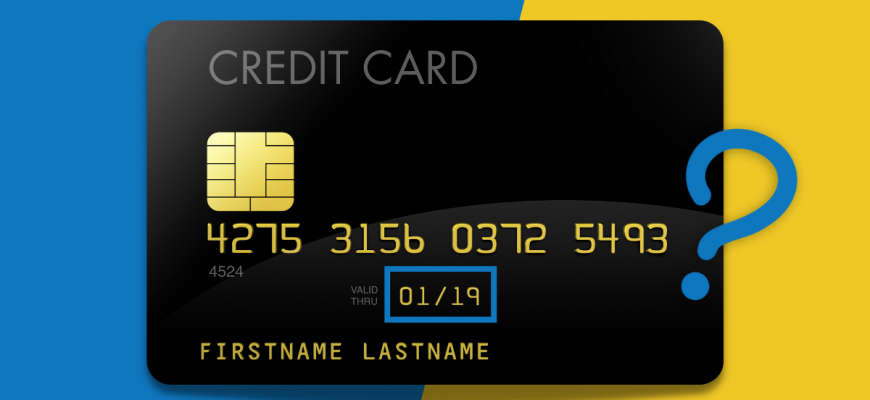

When you pull out a piece of plastic for your purchases, you may notice a date printed on it. This detail serves a specific purpose that impacts your ability to use the item for transactions. It’s essential to grasp how these dates work and what they mean for your spending habits.

The date often indicates the last moment you can use your item without any issues. Once that time passes, a series of automated systems kicks in, marking the item as invalid. It’s not just a random number; it’s tied to security, technology, and even consumer protection measures.

Replacements tend to arrive before the date lapses, ensuring you’re never left in a bind. Companies usually send out new ones a few weeks or even months in advance. It’s a smart move; you don’t want to find yourself without means to make purchases when the moment arrives.

Understanding this aspect can save you from unnecessary embarrassment at the checkout. Always check the print to stay ahead of any potential issues. A little awareness goes a long way in managing your financial responsibilities and maintaining smooth transactions.

Impact of Expiration on Payments

When a financial tool reaches its end of life, it can cause a ripple effect on transactions and user experience. It’s not just about the physical piece of plastic; it’s also about how this affects your ability to make purchases, online or in-store. Understanding these implications can save both time and hassle.

One of the main issues that arises with the end date is failed transactions. If your payment method is outdated, attempts to make purchases may be declined unexpectedly, leaving you in a tough spot when you’re trying to complete a sale. This can be frustrating, especially if you aren’t aware of the situation until the moment you try to pay.

Moreover, many services rely on automatic billing, and an outdated method can disrupt your subscriptions. Missing a payment due to this oversight can lead to late fees or even interruption of services. It can be a real headache to get everything back on track once you realize there’s an issue.

To avoid these scenarios, it’s essential to keep your information current. Regularly check your details and be proactive about updating your payment methods. This way, you ensure a seamless experience and can make purchases without interruption, even when your financial tool reaches its expiration date.

What Happens After a Card Expires?

Once your plastic companion reaches the end of its validity period, a few things come into play that you should be aware of. Many individuals might wonder what steps to take next, both for their finances and any ongoing transactions tied to their accounts.

First off, the financial institution typically sends a new one automatically well before the old one becomes unusable. This new piece of plastic may arrive at your doorstep ready for use, complete with updated features. It’s crucial to activate it right away to ensure smooth transactions moving forward.

If you forget about the upcoming change, don’t panic. Transactions attempted with the outdated version will usually be declined, prompting a reminder to check your mail for the replacement. It’s a good opportunity to review your billing information linked to various services and subscriptions; they’ll need updating to avoid any interruptions.

Additionally, keep in mind that rewards and points linked to the old version typically transfer to the new one, allowing you to maintain your benefits. However, if you’ve accumulated any outstanding balance, be sure to pay it off, as this might affect your financial standing with the issuing bank.

In summary, while the transition may feel a bit disruptive at first, it’s a normal part of managing your financial tools. Staying proactive about the process can help ensure your purchases and finances continue uninterrupted.