Exploring the Necessity of Having a Credit Card While Traveling in Europe

Exploring different countries often raises the question of how to manage expenses during the journey. Many travelers ponder the best ways to handle transactions without encountering complications. While cash may seem like a straightforward choice, the modern age offers various alternatives that can enhance the travel experience.

In bustling markets or quiet cafes, the method of payment can influence not only convenience but also security. Relying solely on physical cash might limit opportunities and lead to frustrations. Meanwhile, alternative methods bring a new level of flexibility, unlocking a world of possibilities for savvy adventurers.

As plans unfold and itineraries take shape, considering the right financial tools becomes increasingly important. The balance between traditional and contemporary options can greatly impact enjoyment and peace of mind. This article delves into the advantages and potential drawbacks of utilizing various payment instruments while navigating through stunning landscapes and vibrant cities.

Advantages of Using Credit Cards Abroad

When traveling to new destinations, having a convenient payment method can significantly enhance the experience. There are numerous benefits that arise from opting for a certain type of payment method while exploring different cultures and landscapes.

First and foremost, the ease of transactions stands out. Whether dining at a local restaurant or shopping for souvenirs, quick and hassle-free payments allow for a more enjoyable outing. No need to fumble with local currency or worry about exact change; simply swipe or tap, and the transaction is complete.

Another notable advantage is security. Carrying cash can be risky, and the potential for loss or theft is always a concern. In contrast, when using a certain payment method, there are often measures in place to protect against unauthorized use. This added layer of safety provides peace of mind while exploring.

Moreover, rewards and benefits associated with such financial tools can be appealing. Many offer points, cashback, or travel perks that can add value to a travel experience. This means that everyday purchases can contribute to future adventures, making the overall journey even more rewarding.

Lastly, tracking expenses becomes simpler and more organized. Digital records provide an easy way to monitor spending, allowing for better budgeting during travels. This thorough overview can help travelers stick to their financial plans without the hassle of keeping paper receipts or counting coins.

Alternatives to Credit Cards in Europe

Exploring different payment methods can open up a world of possibilities when traveling. Relying solely on traditional financial tools isn’t necessary, as many convenient options can simplify transactions while on the go. Being aware of various alternatives ensures a smoother experience for anyone visiting different locations.

One popular choice is a prepaid option. This allows travelers to load specific amounts in advance, controlling spending without the worry of overspending. Simple to use and widely accepted, these instruments offer peace of mind.

Another great option is mobile payment apps. Many countries embrace digital wallets, which let individuals make quick and secure transactions directly from their smartphones. This innovative method reduces the need to carry physical cash and can provide valuable features like transaction history tracking.

Direct bank transfers are also gaining traction, especially for larger purchases or when dealing with local vendors. Many establishments now facilitate these transfers, providing a straightforward method for settling invoices without hassle.

Finally, don’t forget cash. While modern solutions are gaining popularity, having some local currency on hand can be beneficial, especially in places that may not fully embrace digital options. Whether it’s for small purchases or tips, cash remains a reliable fallback.

Understanding European Payment Systems

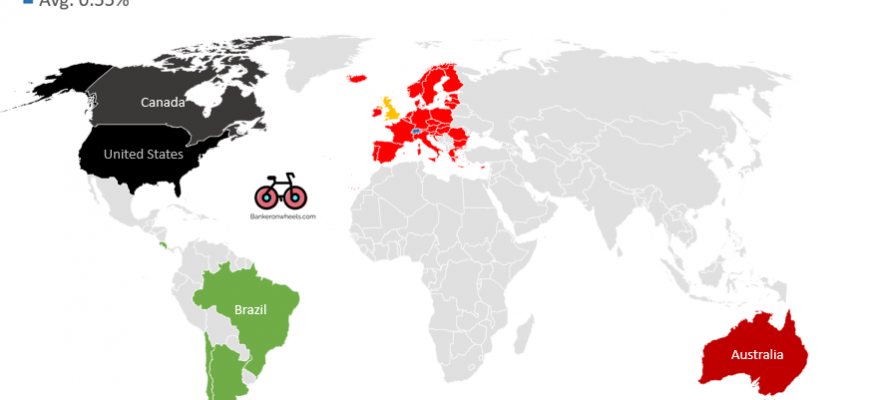

When traveling across various nations, grasping the nuances of financial transactions can greatly enhance the experience. Each country showcases its distinct methods for handling payments, influenced by local customs and regulations. Familiarizing oneself with these methods can pave the way for smoother interactions and fewer surprises.

Many establishments embrace contactless technologies, allowing swift and efficient payments with just a tap. This modern approach not only expedites the checkout process but also aligns with the growing preference for convenience among consumers. Traditional means, like cash, still hold significance in numerous places, particularly in smaller towns or markets where digital options might not be readily available.

Additionally, an array of mobile applications and digital wallets has gained traction, offering users versatility and ease. These platforms often provide competitive exchange rates, enabling travelers to manage their funds without excessive fees. Awareness of potential transaction charges and currency fluctuations can empower more informed financial decisions while abroad.

In some regions, banking institutions may impose specific practices that differ from the norm. Understanding these regional variations can contribute to a stress-free journey. As each location may have its own set of advantages and limitations, knowing what to expect can lead to greater confidence when making financial exchanges.