Understanding Whether to Use Credit or Debit for Your Expenses

In the realm of personal and business finance, the methods of recording financial movements play a pivotal role in maintaining accurate accounts. Whether engaging in daily purchases or managing larger financial obligations, the approach taken can significantly influence an overall financial picture. Grasping the underlying principles of these actions leads to more effective financial management.

When it comes to documenting financial entries, there are distinct approaches employed to classify and track monetary flows. This process not only aids in organizational clarity but also contributes to sound decision-making. Pinpointing the right method for transactions can streamline financial oversight and improve budgetary strategies.

With a variety of options available for managing financial records, understanding the nuances between different classes of recording is essential. Appreciating these subtleties fosters a greater sense of control and can steer individuals and businesses toward more informed financial choices. The ultimate goal is to cultivate a deeper awareness of one’s financial landscape.

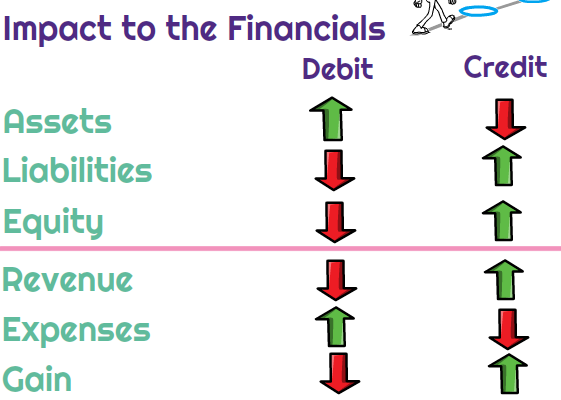

Understanding Credit vs. Debit Transactions

When managing finances, it’s essential to grasp the differences between two fundamental transaction types. One method involves building up a balance that can be paid off later, while the other directly reduces available funds. This distinction plays a crucial role in the way individuals and businesses handle their monetary activities, impacting budgeting and financial planning.

Transactions that involve deferred payments often allow for flexibility in managing cash flow. They enable individuals to make purchases without an immediate outlay, providing breathing room for financial strategies. On the flip side, transactions that deduct funds instantly offer certainty, as they ensure no lingering obligations or potential interest accumulations.

Understanding these concepts enhances decision-making regarding financial management. Knowing which option to utilize in various situations can lead to more efficient budgeting and financial health. In the end, mastering these transaction types empowers individuals to optimize their monetary resources and navigate the complexities of personal and business finance with confidence.

Impact of Expenses on Financial Statements

Understanding how outflows influence financial reporting is essential for any business or organization. These financial movements not only reflect operational activities but also determine the overall health of the company. When analyzing these transactions, one can gain insights into profitability and sustainability.

These outlays have a significant effect on key financial reports, especially:

- Income Statement: This is where the outcomes of spending are directly showcased. High costs may lead to lower net income, highlighting the need for effective management.

- Balance Sheet: While not always immediately visible, accumulated costs impact the liabilities and equity sections. Understanding how they integrate here helps grasp a company’s financial position.

- Cash Flow Statement: This report illustrates the liquidity aspect by showing how operational outflows influence cash generated. It emphasizes the importance of timing in payment schedules.

It’s crucial to note that different types of expenditures can yield various outcomes. For instance:

- Fixed Costs: These remain constant regardless of production levels, impacting long-term planning.

- Variable Costs: Fluctuating with business activity, they can create uncertainty in forecasting profit margins.

- One-time Costs: These can skew financial accomplishments in short periods, warranting careful analysis to avoid misleading interpretations.

In conclusion, the relationship between financial outflows and statements is intricate. A thorough understanding aids in decision-making and enhances strategic planning, ultimately fostering a stronger fiscal environment.

Best Practices for Managing Business Expenses

Effectively overseeing financial outflows is crucial for the success of any venture. Adopting strategic methods can lead to better resource allocation and enhanced profitability. It’s not just about tracking numbers; it’s about understanding how every penny contributes to the larger picture.

One key approach is to create a clear budget. Establishing limits for various categories allows for better control and prevents overspending. Regularly reviewing this plan ensures that adjustments can be made based on changing needs and market conditions.

Another vital tactic is to utilize technology. Employing software dedicated to financial management can streamline processes, offer real-time insights, and simplify record-keeping. The right tools help identify trends, making it easier to spot areas for improvement.

Maintaining accurate documentation is equally important. Keeping receipts and tracking transactions not only aids in transparency but also ensures compliance with regulations. A well-organized filing system can save time and reduce the stress of audits.

Lastly, fostering a culture of awareness among team members can make a significant difference. Encouraging individuals to be mindful of spending can lead to more thoughtful decision-making across the board. Engaging everyone in the financial journey can promote collective responsibility and drive overall success.

Your videos never fail to put a smile on my face. This one was so much fun!