Understanding How to Use a Payment Credit Card Effectively

Have you ever wondered how we navigate the world of transactions in today’s fast-paced economy? The process of purchasing goods and services has evolved significantly, providing us with various methods to manage our finances. Whether it’s a quick coffee run or an online shopping spree, the ability to finalize a purchase has become seamless and efficient. It’s fascinating how technology has transformed our spending habits and influenced our perception of money.

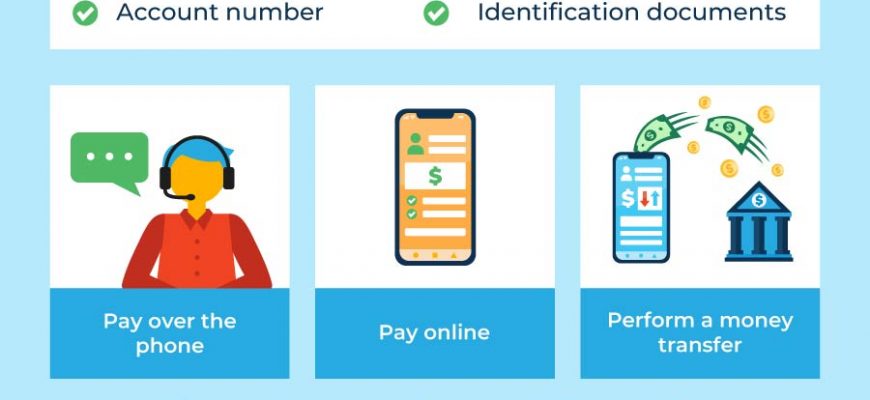

The variety of options available for settling our accounts allows for flexibility and ease. From mobile applications to traditional methods, each approach has its unique set of features designed to cater to different preferences. Some enjoy the convenience of tapping their devices, while others feel more comfortable with traditional methods. Regardless of the method, understanding how these systems operate can empower us to make informed choices.

As we dive deeper into this subject, we’ll explore the intricacies involved in these transactions, highlighting their advantages, potential pitfalls, and everything in between. Let’s embark on this journey to demystify the concepts surrounding financial exchanges and gain a clearer understanding of how to navigate them effectively.

Understanding Payment Processes

Have you ever wondered how the magic happens when you swipe a piece of plastic at the checkout? It might seem straightforward, but there’s a lot happening behind the scenes to ensure your transaction goes smoothly. This section will shed light on the intricate steps involved in processing transactions and the technology that makes it all possible.

Initially, the journey begins when you present your plastic to a merchant. This act triggers a series of electronic communications between different parties involved in the transaction. Your information is securely transmitted through gateways, ensuring that everything is encrypted to keep it safe from prying eyes.

Next, the organization that issued your plastic springs into action. They assess the information received, confirming whether the funds are available and validating your identity. This step is crucial, as it ensures that only authorized individuals can access their funds.

Once the verification is complete, a message travels back through the same channels to the merchant, indicating whether the transaction was successful or if it encountered any issues. If all goes well, the merchant receives the green light, and you can enjoy your purchase without a hitch.

Finally, after everything is confirmed, the financial institutions settle the amount, ensuring that the merchant receives their funds while you’ll see the deduction from your account. This whole process typically happens in a matter of seconds, showcasing the efficiency and sophistication of modern financial technology.

Benefits of Using Cards for Transactions

Using plastic for everyday purchases brings a multitude of advantages that can enhance your shopping experience. It provides not just convenience but also added layers of security and rewards that can make every transaction feel rewarding. Let’s explore some of the notable perks of choosing this method for your expenses.

One of the biggest draws is the ease of use. Swiping or tapping your card is often quicker than fumbling with cash or counting out coins. This efficiency can save you time, especially in busy situations. Plus, the built-in tracking features allow users to monitor their spending habits effortlessly, as most institutions provide monthly statements detailing where your funds go.

Another significant benefit is the added security. Many cards offer fraud protection, meaning if someone uses your information without permission, you’re typically not held responsible for those unauthorized charges. Additionally, many modern variations come equipped with contactless technology, making them harder to misuse in public spaces.

Rewards are also a significant attraction. Many offer cash-back incentives or points that can be redeemed for future purchases, travel, or other perks. This turns routine expenditures into a chance to earn something back, making them more attractive than using cash alone.

Lastly, some establishments may offer exclusive discounts or promotions for those who utilize the plastic option. These advantages can make transactions not just practical but also financially beneficial, fostering a smart approach to spending.

Common Issues with Credit Card Payments

When it comes to making transactions using plastic money, many individuals encounter various challenges that can be frustrating. Understanding these typical hurdles can help consumers navigate their financial activities more smoothly. From technical difficulties to personal oversights, knowing what to look out for can save you time and trouble.

One prevalent concern is insufficient funds. This often leads to declined transactions, which can be quite embarrassing, especially in a crowded store or during an online checkout. Keeping tabs on your available balance is essential to avoid awkward situations.

Another issue often arises from incorrect information. A simple typo when entering your details or a mismatch with your billing address can result in failed transactions. Always double-check the information you provide to ensure a seamless experience.

Fraud alerts and security blocks can also cause disruptions. Financial institutions monitor accounts for unusual activity, and high-value purchases or sudden shifts in spending patterns may trigger these protective measures, leaving you unable to complete your intended transaction.

Finally, expired or damaged cards can be a major setback. Regularly checking the expiration date and ensuring your card is in good condition can prevent unexpected rejections. By being aware of these common obstacles, you can better prepare yourself for a hassle-free experience in the future.