The Importance of Credit Checks for Landlords When Screening Potential Tenants

When seeking to secure a rental arrangement, many individuals might wonder what criteria property owners use to assess potential tenants. It’s not just about the application form or a casual conversation; there’s often a deeper process at play. A thorough analysis of personal finances may be a critical component, helping to ensure that the person interested in a lease is capable of meeting their obligations.

In this article, we will delve into the reasons behind this practice, exploring how assessing financial backgrounds can mitigate risks for those offering their spaces for rent. Understanding this process can empower future tenants, allowing them to present themselves in the best light during the leasing journey.

Moreover, we’ll discuss what factors typically come into play during this evaluation and offer tips on how individuals can prepare themselves. Being informed not only helps in navigating the rental market but also enhances one’s chances of securing that desired home.

Importance of Tenant Evaluations

When it comes to finding a place to live, understanding the financial background of prospective occupants is crucial. Assessing a person’s ability to meet their rental commitments can save both parties from future headaches. This process can illuminate a tenant’s history regarding timely payments and overall financial responsibility, which is essential for maintaining a harmonious living environment.

For property owners, this type of examination is a safeguard against potential risks. By diving into someone’s financial track record, they can gauge the likelihood of receiving payments consistently. It serves as a protective measure that helps ensure stability in rental agreements and minimizes the chance of disputes over missed dues. After all, peace of mind is invaluable when entering into any lease arrangement.

From a tenant’s perspective, going through this assessment can actually work in their favor too. Demonstrating a solid financial history can create a stronger case for securing a desirable residence. It showcases responsibility and can pave the way for smoother negotiations, potentially yielding better rental terms. Ultimately, this scrutiny benefits the housing ecosystem as a whole.

Understanding the Credit Checking Process

When searching for a new place to live, many individuals encounter a necessity that often feels intimidating. This common practice allows property owners to gauge the financial reliability of potential tenants. It serves as a vital step in the rental journey, aimed at ensuring that obligations can be met consistently.

So, how does this entire procedure unfold? Initially, the individual seeking accommodation typically submits an application form, which may require essential personal and financial details. This information lays the groundwork for evaluating one’s ability to fulfill financial commitments.

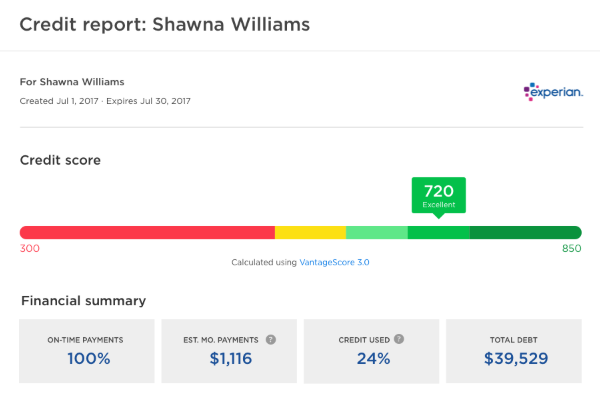

After submitting the application, the owner or their representative obtains permission to conduct an assessment of the individual’s financial background. This usually involves reviewing payment histories, outstanding debts, and overall financial behavior. The collected data is then analyzed to determine the likelihood of timely payments.

It’s worth noting that there are various types of evaluations available. Some are more comprehensive than others, so it’s essential to be aware of what is being reviewed. The results can significantly influence a property owner’s decision, as they search for trustworthy occupants.

Ultimately, understanding this evaluation process can empower applicants, highlighting the importance of maintaining a solid financial standing. After all, being aware of what goes into these assessments can help individuals navigate the rental landscape with greater confidence.

Impact of Financial History on Rental Applications

When applying for a rental unit, your financial background can play a significant role in the decision-making process. It’s more than just numbers; it represents your ability to meet obligations and manage responsibilities. A positive record can enhance your chances, while a troubled past can raise concerns for potential property owners.

The first thing to consider is trust. Property managers are seeking reliable tenants who will honor their commitments. A solid financial track record often translates to dependable payments and a lower risk of late fees or defaults. This kind of assurance is invaluable when selecting the right fit for their property.

On the other hand, a history marked by financial issues can trigger skepticism. Instances like late payments or defaults may lead to questions about your reliability. It can result in a more thorough review of your overall application, potentially sidelining you in favor of candidates with stronger financial profiles.

Moreover, having a transparent approach can also make a difference. If you have faced challenges in the past but have since taken steps to improve your situation, showcasing this progress can positively influence your chances. Open discussions about your journey can highlight your determination and responsibility, which many property managers value.

Ultimately, being mindful of how your financial background reflects on your rental application can steer your approach. Whether it’s improving your habits or addressing past mistakes, understanding this impact can be a crucial strategy in securing your desired home.