Considering Whether to Accept FAFSA Financial Aid Offers

Entering the world of higher education often brings a whirlwind of decisions, especially regarding funding. Many students discover they qualify for various financial resources, but the question arises: is it necessary to proceed with these offers? Understanding the nuances behind this choice can significantly impact your academic journey and financial future.

As you explore potential funding options, it’s essential to weigh the benefits and implications of utilizing these financial resources. Some may find that taking on monetary support aligns perfectly with their educational goals, while others might prefer to seek alternative solutions. This decision not only influences finances but could potentially shape your overall college experience.

Before diving into any commitments, consider your unique situation. Reflect on your current financial standing, your educational aspirations, and how each option fits into your plan. It’s crucial to make an informed choice that serves your interests and educational pursuits in the best way possible.

Understanding FAFSA Aid Acceptance

This section delves into the considerations surrounding financial assistance from federal programs designed for students. Navigating the world of educational funding can be overwhelming, and making informed choices is essential for your academic journey. Many individuals often wonder about the implications of receiving such monetary support, and it’s crucial to grasp what it entails.

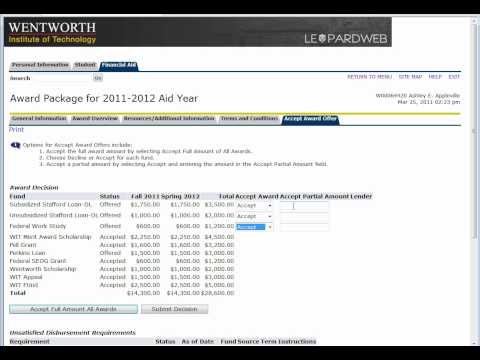

When you receive a financial proposal from your school, it’s important to evaluate the options presented. Not all support is mandatory; you have the liberty to decide what aligns best with your current situation and future plans. Take time to assess the benefits and obligations attached to these funds, as they can significantly influence your educational experience.

One key aspect to consider is whether the financial assistance will complement your overall budget. Understanding your financial landscape can help you determine if this funding is truly necessary. Additionally, it’s wise to reflect on your long-term goals and how accepting this contribution could potentially impact other opportunities, such as scholarships or grants.

Ultimately, the choice rests in your hands. Evaluating the implications can empower you to make decisions that will shape your academic and financial future.

Evaluating Your Financial Aid Options

When it comes to financing your education, you may find a variety of options available. Understanding these choices is crucial to making informed decisions. It’s important to weigh the advantages and disadvantages of each possibility before moving forward.

Start by considering grants and scholarships; both can significantly reduce your expenses, as they generally do not require repayment. Next, think about loans, which can help cover costs but come with the burden of repayment plus interest. Make sure to also investigate work-study opportunities, offering valuable experience while helping to offset your tuition.

Another key factor is your financial situation. Analyze your current budget and potential income after graduation to determine how much support you genuinely need. Engaging in conversations with financial experts, family members, or peers can also provide insights and guidance.

Ultimately, this is about finding the right balance for your unique circumstances. Take your time, research extensively, and choose options that align with your goals and financial health.

Implications of Declining Financial Assistance

Choosing not to take financial support can lead to various consequences, shaping both your educational journey and future options. It’s essential to weigh the pros and cons before making a decision that might affect your studies and finances down the line.

By opting out of financial resources, students might face increased tuition costs and higher levels of student debt. This can alter one’s approach to budgeting and managing expenses throughout college years. Moreover, without assistance, some students may need to work additional hours or take on a part-time job, which could impact their academic performance and available study time.

Furthermore, this decision could limit access to certain opportunities, such as internships or study abroad programs that often provide financial support. The absence of funding might also restrict enrollment in specific courses or institutions, ultimately influencing career paths and future earnings.

It’s also worth considering the emotional and psychological effects. Stress related to financial pressures can take a toll on overall well-being, impacting focus and motivation. In a landscape where monetary worries can distract from academics, the choice to forgo financial assistance can create additional burdens.

Evaluating these factors is crucial. Making an informed choice can pave the way for a smoother academic experience, ensuring that you are fully prepared for the challenges and opportunities that lie ahead.

Wow;you light up the screen! This video is an absolute masterpiece!