Understanding the Impact of Financial Aid Refunds on Your Income Tax Situation

When it comes to pursuing higher education, most students find themselves navigating a complex landscape of monetary support designed to ease the financial burden. Among these resources, there are various types of funds that may end up in your hands, often leaving students pondering their implications. Have you ever stopped to think about how these amounts affect your overall financial standing?

As you dive into the world of higher learning, you might receive a lump sum that can be used for tuition, books, or living expenses. However, if you’re wondering whether this money could be seen as part of your earnings, you’re not alone. Many students grapple with this very question, especially when tax season rolls around. Understanding the classification of such funds is crucial, not just for compliance with regulations, but also for effective financial planning.

In this discussion, we’ll navigate the nuances of these resources and help clarify their role in your personal finances. Whether you’re just starting college or are already knee-deep in coursework, having a handle on how these funds are viewed can make a significant difference in how you approach your budget and manage potential tax obligations.

Understanding Financial Aid Refunds

When you receive support for your educational expenses, it often involves a process where you may get some excess funds after covering tuition and other costs. These additional amounts can offer a sense of relief, allowing you to handle other financial responsibilities associated with your schooling. However, it’s essential to grasp the implications of these funds, especially how they relate to your overall financial situation.

These excess resources can come from different sources, and how they affect your financial landscape varies. Depending on the origin, they might play a role in determining your eligibility for various programs or could influence future assistance opportunities. Understanding the nature of these funds helps in managing your finances strategically.

While these amounts might seem like free money, it’s crucial to recognize that they can have potential consequences. For example, reporting requirements or tax implications can arise depending on how you utilize them. Being informed about these aspects enables you to make savvy decisions about your finances and ensures you remain compliant with any relevant regulations.

In essence, taking the time to learn about these extra funds and their implications can pave the way for a more secure financial path during your academic journey and beyond.

Impact on Taxable Income

Understanding how certain monetary assistance affects your overall earnings can be quite revealing. It’s essential to look closely at how these funds integrate into your broader financial picture, especially when tax season rolls around. Not every dollar you receive contributes to your total taxable earnings, and clarifying these details can help you avoid unnecessary surprises during filing.

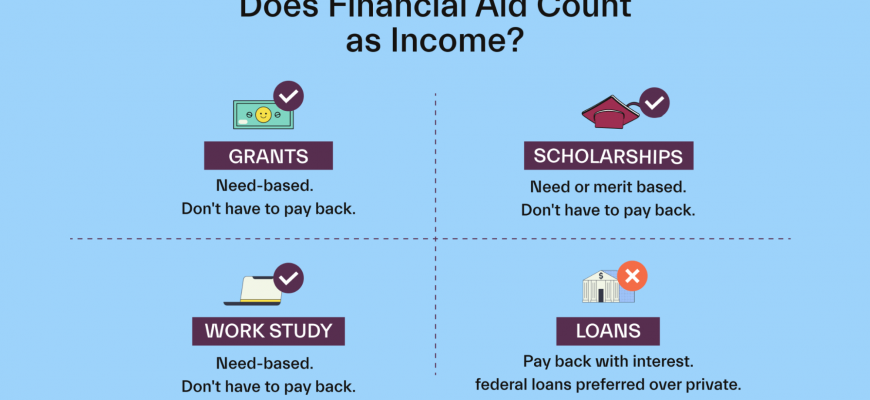

When assessing your annual earnings, not all sources of funding have the same implications. Some stipends or subsidies may be categorized differently, influencing how they appear on your tax return. It’s important to distinguish between grants that are meant to cover specific expenses and those that are seen as supplementary payments.

Be mindful of the regulations set by the Internal Revenue Service, as they provide guidelines on what is deemed taxable. In general, if the funds are designated for tuition, fees, or other qualified educational expenses, they may not be included in your taxable earnings. However, if they exceed those expenses or are provided for other purposes, you may find them factored into your overall financial reporting.

Ultimately, knowing how these different streams impact your tax obligations can help you plan better and make informed choices about your finances. Staying updated on IRS rules is necessary to ensure you aren’t over-reporting your earnings and paying more than you need to.

Eligibility for Government Assistance Programs

When it comes to accessing various support programs offered by the government, understanding what counts as resources is essential. Many individuals are unsure whether certain types of monetary support can impact their eligibility. This can be particularly confusing, especially when unexpected funds are involved. It’s crucial to be well-informed about how different types of assistance are viewed by authorities to avoid any surprises.

Many programs have specific requirements that determine who qualifies and how much support one can receive. Whether you’re looking into housing support, food assistance, or healthcare programs, knowing the details is vital. Each program may have different regulations surrounding what is considered allowable resources, which can significantly affect your chances of qualifying.

Being aware of how various forms of support are treated can aid in planning. For example, while some one-time payments may be excluded from resource calculations, ongoing support can be a different story. It’s wise to check the guidelines of the specific program you are considering, as they often outline what is included or excluded.

Staying informed and proactive in understanding these aspects can help ensure you are making the best decisions for your situation. It’s not just about receiving funds–it’s about how those funds interact with the broader landscape of assistance available.