Exploring the Role of Financial Aid in Covering College Expenses

Deciding to further your education can be both an exciting and daunting prospect. The journey often comes with numerous considerations, one of which is how to manage the costs associated with it. Many prospective students find themselves wondering about the resources available to help bridge the gap between their dreams and financial reality.

It’s essential to explore the various options that can support students on their quest for knowledge. From scholarships to grants, there are several mechanisms that can alleviate the burden of tuition and living costs. Understanding these resources can empower individuals to make informed choices and realize their academic ambitions without being overwhelmed by expenses.

As we delve into this topic, we’ll examine the different types of support available, the eligibility criteria, and how best to navigate the system. By gaining a comprehensive understanding, you can approach your educational journey with confidence, knowing that there may be opportunities to ease your financial worries.

Understanding Financial Aid Options

Navigating the world of monetary assistance can be overwhelming, but it’s crucial for making education more accessible. There are various avenues available to help alleviate the cost of your studies, each with its own set of rules and benefits. Whether you are just starting your journey or looking for extra support, familiarizing yourself with these resources can empower you to make informed decisions.

Grants are typically offered based on need and do not require repayment. They can come from the government or private entities, providing a solid foundation for your funding strategy. In contrast, scholarships often reward merit, whether it be academic excellence, athletic prowess, or community service. Unlike loans, these funds are also free to keep, making them an attractive option.

Loans are another route worth considering. These sums of money must be repaid over time, often with interest. Understanding the terms of repayment is crucial, as this type of support can impact your finances long after you complete your studies. Additionally, there are various types of loans, including those with favorable conditions for borrowers.

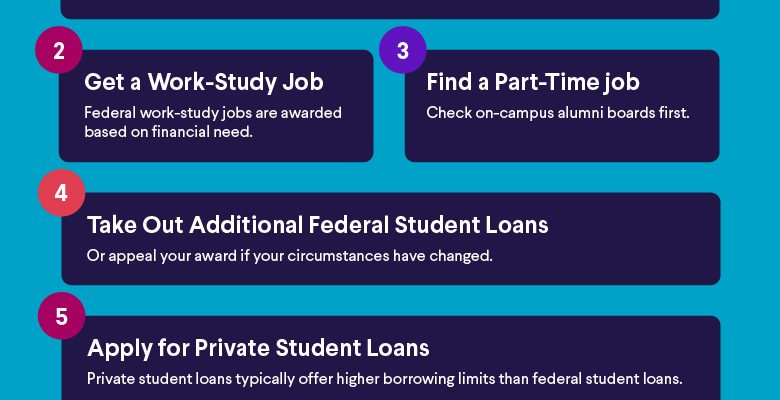

Lastly, many institutions offer work-study programs, allowing you to gain valuable work experience while earning funds to assist with costs. Each option can play a significant role in your journey, and knowing how to combine them effectively can lead to a more manageable financial experience as you pursue your goals.

How Scholarships Can Reduce College Costs

Many students are searching for ways to lessen their educational expenses, and scholarships are a fantastic option that can make a significant difference. These awards can provide assistance based on various criteria, helping students navigate the financial challenges of higher learning without incurring massive debt.

One of the best things about scholarships is that they don’t need to be repaid, which means the funds you receive go directly towards your studies and living expenses. Whether they are merit-based, need-based, or focused on specific talents or interests, these opportunities can dramatically lower the out-of-pocket costs associated with attending an institution.

Additionally, receiving a scholarship can open doors to other forms of support, as some organizations and schools may offer additional incentives to students who excel in their studies or extracurricular activities. By building a strong academic record, students may qualify for even more scholarships, creating a positive cycle of funding opportunities.

Applying for various scholarships requires some effort, but the potential savings are well worth it. Resources such as scholarship databases and organizational websites can help you find suitable options, making it easier to discover those hidden gems that could significantly reduce your educational expenses.

In conclusion, tapping into scholarship opportunities can be a smart strategy for students looking to alleviate the financial burden of their educational journey. With careful planning and dedicated research, many can find the support they need to focus on their studies rather than worrying about costs.

The Role of Grants in Education Financing

When it comes to pursuing higher education, many individuals seek various options to lessen the burden of expenses. One crucial element in this equation is the availability of grants, which serve as a beacon of hope for those looking to further their studies without accumulating significant debt. These resources provide essential support, allowing students to focus more on their academic journey and less on the financial strain.

Grants are often awarded based on specific criteria, such as academic achievement or demonstrated need. Unlike loans, these funds do not require repayment, making them an attractive choice for many learners. They can cover a range of costs, from tuition fees to textbooks and living expenses. This flexibility ensures that recipients can allocate the resources effectively according to their unique situations.

Moreover, various organizations and institutions offer grants, each with its own particular focus and eligibility requirements. This diversity allows students from different backgrounds and fields of study to find suitable opportunities. Whether through government programs, private foundations, or educational organizations, there’s usually something available that can make a meaningful difference in someone’s pursuit of knowledge.

In summary, grants play a pivotal role in educational financing by providing essential support that alleviates financial burdens. They empower learners to reach their academic goals while enabling them to build a brighter future without the weight of excessive debt. Understanding the significance of these resources can help students make informed decisions as they navigate their educational paths.