Exploring the Role of Financial Advisors in Tax Assistance and Planning

When it comes to managing your finances, many people wonder about the role of professionals in guiding them through various aspects of their financial lives. One area that often raises questions is how these experts can influence and optimize one’s obligations to the government. It’s not just about making investments or building wealth; there’s a wide spectrum of financial strategy that touches on several crucial matters, including adherence to tax regulations.

Understanding the complexities of tax responsibilities can be daunting for anyone. The nuances involved in deductions, credits, and filing can quickly become overwhelming. This leads many to seek out specialists who can provide insights and strategies tailored to individual circumstances. By tapping into the knowledge of seasoned professionals, individuals may uncover significant opportunities to enhance their overall financial health while also ensuring compliance.

So, do these specialists really make a difference in managing one’s fiscal duties? The answer often lies in their ability to navigate intricate regulations and identify potential savings. Whether through smart planning or innovative strategies, the support they offer can be invaluable in creating a sustainable path to financial success while alleviating some stress associated with fiscal obligations.

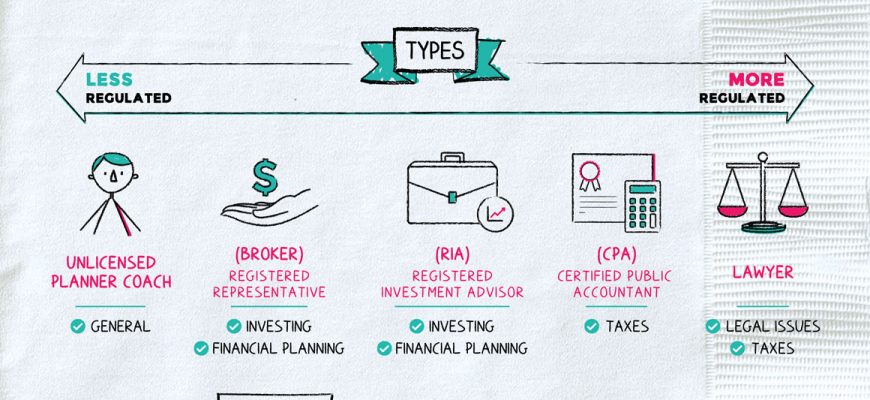

Understanding the Role of Financial Advisors

When it comes to managing money, many people seek guidance from professionals who specialize in navigating the complex world of finances. These experts play a crucial role in shaping a person’s financial future and making sense of numerous options available in the marketplace. Their expertise can illuminate various pathways to achieving specific monetary goals, ultimately contributing to long-term stability and growth.

One key aspect of their profession is analyzing individual circumstances to provide tailored advice. They delve into factors like income, expenditures, and overall goals, ensuring a personalized approach. This isn’t just about crunching numbers; it’s about understanding unique situations and crafting strategies that align with personal aspirations.

Another significant function involves strategic planning. Whether it’s investing in the stock market, setting aside funds for retirement, or purchasing assets, these specialists are equipped to guide clients through different strategies. They stay updated on the latest trends and regulations, which can be particularly beneficial when it comes to financial strategies that can minimize obligations.

Moreover, they often collaborate with other professionals, such as accountants and lawyers, to ensure that all aspects of a person’s financial landscape are considered. This holistic approach can lead to more efficient planning and execution, paving the way towards achieving financial targets while maximizing benefits.

Tax Planning Strategies Offered by Advisors

When it comes to managing one’s financial landscape, incorporating effective methodologies can make a significant difference. Professionals in this field often emphasize the importance of forward-thinking techniques that aim to minimize liabilities and maximize benefits. These methods not only assist individuals in maintaining compliance but also enable them to make the most of their contributions to various accounts.

One popular approach is the strategy of deferred income, where individuals can defer some of their earnings to a later date, potentially reducing their current liabilities. Additionally, deduction optimization plays a crucial role, as it entails identifying and utilizing all eligible deductions available under the current laws. This can significantly lighten the burden by lowering the overall taxable amount.

Another aspect worth mentioning is asset allocation, which involves strategically positioning investments to achieve favorable outcomes not only for growth but also for tax efficiency. By understanding how different assets are taxed, one can better navigate the complexities of capital gains and losses.

Lastly, long-term strategies like retirement account contributions are vital. Maximizing contributions to retirement plans can provide immediate tax benefits while securing a stable financial future. Implementing these techniques can lead to a more favorable fiscal situation, making it essential to consider them seriously.

The Benefits of Professional Tax Guidance

Seeking expert support for managing your fiscal responsibilities can lead to significant advantages. Engaging a knowledgeable individual in this area brings an array of insights that can simplify complex situations and enhance your financial well-being.

One major perk is the ability to accurately navigate regulations. Professionals stay updated on the latest changes and nuances in the law, ensuring that you’re not inadvertently overlooking important details that could impact your obligations. This expertise can also unlock potential savings you might have missed otherwise.

Another positive aspect is personalized strategies tailored to your specific circumstances. Each person’s financial landscape is distinct, so obtaining customized recommendations can help you make wiser decisions. This tailored approach often results in a more efficient allocation of your resources.

Moreover, relying on a specialist can provide peace of mind. You can focus on other priorities in your life, knowing that your financial landscape is in capable hands. This not only reduces stress but also boosts confidence in your decisions.

In addition, having an ally in this sphere can facilitate better long-term planning. Professionals can assist you in setting up structures that benefit you over time, promoting smarter choices that align with your overarching financial goals.