Understanding the Expiration Policy of Credits and What It Means for You

Have you ever wondered what happens to those accumulated perks or rewards after a certain period? It’s a common question for many, especially in a world where loyalty programs and various incentives are part of our everyday transactions. Not all of these advantages last indefinitely, and understanding their lifecycle can save you from missing out.

Some programs have specific durations for which their elements remain valid, creating a sense of urgency. You might find yourself asking if there’s a limit to how long you can enjoy these advantages. Knowing the rules of the game can empower you to make the most of what you’re entitled to, ensuring you use them before they vanish.

Before diving into the nitty-gritty details, it’s essential to grasp the broader implications of these time constraints. Not only do they influence how we plan our purchases and rewards, but they also reflect the strategies companies use to keep their patrons engaged and returning for more. So, let’s unravel this mystery and answer some of those burning questions!

Understanding Credit Expiration Policies

Many people often wonder about the longevity of their rewards or points earned through various programs. It’s common to have questions about what happens to these benefits over time. Some schemes may have specific guidelines regarding how long individuals can utilize their accumulated advantages before they become inactive. Navigating these policies can be crucial for maximizing the benefits you receive.

Different organizations implement various timeframes for when these perks may become void. Some might offer generous durations, while others have stricter conditions. Knowing the rules can help you strategize your usage and avoid disappointment. It’s essential to stay informed and take proactive steps so that your hard-earned rewards don’t go to waste.

In addition, it’s worthwhile to keep an eye out for any communications from these programs. Businesses often provide updates about changes or reminders regarding the status of your amassed rewards. Staying connected ensures you won’t be caught off guard by potential limitations that could affect your plans. Always read the fine print and consider periodic check-ins to keep track of your options.

Moreover, some programs may offer opportunities to extend the lifespan of your accrued advantages through participation in promotions or maintaining certain activity levels. Engaging actively with the offerings can not only enhance your experience but also prolong the term of your rewards. Take advantage of these options to make the most out of what you have.

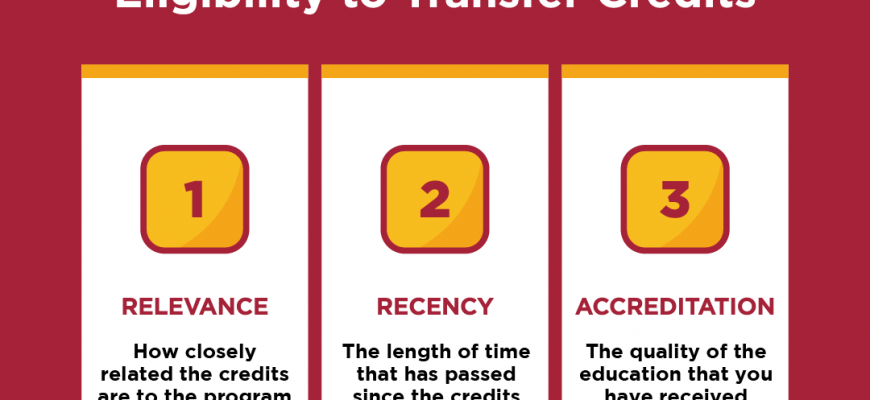

Factors Influencing Credit Validity

When it comes to the longevity of certain benefits or allowances, several elements come into play. Understanding these factors can provide valuable insights into how long these advantages remain useful and what might affect their use over time. It’s not just about a simple timeline; multiple aspects can determine whether you still have access to those perks.

One significant aspect is the terms and conditions associated with the offer. Each promotion or benefit usually has specific rules that dictate its duration and usage. If you’re not familiar with these guidelines, it can lead to unexpected surprises. Additionally, the frequency of usage can have an impact; if a benefit isn’t utilized for a certain period, it may become inactive.

Moreover, external changes can also play a role. For instance, company policies might shift, or economic pressures could influence the way these offerings are managed. Keeping an eye on industry trends and news can help you stay informed about potential changes that could affect your entitlements.

Lastly, personal engagement matters. Actively monitoring your situation and making timely transactions can help ensure that you maximize your opportunities. Being proactive can make all the difference in getting the most out of any available advantages.

What Happens When Balances Become Invalid?

When your stored values reach their end date, it can lead to some unexpected consequences. You might have been saving them for a special purchase or experience, thinking you had plenty of time. However, once they are no longer valid, you lose the opportunity to use them, and that can be frustrating.

Typically, when these balances are voided, they simply disappear from your account. This means that any plans you had for using them are dashed. It’s always a good idea to keep track of when these time-sensitive items need to be utilized to avoid disappointment.

In many cases, there may be no recourse to recover what was lost. Sometimes, companies will send reminders as the deadline approaches, but don’t always rely on that. Staying proactive about managing time-sensitive resources helps ensure that you benefit from everything available to you.