Exploring Whether Credit Unions Provide Certificate of Deposit Options

Many individuals explore various options for safely growing their savings while earning a decent return. One popular choice among savers is to invest their funds in secure savings vehicles that promise a fixed interest rate over a specified period. These financial products are quite appealing due to their reliability and the predictability they bring to personal finance management.

When considering where to make these investments, a question often arises: Do organizations that prioritize member needs and foster community well-being have similar financial products available? It’s worth delving into how these institutions can play a role in helping their members reach their financial goals while also providing attractive terms.

By examining the services provided by these member-focused entities, individuals can gain insight into the advantages and potential hesitations surrounding these investment options. Understanding the unique features and terms can empower savers to make informed decisions that align with their financial aspirations.

Understanding Certificates of Deposit at Financial Cooperatives

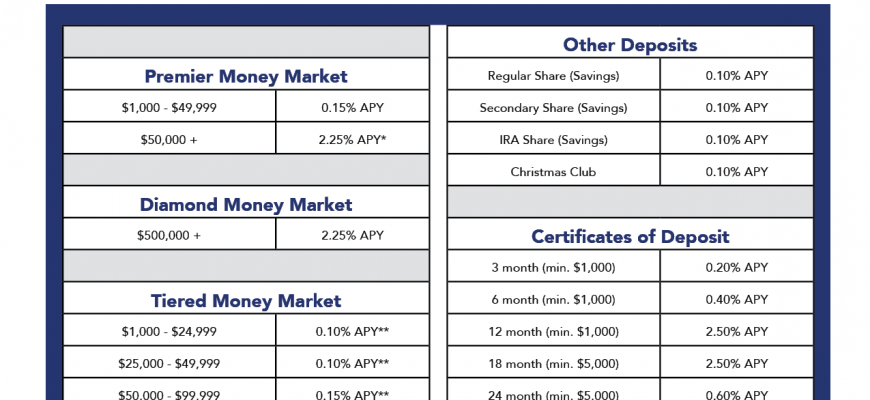

When it comes to saving money while earning interest, many individuals look for safe and reliable options. One popular choice among these savings methods is the certificate of deposit, a financial product that allows you to set aside funds for a predetermined period. The exciting part is that not all establishments providing these savings vehicles are the same; some may offer unique perks, making your investment experience even more appealing.

These financial institutions typically feature different terms and conditions for their savings products. You might encounter various lengths for the investment period, along with distinct interest rates that can increase your returns. Additionally, some organizations might provide options for laddering, which can enhance your liquidity while still taking advantage of higher interest rates. This flexibility can be a fascinating way to manage your finances while maximizing your earnings.

Moreover, individuals often feel a sense of community and trust when engaging with these entities. They tend to prioritize their members’ needs, which can lead to more personalized service and better overall experiences. Understanding the offerings and how they differ from traditional banks helps you make a more informed decision about where to invest your savings.

Benefits of Choosing Financial Cooperatives for Time Deposits

When it comes to saving for the future, many people overlook the advantages of financial cooperatives. These member-focused institutions often provide attractive alternatives to traditional banks, especially for those looking to invest their savings in fixed-term accounts. By exploring the benefits of these places, you may find that they meet your needs more effectively.

Personalized Service: One of the most significant advantages is the personalized attention you receive. Because these organizations prioritize their members, the staff is often more willing to take the time to understand your financial goals and offer tailored solutions.

Competitive Rates: Another appealing aspect is the potential for higher interest rates compared to conventional banks. These establishments typically return profits to members, which can lead to better rates on savings products. This means more money in your pocket over time.

Lower Fees: Financial cooperatives are known for their lower costs. With minimal fees associated with accounts and transactions, your savings can grow without the burden of high charges eating into your earnings. This aspect is crucial for anyone looking to maximize their returns.

Community Focus: Many appreciate the local feel of these institutions. They tend to support community initiatives and engage with local projects, allowing members to feel part of something bigger. When you choose them, you’re contributing to the welfare of your community while securing your financial future.

In conclusion, opting for a financial cooperative for your fixed-term investments presents numerous benefits. From personalized support and superior interest rates to lower fees and a strong community focus, these institutions may be the perfect choice for savers looking to grow their wealth responsibly.

Comparison of Certificates: Financial Institutions vs. Banks

When it comes to saving products with fixed interest rates and set terms, it’s essential to know how different types of financial entities stack up against each other. Both alternatives provide unique benefits for savers, but there are also key differences that can influence your choice. Let’s dive into the specifics and see how these two popular types of organizations compare in this realm.

One notable aspect that sets them apart is the interest rates they typically provide. Institutions often tend to offer competitive rates, sometimes surpassing those found at traditional banks. This can make a significant difference for individuals looking to maximize their returns over time. However, it’s always wise to shop around, as rates can vary widely between individual providers.

Another important factor is membership requirements. Access to savings vehicles at institutions often comes with eligibility criteria based on factors like location or affiliation with certain groups. On the other hand, banks generally welcome anyone looking to save, which could be more convenient for some. This accessibility can play a vital role in your decision-making process.

Additionally, consider the level of customer service. Institutions often pride themselves on a community-centered approach, which means personalized service and potentially more flexible terms for their members. In contrast, larger banks might offer a more corporate feel, with less emphasis on individual relationships but a more extensive network of branches and ATMs.

Ultimately, both options have their merits, and the best choice depends on your unique financial situation and preferences. Whether you gravitate towards the community-focused services or the widespread accessibility, doing thorough research will ensure you find the right fit for your savings goals.