Understanding the Expiration Policies of Credit Card Reward Points

Imagine gathering a treasure trove of rewards from your daily spending and the excitement that comes with it. However, as time passes, many begin to wonder whether this accumulated value might fade away. The thought can be disheartening, especially after putting in the effort to earn those benefits.

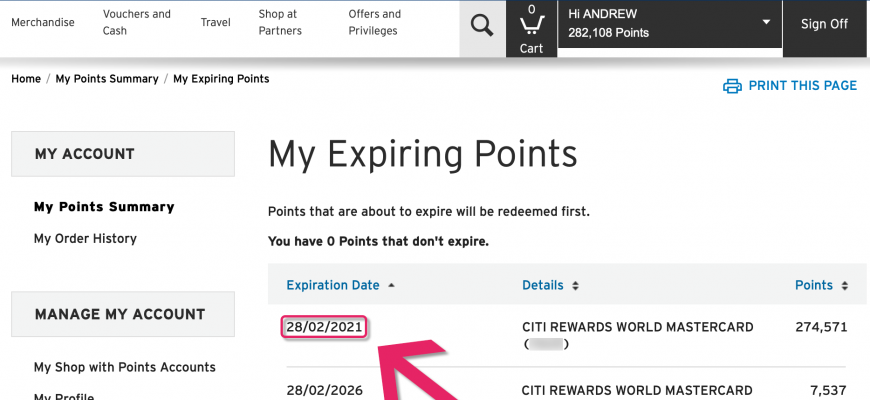

The reality is, the longevity of these rewards can vary significantly depending on the system you’re using. Some programs have seemingly generous timelines, while others may impose stricter conditions that could lead to diminishing returns. It’s essential to understand the terms of your specific rewards to make the most of what you’ve earned.

Staying informed about how long those goodies last–and what actions might be necessary to keep them intact–can empower you as a savvy consumer. After all, knowing the rules of the game means you can maximize the perks you enjoy from your spending habits.

Understanding Reward Currency Lifespan

When it comes to the benefits you earn through various financial programs, it’s essential to grasp how long these rewards are valid. Many folks assume that once they rack up a substantial amount, they’ll have all the time in the world to use them. However, the reality is often different–there are various factors that determine how long these incentives can be enjoyed.

Different programs have their own policies regarding the timeline for using these accrued benefits. Some might allow you to hold onto them indefinitely, while others might impose specific time limits. Knowing these rules can help you strategize your spending and ensure that you maximize the value you receive from your accumulated rewards. It’s all about being informed and taking action before it’s too late!

Additionally, it’s noteworthy that many programs have specific parameters that can affect how long you can use your rewards. For instance, inactivity on your account might lead to a reduction in their validity. Being aware of such nuances can directly impact your experience and overall enjoyment of the benefits you’ve earned through your spending patterns.

Factors Influencing Point Expiration

When it comes to loyalty rewards, various elements play a crucial role in determining how long you can enjoy the benefits of your accumulated rewards. Understanding these factors can help you maximize the value of your efforts. Whether you’re a frequent traveler or just a casual user, being aware of these influences is key to getting the most out of what you’ve earned.

One significant aspect is the type of program you’re enrolled in. Different brands and programs have distinct policies regarding how long rewards remain valid. Some may offer flexible timeframes, while others might impose stricter guidelines. Your activity level also affects this; engaging frequently with a program can often extend the longevity of your rewards. Programs may have provisions to refresh or reset the expiration period based on member interaction.

The method of earning these rewards is another factor to consider. Bonuses and promotional offers might come with their specific terms, which could include shorter validity periods. Additionally, the status tier within a program can impact how long your rewards last. Higher-tier members often enjoy extended privileges and may find their rewards have a more generous timeframe compared to standard users.

Lastly, it’s essential to keep an eye on notification practices. Many programs send reminders as the end date approaches, but not all do so consistently. Ensuring your contact information is up-to-date can help you stay informed about any changes that may affect the usability of your benefits. By being proactive and aware of these variables, you can make the most of your hard-earned rewards.

Maximizing Rewards Before Expiration

Making the most of your rewards can be an exciting challenge, especially as deadlines approach. It’s essential to stay on top of how to utilize your accumulated benefits effectively to ensure you don’t miss out on their value. By planning ahead, you can transform what might seem like an impending loss into fantastic opportunities.

Start by reviewing your current balance regularly. Understanding what you have can help you strategize your spending or redeem options. Look for seasonal promotions or special offers that can give you extra value for your accumulated rewards. Many programs provide bonuses during certain times, so keeping an eye on these can enhance your returns significantly.

Consider pooling rewards with friends or family if that’s a possibility. Joining forces can allow you to access higher-tier rewards that might otherwise be out of reach for an individual. Grouping your benefits can lead to unique experiences or products that you might not have been able to enjoy alone.

Lastly, don’t hesitate to treat yourself. Use your rewards for a memorable experience or that special item you’ve had your eye on. Prioritizing enjoyment over mere accumulation can make your efforts feel worthwhile and satisfying. With a little planning and a proactive approach, you can ensure that your hard-earned benefits are maximized before the clock runs out.