Exploring the Drawbacks and Downsides of Using a Credit Card

When it comes to managing personal finances, everyone knows the allure of plastic money. It promises convenience, flexibility, and a world of opportunities at your fingertips. However, beneath this shiny exterior lies a different story, one that many users may overlook until it’s too late. While the benefits seem endless, there are some not-so-glamorous realities that can catch individuals off guard.

Many enthusiasts of this financial tool often dismiss potential pitfalls, focusing solely on the immediate rewards. Yet, by failing to acknowledge the negatives, one might end up in a precarious situation. From mounting debts to hidden fees, the darker side can create significant stress and financial turmoil if not approached with caution.

Understanding these less favorable aspects is crucial for anyone looking to utilize this financial instrument wisely. Awareness is key, and being informed can make all the difference in avoiding traps that can lead to unfavorable circumstances. Let’s explore what lies beyond the glossy surface and uncover the true implications of using this ubiquitous financial option.

High Interest Rates and Fees

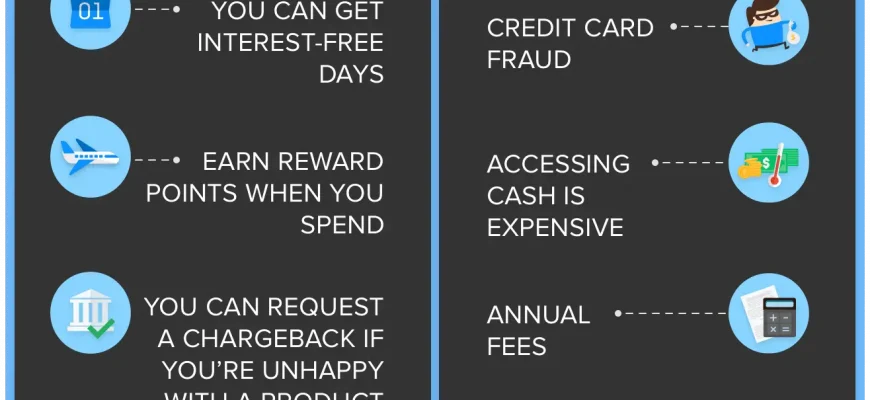

When it comes to borrowing money, there are always hidden costs that can catch you off guard. Many individuals find themselves overwhelmed by the ongoing expenses associated with utilizing these financial tools. It’s not just about how much you spend, but also about what it ultimately costs you over time.

The reality is that charges can add up quickly, especially if you aren’t careful. High rates can lead to soaring balances, making it challenging to pay off what you owe. Even missing a single payment can result in sky-high penalties and additional charges, turning a minor slip-up into a financial headache.

Moreover, these financial instruments often come with various fees that can surprise users. Annual fees, transaction costs, and late payment penalties can accumulate, leading many to wonder if the benefits truly outweigh these financial burdens. It’s essential to keep an eye on your spending habits and be fully aware of the terms and conditions before diving in.

Impact on Credit Score

When you think about how borrowing tools shape your financial life, one key aspect often comes to mind: the effect on your scoring profile. Many people overlook the importance of managing their borrowing habits, which can have a significant influence on this vital number. Understanding this connection is essential for anyone looking to maintain or improve their financial standing.

Every time you apply for a new account, the lender checks your financial history, which can lead to a temporary dip in your score. This is especially true if you submit multiple applications in a short period. Lenders might see this as a sign of financial distress, potentially making them hesitant to extend credit in the future.

Moreover, carrying a high balance relative to your available limit can negatively impact your score. This ratio, often referred to as utilization, is a critical factor in how scoring agencies evaluate your reliability. Keeping this ratio low is generally advised if you want to be seen as a responsible borrower.

Additionally, missing payments or making late ones can deal a serious blow to your financial reputation. The repercussions of such actions can linger for years, affecting not just your ability to obtain loans but also the terms and rates offered by lenders. Staying on top of payments can help build a stronger profile over time.

It’s worth noting that having open accounts can also be beneficial, as it shows a history of responsible borrowing. However, the key is finding that delicate balance between using these accounts wisely and not overextending yourself. Awareness and good practices can lead you toward a healthier financial future.

Overspending and Financial Temptation

In today’s fast-paced world, it’s all too easy to find ourselves caught up in the allure of instant gratification. The convenience of having a piece of plastic that opens the door to countless purchasing opportunities can be both a blessing and a curse. While it makes transactions smooth, it can also lead to some tricky situations that may not benefit your financial health.

When you have access to funds that aren’t immediately visible, it’s easy to lose track of what you’re actually spending. The thrill of shopping can overshadow the reality of managing your budget, leading to purchases that you might later regret. This tendency to indulge can create a slippery slope, where the line between necessary expenses and luxuries becomes blurred, ultimately straining your financial situation.

Moreover, the constant exposure to enticing offers, reward programs, and sales can create an environment ripe for impulsive decisions. Feeling obliged to take advantage of a deal often leads to acquiring items that you don’t really need. Over time, this behavior can accumulate, resulting in a financial burden that feels impossible to manage.

In essence, while having easy access to funds may seem harmless, it can open the door to habits that may compromise your long-term financial stability. Being mindful of the impact of these choices is crucial to maintaining control over your financial destiny.