Exploring the Importance and Impact of Credit Length in Financial Transactions

When you settle in for a movie, have you ever found yourself scrolling through that sequence at the end? You know, the part where names and roles flash across the screen? It’s a fascinating aspect of filmmaking that often goes unnoticed. Many people wonder about the significance of these sections and how they vary in presence and substance. This discussion dives into the fascinating world of these acknowledgments, exploring why they matter and how they are structured.

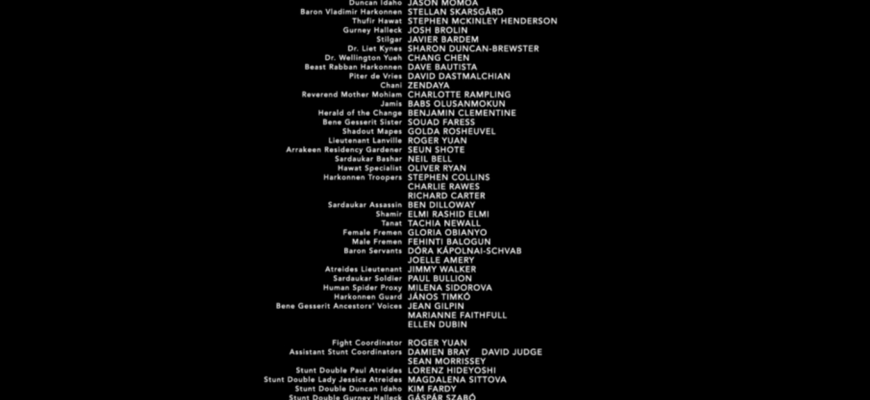

In the cinematic landscape, these sections serve as a tribute to those who contribute to the making of a film. From directors and producers to countless crew members behind the scenes, their collective efforts culminate in the storytelling we enjoy on screen. The duration of this part of the film can significantly impact viewers’ experience and connection to the work as a whole. Understanding the various factors that influence its portrayal can enhance our appreciation for the art of cinema.

So, join us as we unpack the intricacies of these recognitions, examining the reasons behind their variations and the impact they have on both filmmakers and audiences alike. Whether you’re a casual viewer or a dedicated film buff, there’s always something new to learn about the fascinating world of cinematic acknowledgment.

Understanding Credit Duration in Finance

When it comes to financing, the timeframe associated with borrowing money plays a crucial role in shaping financial decisions. Knowing how long you’ll be repaying a loan, or how long you have to manage your credit obligations, can significantly impact your overall financial health. Let’s dive into why this concept is pivotal for anyone dealing with loans or credit agreements.

The duration of your financial commitment can affect various aspects of your budget and planning. Here are some key points to consider:

- Interest Rates: Shorter terms may provide lower rates, while longer terms can lead to higher overall costs.

- Monthly Payments: A brief repayment period usually translates to elevated monthly payments, while extended periods can reduce monthly expenses but increase total interest paid.

- Financial Flexibility: Longer repayment periods might offer more breathing room in your budget, but they can also tie you to a financial obligation for a significant time.

Understanding this aspect can significantly aid in making informed decisions. It’s vital to evaluate your own financial situation, goals, and risk tolerance. Here are some considerations:

- Assess your income stability and future earnings potential.

- Determine your comfort level with debt and repayments.

- Consider your long-term financial objectives and how they align with potential borrowing.

In conclusion, grasping the duration of your financial engagements can influence everything from how you budget monthly to how you plan for future financial stability. By weighing the pros and cons of varying timeframes, you can make choices that align best with your personal financial landscape.

The Impact of Credit Duration on Scores

When it comes to evaluating financial profiles, one key factor often emerges as a significant player: how long your financial obligations have been in place. The duration of your agreements can greatly influence the numerical ratings that lenders use to assess your reliability. Understanding this connection can help you manage your financial decisions more effectively.

Firstly, a more extended history typically indicates responsible management of debts. Lenders tend to favor individuals who have demonstrated consistent repayment habits over time. This sense of stability can lead to higher scoring, as it showcases your ability to handle financial duties without defaulting.

Conversely, a shorter history may raise red flags for potential creditors. Without ample evidence of your repayment track record, they might view you as a higher risk. Establishing a longer engagement with various obligations can contribute positively to the overall impression you leave on scoring models.

Moreover, the variety of your financial engagements can also play a part. Maintaining a mix of different types of accounts, such as revolving credit and installment loans, over an extended period, can further enhance your standing. This demonstrates not only your capability to manage multiple responsibilities but also your adaptability in navigating different financial landscapes.

In conclusion, being mindful of how long your financial tools have been active offers valuable insight into shaping your profile. Committing to a longer duration of sound financial practices can pave the way for improved ratings and greater opportunities in the future.

Strategies for Managing Credit Wisely

When it comes to handling your financial commitments, a thoughtful approach can make all the difference. By adopting smart techniques, you can navigate the intricacies of borrowing effectively, ensuring your resources are maintained and your obligations fulfilled.

First and foremost, it’s essential to keep track of your obligations. Use digital tools or even a simple spreadsheet to monitor due dates, outstanding amounts, and interest rates. This awareness will help you avoid late fees and keep your finances organized.

Budgeting is another vital component. Allocate a specific portion of your monthly income towards settling your dues. This method not only prevents overspending but also creates a sense of discipline, helping you live within your means while managing your responsibilities.

Pay more than the minimum whenever possible. This strategy reduces the total amount owed over time and can lead to significant savings on interest. Even a small increase in your payments can make a noticeable difference in the long run.

Consider consolidating your obligations if you’re juggling multiple accounts. This approach simplifies your payments and often secures a lower interest rate, making it easier to manage your overall financial picture.

Additionally, timely payments can boost your credit score, opening doors to better opportunities in the future. Make it a priority to pay on or before the due date to build a solid financial reputation.

Lastly, stay informed about the terms of your agreements. Understanding the specifics can prevent unexpected surprises and empower you to make better financial decisions.