Exploring Financing Options for Enhancing Your Home

When it comes to enhancing your living space, navigating the financial landscape can feel daunting. Many individuals dream of transforming their residences but may hesitate due to concerns about funding. Fortunately, there are various options available that can help you embark on these exciting ventures without breaking the bank.

Exploring Various Funding Avenues can open doors to creating that perfect sanctuary you’ve always envisioned. Whether it’s adding a cozy reading nook, upgrading your kitchen, or refreshing your outdoor area, understanding how to manage finances is key to making these aspirations a reality. From traditional loans to modern financing options, the journey towards revitalizing your dwelling begins with informed decisions.

As you delve into this topic, you’ll discover that assistance is within reach. With the right resources and a clear plan, moving from dream to reality is not only possible, but also achievable. So, let’s explore the avenues that can turn your aspirations into tangible results!

Understanding Financing Options for Renovation Projects

When it comes to enhancing living spaces, knowing your financial alternatives is key. There are multiple pathways to fund your renovation endeavors, each with its unique benefits and considerations. Whether you want to modernize your kitchen or create a cozy backyard retreat, understanding these choices can empower you to make informed decisions.

Personal Loans are a popular option. These unsecured loans provide quick access to cash without requiring collateral. Potentially higher interest rates can be a downside, but they often offer flexible repayment terms, making them attractive for many homeowners.

Home Equity Loans allow you to tap into the value of your property. By borrowing against the equity you’ve built, you can secure substantial funds for larger projects. However, keep in mind that this usually requires a good credit score and comes with risks if you cannot keep up with payments.

Alternatively, consider Credit Cards for smaller tasks. They’re convenient for quick purchases, but be cautious of high-interest rates that can accumulate quickly if balances are not paid off promptly. Using rewards cards might even earn you points on your expenditures.

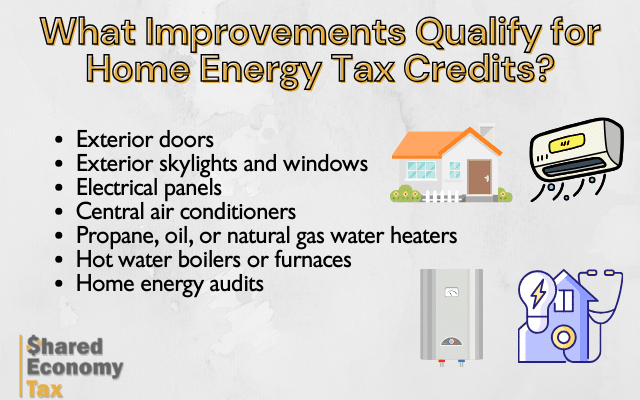

Lastly, some homeowners explore specialized financing options. These might include government-backed loans or programs designed specifically for sustainable upgrades. They can offer favorable rates and terms, making them appealing for those committed to eco-friendly living.

Ultimately, the right choice depends on your individual circumstances, budget, and the scale of your project. Take your time, research your options, and you’ll find a financing solution that suits your renovation journey.

Maximizing Value with Renovation Loans

When it comes to elevating your living space, it’s essential to think strategically. By choosing the right financing options, you can unlock the full potential of your property. This opens up not just opportunities for aesthetic upgrades but also smart investments that can significantly boost your property’s market appeal.

Leveraging financing for renovations allows homeowners to make necessary changes without depleting their savings. Whether it’s a kitchen makeover or energy-efficient upgrades, the ability to access funds can transform a space while ensuring that the costs are manageable over time.

Moreover, enhancements made with such funding can lead to a notable increase in your property’s value. Buyers are often attracted to modern, well-maintained spaces, and investing in key areas can yield impressive returns. Think about what potential purchasers are looking for; kitchens, baths, and outdoor areas often top the list.

In conclusion, making wise choices with relevant financial support can set the stage for both enjoyment and future gains. The right projects can elevate the living experience, all while securing your investment’s worth. So, get ready to explore how you can make the most of your property with thoughtful renovations!

Tips for Choosing the Right Financing Plan

When it comes to enhancing your living space, selecting the appropriate financial solution can make all the difference. With so many options available, it’s crucial to navigate these choices wisely to find a plan that aligns with your budget and goals. Here are some handy tips to guide you through the selection process.

Assess Your Budget: Before diving into different options, take a close look at your finances. Understand your current expenses and how much you can comfortably allocate each month. This will help you avoid picking a plan that stretches your budget too thin.

Compare Interest Rates: Not all solutions come with the same terms. Take the time to shop around and compare interest rates from various lenders. A lower rate can save you a substantial amount over the life of your financing.

Understand the Terms: Every financing option has its own set of conditions. Read the fine print carefully and ensure you understand any fees, repayment periods, and other stipulations that might catch you off guard later.

Consider Your Long-Term Plans: Think about how long you intend to stay in your current place. If your plans could change soon, opt for a plan that offers flexibility, which will allow you to pay off the balance without incurring hefty penalties.

Seek Professional Advice: If you’re feeling overwhelmed, don’t hesitate to consult with a financial advisor. They can offer insights based on your personal situation and help you navigate through options tailored to your needs.

By following these tips, you’ll be better equipped to choose the financial plan that fits your situation perfectly, making your space transformation smoother and more enjoyable.