Exploring Dependents’ Tax Credits on the W4 Form and Their Impact on Your Withholding Decisions

When it comes to handling your finances, particularly during tax season, there are certain perks designed to ease the burden for those who support others. These advantages can potentially lead to a more favorable financial outcome, especially for individuals who provide for their loved ones. Grasping these options can make a noteworthy difference in your overall fiscal health.

A key aspect to consider is how these incentives can directly impact your tax obligations. By leveraging the right information, you can potentially maximize your savings and ensure that you’re making the most of what’s available to you. It’s all about knowing what you can claim and how it translates into the bigger picture.

Diving into these available options often reveals a complexity that can seem overwhelming at first, but don’t worry! It’s perfectly manageable. With a bit of guidance and understanding, you can navigate through the various regulations and ultimately enhance your financial situation. Whether you’re a seasoned taxpayer or a newcomer, familiarizing yourself with these benefits is crucial for everyone looking to optimize their returns.

Understanding Dependents on Your W-4

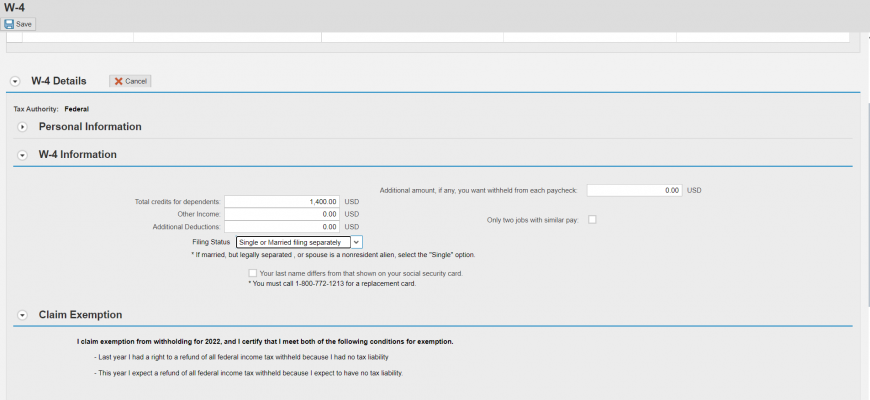

When filling out your W-4 form, it’s important to consider the individuals who rely on your support. These individuals can impact your tax situation significantly and play a key role in determining how much money is withheld from your paycheck. Getting a clear grasp on how these factors work together can lead to a better financial outcome during tax season.

It’s essential to identify the criteria for who qualifies as someone needing your assistance. This will often include children, relatives, or others you provide financial support to. Recognizing these relationships not only helps in completing your W-4 effectively but also ensures you’re keeping as much of your hard-earned money as possible while complying with tax regulations.

Being mindful of these aspects allows you to adjust your withholding to reflect your personal circumstances accurately. It’s beneficial to re-evaluate your situation periodically, especially after major life changes like marriage, birth of a child, or shifts in income. Understanding who counts in this equation can lead to smarter financial planning and, ultimately, more take-home pay throughout the year.

Tax Benefits of Claiming Dependents

When you have little ones or other individuals relying on you, there are financial advantages that can significantly ease your tax burden. These perks can help reduce your taxable income, ultimately leading to a lower tax bill or potentially a larger refund. Understanding these benefits can be a game changer when it comes to filing your taxes.

One of the primary advantages relates to the ability to lower your overall taxable income. This means you could be paying taxes on a smaller amount of money, which can be especially helpful as you juggle expenses related to those relying on you. Additionally, certain programs provide a specific reduction in your tax amount, effectively making a noticeable difference in your overall financial situation.

Also, there are provisions that allow you to take advantage of specific expenses incurred for raising children or caring for other individuals. These allowances can cover a range of costs, helping to offset the financial responsibilities you manage throughout the year. Knowing what applies to your situation can lead to substantial savings.

Ultimately, ensuring that you utilize all the benefits available can lead to more money in your pocket. It’s worth taking some time to understand how these elements work together to support your financial well-being and help you navigate the complexities of tax season with greater ease.

How to Adjust Your Withholding Correctly

Understanding how to fine-tune your tax deductions can save you a lot of hassle come tax season. It’s all about making sure that you’re having just the right amount taken from your paycheck throughout the year. This means you won’t owe too much at tax time, nor will you get too large a refund that might feel like a missed opportunity to invest or save. Let’s break it down.

The first step is to evaluate your current situation. Think about any life changes, like adding new members to your household or changes in income. These factors can significantly influence how much should be withheld. Once you have a clear picture, you can move on to updating your forms appropriately.

Next, you’ll want to fill out your withholding form accurately. It’s essential to provide honest estimates of your earnings and any adjustments necessary. Utilizing the IRS withholding calculator can be incredibly useful here, as it will guide you in determining the right amounts. If you’re unsure, consulting with a tax professional can help clarify things even further.

After you’ve made your adjustments, keep an eye on your pay stubs. This will help you confirm that changes are implemented correctly. If things seem off, don’t hesitate to revisit your form or reach out for help.

Finally, make it a habit to review your withholding annually. Life changes can happen unexpectedly, and it’s wise to stay proactive. By regularly assessing your situation, you can ensure that you remain on track and avoid any unpleasant surprises down the line.