Exploring the Benefits of Tax Credits Available for Dependents

When it comes to navigating the world of personal finances, many individuals find themselves looking for ways to ease the burden of supporting their loved ones. There are various strategies available that can significantly impact one’s financial landscape, especially for those who are carrying the responsibility of additional family members. By exploring the available options, you can discover valuable opportunities to enhance your financial well-being.

In essence, the government offers several initiatives designed to provide fiscal relief and assistance to those supporting family members. These offerings can come in various forms and can lead to substantial savings during tax season. Understanding how these programs work and the eligibility requirements can open up a world of advantages that some may overlook.

Whether you’re a parent looking to maximize your resources, or a guardian raising a family member, delving into these financial avenues can yield positive results. It’s all about making informed choices that align with your situation and ensuring you’re taking full advantage of the support available.

Understanding Dependent Tax Benefits

When it comes to filing your taxes, having certain individuals relying on you can significantly impact your overall financial situation. These benefits are designed to provide relief to those who support others, lightening the load during tax season. By recognizing and utilizing these potential advantages, you can potentially reduce your taxable income and enhance your refund.

Essentially, this assistance is a way for the government to acknowledge your role in supporting others. Whether it’s a child, relative, or another individual, showing that you’re responsible for someone can open doors to financial advantages. Navigating the rules and requirements doesn’t have to be overly complicated; with the right knowledge, understanding how these benefits work can lead to smarter decisions when it comes to your finances.

It’s important to explore the eligibility criteria, as specific guidelines determine who qualifies and what you need to provide. Keeping accurate records and being aware of the distinctions between various types of assistance can also prove beneficial. Knowing how different situations affect your overall tax stance allows for a more informed approach to managing your finances.

In conclusion, grasping the details surrounding these financial advantages is crucial for maximizing your potential savings. Taking the time to understand how they fit into your overall tax strategy empowers you to make the most of your situation, ensuring you don’t leave any potential benefits on the table.

Eligibility Requirements for Assistance Programs

When navigating various support programs, understanding who can benefit is essential. There are specific guidelines that help determine if individuals can receive these financial aids or benefits. These conditions are often based on familial status, income levels, and sometimes age-related factors.

First and foremost, one must consider their household composition. This refers to the number of individuals living in a home and their respective roles. Certain programs aim to support families, so the presence of children or other dependents can significantly influence eligibility.

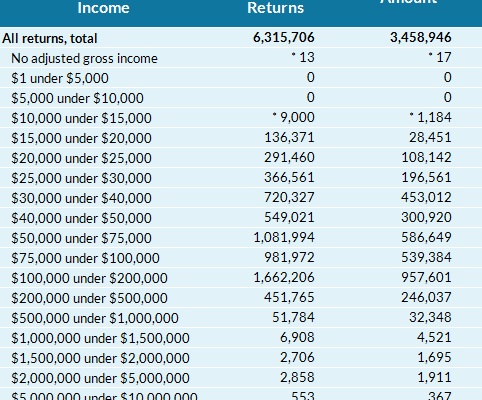

Income plays a crucial role as well. Most assistance schemes have established income thresholds that participants must meet or fall below. This ensures that support reaches those who truly need it. It’s important to evaluate not only annual earnings but also potential deductions that might impact total income calculations.

Additionally, some initiatives have age restrictions that can affect accessibility. Programs designed for minors or students have distinct criteria compared to those aimed at adults or seniors. Understanding these nuances can significantly impact your eligibility status.

Lastly, documentation is key. Individuals interested in these programs must be prepared to provide proof of their household situation and income. This ensures a transparent process and helps agencies allocate resources effectively. By gathering the necessary paperwork ahead of time, applicants can navigate the process more smoothly.

Maximizing Benefits for Families

When it comes to supporting families, there are many opportunities to enhance financial well-being. Understanding the available resources and programs can lead to substantial advantages. By leveraging these options wisely, you can make a significant impact on your household budget and overall quality of life.

One effective strategy involves staying informed about the latest regulations and offerings. This not only ensures you are taking full advantage of what is available but also helps you plan for the future. Families should explore any eligible allowances, assistance programs, or local initiatives that can provide much-needed relief.

Another important aspect is proper documentation. Keeping organized records of expenses and necessary information can streamline the process of obtaining support. It can help simplify interactions with financial institutions or governmental agencies, leading to quicker resolutions and approvals.

Additionally, seeking guidance from professionals, whether they are financial advisors or community organizations, can pave the way for greater insight. These experts can highlight benefits that might not be immediately apparent, helping families to make informed decisions regarding their finances.

Lastly, engaging with other families in similar situations can provide valuable tips and shared experiences. Community support plays a vital role, enabling families to exchange knowledge and strategies that may prove beneficial to all involved.