Essential Information About Credits for the CPA Examination

When embarking on the journey towards professional certification in accounting, one of the key aspects to consider is the accumulation of necessary qualifications. This process often entails a comprehensive understanding of educational standards and respective credentials that must be achieved. It’s not just about passing tests; there’s a whole landscape of prerequisites that aspiring accountants need to navigate.

The pathway is often varied, shaped by individual backgrounds and state requirements. As you delve deeper, you’ll discover a myriad of courses and learning opportunities that enhance your knowledge and skills. Each component plays an essential role in shaping your professional profile, preparing you for the challenges ahead.

Ultimately, the journey is about more than just fulfilling a checklist. It’s an enriching experience that lays the foundation for a successful career in the financial realm. Understanding these components will empower you to take informed steps towards your aspirations in the world of accounting.

Understanding Eligibility Requirements

When diving into the world of accounting certification, it’s crucial to be aware of the prerequisites you need to meet. These guidelines can often shift from one state to another and may encompass a range of factors including educational achievements and professional experience. Taking the time to familiarize yourself with these stipulations will save you from any surprises along the way.

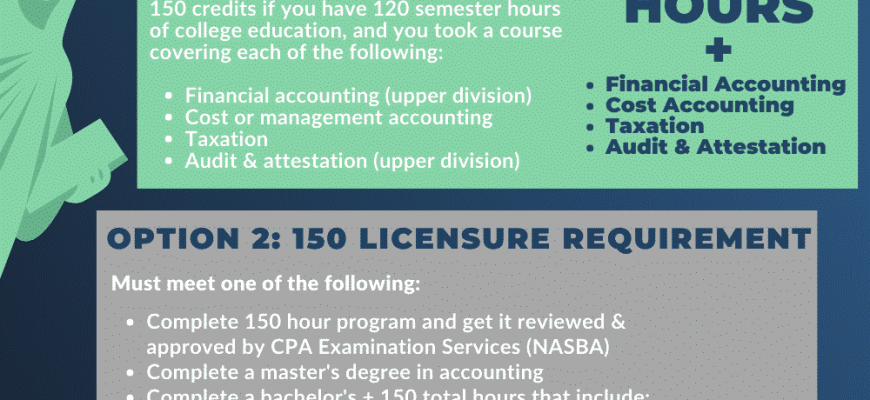

Your academic background plays a significant role in determining if you qualify to pursue this certification. Many candidates are required to have completed a certain number of credit hours in relevant subjects like accounting and business. Additionally, there may be specific degrees that are preferred or even mandatory for enrollment in the program.

Experience can also be a key component. Depending on where you are attempting to achieve your designation, various states might ask for practical experience within a certain timeframe, often under the supervision of a licensed professional. Understanding these criteria is essential for mapping out your journey in the accounting profession.

Finally, there could be additional mandates such as age requirements or residency stipulations that you must adhere to. Thoroughly researching these factors will aid in positioning yourself for success and ensuring you meet all necessary benchmarks before taking this significant step in your career.

Maximizing Your Credits for CPA Success

Achieving your goals in the accounting profession requires strategic planning and informed decisions. One key aspect of this journey involves effectively accumulating the necessary points and accolades that strengthen your resume. Let’s explore some tips to help you optimize your journey towards professional certification.

- Understand Requirements: Familiarize yourself with the specific qualifications needed in your state or jurisdiction. Knowing the prerequisites sets a strong foundation.

- Leverage Educational Opportunities: Look for accredited programs and workshops that offer valuable insights and instruction. Online courses can also provide flexibility.

- Seek Relevant Experience: Participate in internships or entry-level positions that allow you to gain practical knowledge. Hands-on experience enhances your understanding.

- Network with Professionals: Connect with others in the field. Networking can lead to mentorship opportunities and insights about best practices for success.

- Stay Informed: Follow changes in regulations and updates in the industry. Being aware of new trends can position you ahead of the competition.

- Utilize Study Resources: Invest in study guides, online platforms, and practice tests to enhance your preparation efforts. The right tools can make a significant difference.

Incorporating these strategies into your career path not only helps you in gathering the necessary qualifications but also prepares you for the challenges ahead. Focus on consistency and a proactive approach, and you’ll surely find your way to success in the accounting realm.

Common Misconceptions About CPA Credit Hours

When it comes to the requirements for professional certification in accounting, there are several misunderstandings that persist among aspiring candidates. Many individuals believe that the pathway to achieving their goals is riddled with complex rules and restrictions. In reality, the journey can be more straightforward once you clear up these misconceptions.

One prevalent myth is that all educational experiences are created equal. Some individuals think any type of coursework will count toward their requirements. However, it’s essential to recognize that the content of the classes and their relevance to the field often dictate whether they’ll be accepted. Simply put, not every class will help you tick that box.

Another common belief is that acquiring a certain number of hours guarantees immediate eligibility for professional certification. While accumulating these hours is indeed a necessary step, there are other factors to consider, such as practical experience and applicable ethics training. It’s not solely about the numbers; the quality and context of your learning matter just as much.

Additionally, many assume they must complete their educational requirements in a specific timeframe. In truth, there is flexibility in how and when you can pursue relevant learning opportunities, allowing you to tailor your path based on your personal circumstances. This aspect can significantly relieve the pressure commonly felt by candidates.

Lastly, some may believe that once they’ve obtained the necessary qualifications, they’re set for life. However, continuous professional development is key to maintaining your credentials and staying current in the ever-evolving field of accounting. Embracing a mindset of lifelong learning ensures your expertise remains relevant and valuable.