Exploring the Benefits of Credit with ZenMarket Services

Nowadays, managing finances has become more than just a routine task; it’s a journey filled with opportunities and challenges. In a world where convenience is key, platforms are emerging that cater to the diverse needs of individuals and businesses alike. These services aim to simplify transactions, enhance purchasing power, and provide tailored options for users seeking to make the most out of their financial experiences.

The rapid evolution of online marketplaces has transformed the way we think about spending and saving. With a plethora of options available at our fingertips, it’s essential to navigate these waters wisely. This is where modern financial tools come into play, offering unique features designed to enhance accessibility and streamline processes. Users can benefit from innovative services that not only facilitate purchases but also empower them to make informed decisions.

By understanding these contemporary solutions, you open doors to a more fulfilling financial journey. Exploring the intricacies of such platforms allows you to discover methods that extend your financial capabilities, enhance your transactions, and ultimately contribute to your overall financial well-being. Ready to dive in and learn more? Let’s explore what’s out there!

Understanding Financing Options

When it comes to making purchases online, especially from platforms that offer a wide range of products, knowing how to manage your spending is crucial. Many users often look for ways to facilitate their buying experience and to stretch their budget further. This section will guide you through the essentials of utilizing various financing methods to enhance your shopping journey.

One of the key aspects of managing your finances in a digital marketplace is exploring the flexibility in payment options. By leveraging different methods, you can take advantage of promotional deals, seasonal discounts, and exclusive offers that may not always be available through standard payment procedures. Understanding how to incorporate these options into your buying strategy can make a significant difference in your overall experience.

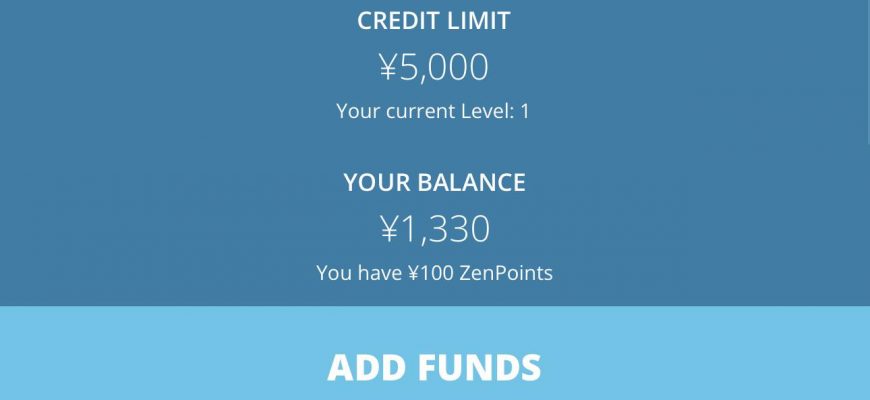

Additionally, it’s important to familiarize yourself with the terms and conditions associated with any financing arrangement you choose to use. Each platform may have certain guidelines that dictate usage limits, interest rates, or repayment schedules. Being aware of these details will help you make informed decisions and avoid unnecessary pitfalls.

Ultimately, the goal is to create a seamless and enjoyable shopping experience while ensuring that your financial health remains intact. By taking the time to understand the available options and how they can work for you, you can confidently navigate the world of online purchasing, making the most of what the marketplace has to offer.

How This Service Enhances Shopping Experience

Imagine a platform that takes the hassle out of online shopping, making it both enjoyable and efficient. It offers a seamless way to access countless products from various vendors, ensuring that you find exactly what you’re looking for without the usual stress. With innovative solutions and user-friendly features, this service revolutionizes how we shop in the digital age.

One of the standout aspects is the intuitive interface, which allows users to navigate effortlessly through a vast selection of goods. Filters and search options are designed to refine your search, transforming the often tedious task of browsing into a fun adventure. No more endless scrolling or sifting through irrelevant items; everything you want is just a click away.

Additionally, the service provides tools to track prices and receive alerts for discounts, saving you money while enhancing your shopping journey. Users can capitalize on exclusive deals and special offers that might not be available elsewhere. This approach not only enhances the experience but also instills confidence in making informed purchasing decisions.

Moreover, comprehensive customer support is always at your disposal. Whether you have questions about shipping, need assistance with an order, or seek product recommendations, help is just a message away. This support transforms the shopping process from a solitary activity into an engaging experience filled with professional guidance.

Ultimately, this platform transcends traditional online shopping paradigms by focusing on user satisfaction, convenience, and engagement. It ensures that every interaction is smooth and enjoyable, making it an essential tool for savvy shoppers everywhere.

Tips for Managing Financial Trust Responsibly

When it comes to handling borrowed funds, a little bit of knowledge can go a long way. It’s all about making informed choices that not only keep your finances in check but also pave the way for a secure future. Mastering this art can greatly enhance your peace of mind and allow you to take advantage of opportunities that come your way.

1. Keep Track of Your Spending

One of the best strategies to maintain control is to monitor your expenses closely. Create a budget that outlines your income and outgoings, and stick to it. This will help you understand where your money goes and identify areas for improvement.

2. Pay On Time

Timeliness is crucial. Making payments promptly not only avoids late fees but also builds a positive reputation with those you owe. This can open doors for better terms in the future.

3. Know Your Limits

Before taking on any financial obligations, know how much you can realistically handle. Borrowing within your means ensures that you won’t find yourself in a precarious situation down the line.

4. Consider Consolidation

If juggling multiple commitments is becoming overwhelming, think about consolidating your debts. By merging them, you may benefit from a lower interest rate and simplified payments.

5. Use Resources Wisely

Take advantage of tools and services designed to assist in managing your financial dealings. Online platforms can provide valuable insights, reminders, and tracking options to help you stay organized.

6. Stay Informed

The financial landscape is always changing. Keeping yourself updated on trends, regulations, and strategies can empower you to make decisions that align with your long-term goals.

Overall, effective management of borrowed resources comes down to smart planning, discipline, and continuous learning. By applying these practical tips, you can navigate the world of financial obligations confidently and successfully.