Exploring the Role and Impact of Credit Unions Across Europe

In the realm of finance, there’s a fascinating concept that brings people together to achieve common monetary goals. These community-driven organizations are built on the principles of cooperation and mutual support. They offer individuals the chance to pool their resources, share knowledge, and ultimately take control of their financial destinies.

What sets these institutions apart is their commitment to serving their members rather than generating profits. They provide a more personalized approach to financial services, prioritizing the needs of individuals and families over the bottom line. Whether it’s saving for a new home, securing a loan for a business venture, or simply managing day-to-day finances, these collaborative efforts create a welcoming environment for all.

As we explore the landscape of these financial institutions on the continent, we will uncover their unique characteristics, their impact on local communities, and how they continue to evolve in an ever-changing financial world. The journey into this aspect of finance reveals not only numbers and services but also stories of empowerment and resilience from individuals who have embraced this model.

Understanding the Role of Financial Cooperatives

In a world where financial institutions often prioritize profit over people, a different approach has emerged through community-driven organizations. These entities aim to empower individuals by providing them with access to essential financial services while fostering a sense of belonging and mutual support. Their mission revolves around collaboration rather than competition, reshaping how many perceive the world of finance.

At their core, these organizations thrive on the principle of member ownership. This means that those who use their services also have a stake in their operation. By sharing profits and decisions, these groups promote a model that prioritizes community wellbeing over corporate gain. This aspect is not just appealing; it’s transformative, especially for those who may find themselves underserved by traditional banking systems.

Moreover, the role of these cooperatives extends beyond merely offering loans or savings options. They frequently engage in educational initiatives, helping members understand personal finance better. This empowerment leads to informed decisions, encouraging financial literacy among the community. As a result, individuals become more aware of their economic circumstances and better equipped to navigate challenges.

In summary, these organizations are more than just financial service providers; they are vital community hubs that prioritize collaboration, education, and mutual growth. By cultivating a supportive environment, they play a significant role in enhancing the financial well-being of their members while fostering strong ties within the community.

History and Development of Cooperative Financial Societies

The journey of cooperative financial institutions is a fascinating one, rooted in the idea of community support and mutual assistance. These organizations emerged in response to financial exclusion and the need for accessible services, aiming to empower individuals by pooling resources together. Over the years, they have evolved into vital components of the financial landscape, fostering a sense of belonging among members while promoting economic well-being.

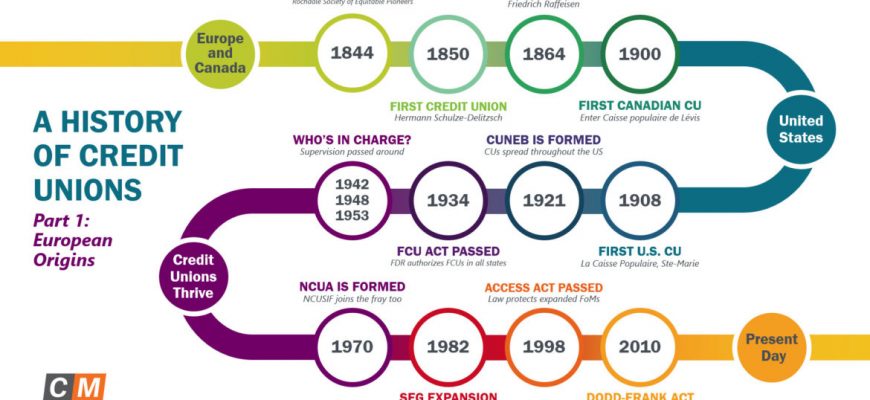

The origins of these financial collectives can be traced back to the 19th century, when visionary thinkers began advocating for models that prioritized people over profit. They sought to create safe spaces for individuals to save and borrow, without the burdensome fees often associated with traditional banking entities. This grassroots movement gained momentum, leading to the establishment of several pioneering institutions that laid the groundwork for the modern iterations we see today.

Benefits of Joining a Financial Cooperative

Being part of a community-driven financial organization offers a range of advantages that can significantly enhance your financial well-being. These groups prioritize their members’ needs above all else, creating an environment where individuals can thrive together. From better rates to personalized services, the benefits are numerous.

One major advantage is access to lower interest rates on loans, making borrowing more affordable. Additionally, members often enjoy higher returns on savings compared to traditional institutions. This is mainly due to the cooperative model, which allows profits to be funneled back to the members rather than external shareholders.

Furthermore, joining one of these organizations fosters a sense of community. It’s not just about finances; it’s about building relationships with like-minded individuals who share your values. Many of these entities offer financial education programs, helping you make informed decisions and improve your financial literacy.

Another significant perk is the customer service experience. Members typically receive personalized attention and support, making it easier to address any concerns or questions. This level of care and understanding is often hard to find in larger, impersonal financial institutions.

In summary, becoming a member of a cooperative can lead to improved financial opportunities, a supportive community, and a service-oriented experience that prioritizes your needs. It’s a smart choice for anyone looking to take charge of their financial future.