Unlock Exclusive Savings with the Latest Credit Union West Promo Code

In today’s dynamic financial landscape, individuals are constantly on the lookout for smart ways to save and maximize their resources. One exciting option that many are discovering involves taking advantage of special deals and incentives provided by various financial institutions. These offers can enhance your banking experience, making it more rewarding and beneficial in numerous ways.

Whether you’re searching for lower fees, better interest rates, or additional perks, there are numerous opportunities to explore. Engaging with specific organizations that specialize in community banking can lead to a treasure trove of financial advantages that may not be readily available elsewhere. By utilizing unique offers, you can securely navigate your financial journey while enjoying added value at every step.

So, if you’re eager to discover how you can elevate your financial experience and unlock potential savings, you’re in the right place. Let’s delve into the ways you can make the most of these unique opportunities and see what incredible benefits await you!

Understanding Membership Advantages

When you think about where to put your money, it’s important to consider the unique perks of joining a member-focused financial institution. These organizations prioritize their members’ well-being, offering a range of services that can enhance your financial experience. By opting for this alternative to traditional banks, you can unlock a world of benefits designed to empower you on your financial journey.

One of the most appealing aspects of membership is the competitive interest rates on savings and loans. Unlike conventional banks that prioritize profit, these institutions aim to provide fair returns and lower borrowing costs. This means that you can not only grow your savings at a faster pace but also save money when taking out loans.

Additionally, many of these organizations provide access to personalized services. From financial education resources to one-on-one consultations, members often receive tailored advice that aligns with their unique financial goals. This hands-on approach can make all the difference in achieving financial success while feeling supported every step of the way.

Also worth mentioning is the sense of community that comes with membership. You’re not just a number; you’re part of a collective that shares common goals. Many organizations invest back into their communities, supporting local initiatives and projects that directly benefit the members and their neighborhoods.

Finally, exploring additional incentives such as cashback options and referral bonuses can add even more value. These little extras can enhance your overall experience, making it even more rewarding to remain a part of such an institution. With so many advantages at your fingertips, it’s clear that choosing a member-oriented organization could be a smart move for your financial future.

How to Use Discounts Effectively

Finding ways to save on purchases is always a smart move. Utilizing promotional offers can significantly reduce costs, but there’s an art to using them wisely. Knowing when and how to apply these offers can make a big difference in your overall shopping experience.

First, keep an eye out for special events or seasonal sales. Many businesses provide exclusive deals during holidays or specific dates, so timing your purchases can yield substantial savings. Additionally, make sure to sign up for newsletters or follow brands on social media; they often share limited-time offers with their loyal customers.

Another tip is to read the fine print. Understanding the terms and conditions can prevent any surprises at checkout. For instance, some offers may only apply to certain items or require a minimum spend. By being fully informed, you can maximize your savings potential.

Lastly, don’t hesitate to combine offers when possible. Sometimes, you can stack discounts or use multiple offers for even greater reductions. Remember, every little bit counts, so take the time to find the best possible deals for your needs.

Comparing Offers from Financial Cooperative

When it comes to evaluating the various incentives offered by financial cooperatives, it’s essential to take a closer look at the unique features each one brings to the table. With numerous options available, you might find it beneficial to weigh the pros and cons to determine what aligns best with your financial goals. Different institutions may provide distinct perks, whether they be lower rates, special bonuses, or exclusive member services.

Start by examining interest rates on savings accounts and loans, as these can significantly affect your financial health. Some organizations may have competitive rates that offer better returns on your savings or lower costs for borrowing. Also, consider any additional services they provide, like financial advice or mobile banking features, which could enhance your overall experience.

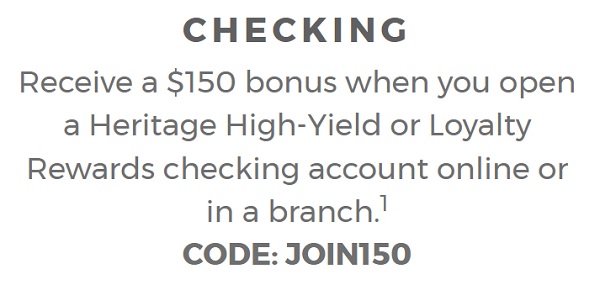

Incentives such as cash bonuses for account openings or referral rewards can also make a difference. These perks can sweeten the deal and make certain institutions stand out in a crowded market. Always read the fine print to ensure you fully understand the terms and conditions associated with any offer you’re considering.

Lastly, don’t forget to take member satisfaction and community involvement into account. A cooperative with a great reputation and strong roots in the community can often provide more personalized service and a sense of belonging. By carefully comparing these elements, you’ll be in a better position to choose an option that truly meets your needs.