Exploring the Process of Logging into Your Credit Union’s Online Banking System

In today’s fast-paced world, managing your finances has never been easier, thanks to the convenience of digital platforms. Individuals can now access a wide array of services from the comfort of their homes or on the go. This shift towards virtual management has become a game-changer, allowing for efficient communication and transaction processing.

Whether you’re checking your balance, transferring funds, or reviewing transaction history, seamless access to your accounts is essential. With user-friendly interfaces and robust security measures, navigating through your financial services has transformed into an effortless experience. Many institutions prioritize making their platforms intuitive, ensuring that everyone can benefit from the available functionalities.

It’s vital to understand the steps needed to access these essential tools securely. Knowing the mechanisms in place can help you feel more at ease while interacting with your financial resources. As you continue reading, you’ll discover straightforward instructions and tips for smoothly engaging with your chosen service provider, ensuring a stress-free experience every time.

Understanding Digital Financial Services

When it comes to managing your finances in today’s fast-paced world, having access to digital tools is essential. These platforms provide a convenient way for individuals to handle their monetary matters from the comfort of their own space. Whether it’s checking balances, transferring funds, or paying bills, modern services have made financial tasks easier and more accessible than ever.

Users can take advantage of various features designed to simplify their experience. With intuitive interfaces, you can navigate through your accounts with ease, making it unnecessary to visit physical locations. Furthermore, the level of security implemented ensures that your information remains protected while you conduct transactions.

Getting started with these services is generally straightforward. Most platforms require only basic personal information to set up an account. Once you’re up and running, you will discover a range of functionalities that can assist you in monitoring your financial health and making informed decisions.

In addition to standard features, many platforms now offer innovative tools like budgeting assistance and financial planning resources. These extras can help you take control of your spending and save for future goals, turning your financial management into a proactive rather than reactive process.

Ultimately, embracing these digital solutions means empowering yourself in your financial journey. With the right tools at your fingertips, you can easily handle your finances, making it a hassle-free experience that suits your lifestyle.

How to Access Your Financial Institution Account

Gaining entry to your financial services account is a straightforward process that enables you to manage your funds with ease. Whether you’re checking your balance, transferring funds, or reviewing transactions, having quick access to your account is essential in today’s fast-paced environment.

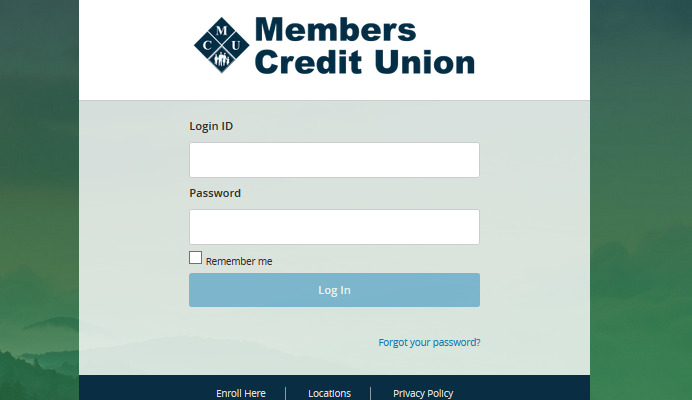

To begin, navigate to the official website of your financial institution. Look for the section dedicated to account access, often labeled clearly for user convenience. Once you find it, click on the designated button to initiate the sign-in procedure.

You will typically be prompted to enter your unique identification information, such as your username or membership number. Afterward, provide your secure passphrase. Make sure you input the information accurately to avoid any lockout issues.

If you encounter difficulties, look for a link labeled ‘Forgot Username or Password’ to regain access. It’s also advisable to set up security questions or enable multi-factor authentication for added protection of your account.

Once you successfully access your account, take a moment to familiarize yourself with the layout and available features. This will enhance your overall experience and help you utilize the full potential of your financial management tools.

Security Tips for Digital Financial Users

When managing your finances through web platforms, it’s essential to prioritize your safety. With cyber threats becoming increasingly sophisticated, knowing how to protect your sensitive information is vital. Here are some practical tips to help you navigate the digital landscape securely.

First and foremost, always ensure that your access point is secure. This means avoiding public Wi-Fi networks when handling financial transactions. Instead, use a trusted connection or your mobile data. Additionally, consider enabling two-factor authentication for an extra layer of protection. This simple step can significantly reduce the risk of unauthorized access.

Keeping your devices up to date is another key aspect of ensuring security. Regularly update your operating systems, browsers, and applications to benefit from the latest security patches. Outdated software can create vulnerabilities that hackers exploit.

Moreover, be cautious with the information you share online. Avoid disclosing personal details on social media or unsecured platforms, as they can provide clues for potential scammers. Always scrutinize emails and messages that prompt you to click on links or provide sensitive data, as these may be phishing attempts.

Lastly, utilize strong, unique passwords for your accounts. A combination of letters, numbers, and symbols plays a critical role in thwarting unauthorized access. Consider using a password manager to help keep track of these. By adopting these practices, you can significantly enhance your safety when managing your finances digitally.