Understanding the Importance of Credit Scores for Businesses and Their Implications for Financial Success

When it comes to securing opportunities for growth and stability in the world of commerce, understanding the importance of a particular numerical representation of one’s financial health is crucial. This evaluation plays a vital role in determining how lenders perceive the viability of collaborations or ventures. In essence, this assessment reflects the trustworthiness and reliability of an entity to uphold its financial commitments.

Many aspiring entrepreneurs and established entities alike may find themselves curious about how this numerical indicator can open doors to funding, partnerships, and even favorable terms in contracts. It’s more than just a number; it’s a gateway to resources that can propel an organization to new heights. Knowing how to interpret this value can empower decision-makers to enhance their financial strategies and foster sustainable growth.

In this discussion, we’ll delve into the factors that influence the evaluation of an enterprise’s financial standing, explore why it matters, and offer practical tips on how to improve it. Whether you’re just starting out or looking to elevate your existing operations, understanding this key aspect will be instrumental in your journey toward achieving success.

Understanding Business Credit Scores

In the world of entrepreneurship, the financial reputation of a company plays a pivotal role in its growth and sustainability. It’s essential to grasp how lenders and suppliers evaluate a firm’s financial reliability, as this influences access to funding and favorable terms. Knowing the factors that contribute to this assessment can empower owners to make informed decisions and enhance their standing in the marketplace.

A range of elements contributes to this financial assessment, including payment history, outstanding debts, and the duration of credit history. Maintaining timely payments and effectively managing obligations can significantly boost a company’s standing. Additionally, having a diverse financial background, such as loans and credit lines, can further strengthen this perception.

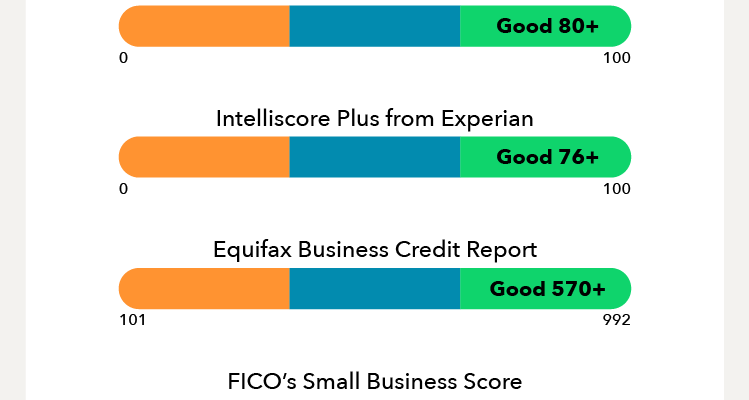

Furthermore, there are various agencies that specialize in evaluating these financial profiles, each employing distinctive methodologies and criteria. Familiarizing oneself with these agencies allows owners to monitor their standing and address any discrepancies promptly. Ultimately, a solid financial standing can lead to improved opportunities, from negotiating better loan conditions to establishing trust with suppliers.

The bottom line is that understanding and managing one’s financial reputation is an ongoing process. By staying informed and proactive, entrepreneurs can position their firms for lasting success and establish reliable partnerships in the industry.

Importance of Ratings for Companies

Understanding the significance of evaluations in the commercial world is vital for any enterprise aiming for success. These assessments serve as a reflection of a company’s financial health, influencing various aspects from securing funding to establishing partnerships. Without a solid evaluation, many opportunities may slip through the cracks.

These ratings play a crucial role in shaping the perception of a firm within the marketplace. Investors, lenders, and even suppliers often rely on these evaluations to make informed decisions. A robust rating can empower a company to negotiate better terms, lower interest rates, and gain a competitive edge. Conversely, a poor assessment might lead to missed opportunities and restricted growth.

Furthermore, maintaining a good evaluation fosters trust and credibility. When a company demonstrates sound financial management and responsibility, it attracts potential alliances and investment prospects. A positive reputation can elevate a company in the eyes of its stakeholders and customers, further reinforcing its position in the industry.

In conclusion, the relevance of assessments cannot be overstated. They not only impact immediate financial dealings but also create a foundation for long-term sustainability and success. Adopting practices that enhance these evaluations is essential for companies striving to thrive in a competitive landscape.

How to Enhance Your Company’s Financial Reputation

Improving how your organization is perceived in the financial world can open up a host of opportunities. It’s essential to take actionable steps that showcase your reliability and responsibility in managing funds. By focusing on a few key areas, you can create a solid foundation that reflects well on your financial history.

First off, make sure to pay your vendors and suppliers on time. Timely payments not only strengthen relationships but also signal to the financial community that you are trustworthy. Set reminders or automate payments to avoid any mishaps.

Next, consider establishing a dedicated financial profile for your enterprise. Keeping personal and professional finances separate is crucial. This makes it easier to track financial behavior and demonstrate your commitment to your company’s financial obligations.

Additionally, monitor your financial tracks regularly. Understanding what factors influence your financial standing allows you to make informed decisions. Stay on top of any discrepancies or errors, as they can have a negative impact on your overall standing.

Finally, don’t hesitate to build relationships with financial institutions. Engaging with banks and other lending entities can provide insights and opportunities that may benefit you in the long run. Communicate openly and maintain those connections to foster a positive image.