An In-Depth Exploration of the Role and Impact of Credit Rating Agencies in Europe

The landscape of financial assessment in our world is filled with numerous players that help both individuals and institutions make informed choices. As the complexity of global finance increases, so does the necessity for reliable evaluations that reflect the stability and credibility of various entities. Whether it’s a burgeoning startup or a long-established corporation, understanding their financial health is essential for any investor or partner.

In this context, certain institutions have emerged as pivotal sources of information. They employ various methodologies to analyze and disseminate insights regarding the economic soundness of organizations and governments. This process is not just about numbers; it’s a detailed narrative that reveals the underlying strengths and weaknesses of a financial entity.

As we dive deeper into this fascinating realm, we’ll explore how these evaluators operate, their significance in shaping financial decisions, and the impact they have on markets and investors across the continent. This journey promises to uncover the vital role they play in fostering transparency and trust in the financial ecosystem.

The Role of Credit Rating Agencies

In the financial landscape, certain entities play a crucial role in guiding investors and institutions alike. These organizations assess the likelihood of individuals or companies meeting their financial obligations. Essentially, they provide a form of assurance, helping stakeholders make informed decisions based on the perceived stability of various borrowers.

The function of these evaluators extends beyond mere number crunching. They analyze economic conditions, review financial statements, and utilize complex methodologies to assign evaluations. Their insights can significantly influence market behaviors, impacting everything from interest rates to investor confidence.

Furthermore, these entities contribute to overall market transparency. By offering an independent perspective, they help reduce information asymmetry, fostering a more level playing field for all market participants. This promotes trust, as stakeholders rely on these assessments to gauge potential risks associated with their investments.

Additionally, the influence of these evaluative bodies can reach governments and public institutions seeking to borrow capital. A favorable evaluation may lead to lower borrowing costs, while a less favorable one could deter potential investors, showcasing the weight of their assessments in broader economic contexts.

Impact on European Financial Markets

The work of organizations that evaluate the financial standing of companies and countries has significant implications for the stability and development of monetary systems. Their assessments influence investor confidence, affect borrowing costs, and determine the overall economic climate. Understanding how these evaluations shape financial landscapes is crucial for stakeholders at all levels.

When these evaluators revise their assessments, it can set off a chain reaction in the markets. For instance, a downgrade can lead to an increase in borrowing costs for governments and corporations. This, in turn, may tighten the availability of capital, impacting business investments and consumer spending. A strong perception can create a favorable environment, attracting foreign investment and boosting market confidence.

Moreover, the influence on national economies cannot be overstated. Positive evaluations typically correlate with lower interest rates, facilitating easier access to financing. Conversely, negative ones can lead to economic downturns, as financial entities steer clear of riskier investments. Thus, the evaluations serve as a barometer for economic health, guiding both policymakers and investors.

Lastly, it is essential to recognize the role of transparency and accountability in this ecosystem. When these evaluators provide clear, well-founded evaluations, it fosters trust among market participants. An environment of openness can enhance stability, reducing the likelihood of sudden market shocks and ensuring informed decision-making.

Regulatory Framework and Oversight Mechanisms

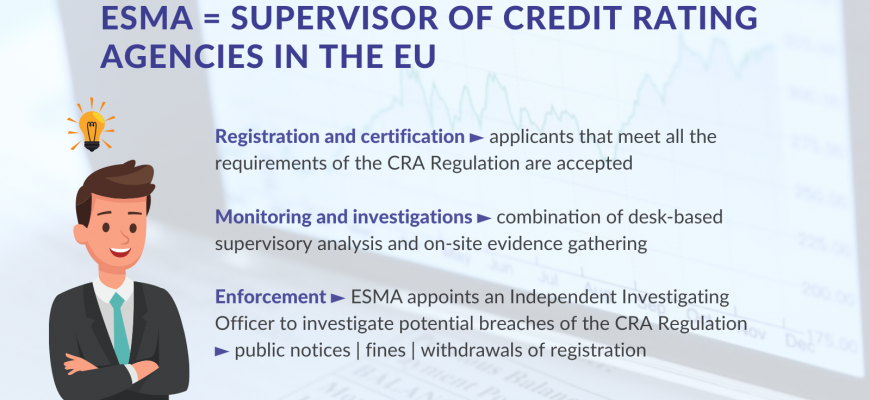

When we talk about the structure that governs financial assessment organizations, it’s crucial to understand the importance of effective supervision and rules in place. This framework is designed to ensure transparency, accountability, and integrity within the sector. Various authorities are responsible for establishing standards and monitoring compliance to maintain a stable financial ecosystem.

The legislative landscape is grounded in diverse regulations aimed at enhancing the reliability of evaluations provided to investors and other stakeholders. These guidelines help define the roles and responsibilities of entities involved in assessments, promoting ethical practices and minimizing conflicts of interest. By setting clear expectations, authorities strive to build trust in the evaluations that influence significant investment decisions.

Oversight bodies play a pivotal role in enforcing these regulations. They conduct regular audits, review methodologies, and assess adherence to established protocols. This vigilance helps to identify potential shortcomings and ensures that the organizations uphold the highest standards. Additionally, collaboration between national and international regulators fosters a more unified approach to oversight, enhancing consistency across borders.

In summary, the regulatory framework and oversight mechanisms create a supportive environment for financial assessment functions. By prioritizing governance, these structures aim to safeguard the interests of market participants while promoting confidence in the overall financial system.