How to Easily Access Your Credit One Card Number Online

In today’s fast-paced world, managing financial resources efficiently has become essential for many individuals. Whether it’s for monitoring expenditures or making informed decisions about personal budgeting, having easy access to essential financial tools is key. This discussion delves into how you can securely access vital information related to your financial instruments from the comfort of your home.

Many often wonder about the functionalities and features available at their fingertips, as technology makes financial management simpler. From tracking transactions to understanding recent charges, knowing how to access this information can empower you to take control of your finances. By utilizing various platforms, it’s easier than ever to keep tabs on your fiscal activities.

As we explore the myriad options available for accessing financial data, the emphasis lies on both security and convenience. Ensuring that your sensitive information is well-protected while still being readily accessible is paramount. Let’s navigate through the essential aspects that can aid you in this pursuit, making your financial experience more seamless.

How to Access Your Financial Details

Accessing your financial information has never been easier, thanks to various digital platforms. Whether you want to check your transactions or manage your account settings, knowing where to look is essential. In this section, we’ll guide you through the straightforward steps to retrieve your detailed information securely and efficiently.

First, visit the official website of your financial service provider. Once there, look for the login section, which is usually prominently displayed. Enter your credentials to access your personal area. If you haven’t registered yet, you may need to create an account by providing some basic information.

After logging in, navigate to the section dedicated to account management. Here, you’ll find an array of options, including transaction history, current balance, and any relevant offers. If you’re searching for specifics, such as spending limits or billing cycles, these details are typically housed under account settings or similar tabs.

If you encounter any challenges while trying to access your information, most websites offer support services. You can reach out via chat, email, or phone for assistance. Remember to always prioritize security–make sure you’re using a secure connection and avoid accessing your details on public networks.

With just a few simple steps, you can effortlessly manage your financial profile and stay informed about your economic activity.

Managing Your Financial Account Remotely

Handling your financial account from the comfort of your home has never been easier. With just a few clicks, you can perform a multitude of tasks that ensure your finances are in order. This section will guide you through the essentials of navigating your account effectively, empowering you to take control of your financial health.

Accessing Your Profile

To start, simply log into your profile using your credentials. This secure gateway will enable you to view your account details, recent transactions, and any applicable rewards. It’s like having a personal assistant right at your fingertips!

Monitoring Transactions

Keeping an eye on your expenditures is crucial. You can easily track where your funds are going, allowing for better budgeting and planning. The platform provides you with detailed insights, making it easier to identify spending patterns.

Making Payments

Paying your bills can be a hassle, but with the right tools, it becomes a breeze. Set up payment reminders or automatic deductions to ensure you never miss a due date. This feature not only saves time but helps you avoid unnecessary fees.

Updating Personal Information

Life changes, and so should your account details. Whenever your contact information or preferences change, you can update them at any time. Keeping your profile current ensures that you receive all necessary communications promptly.

Accessing Support

If you encounter any issues or have questions, customer support is just a click away. The platform offers various support options, from live chat to email assistance, ensuring that help is readily available when you need it.

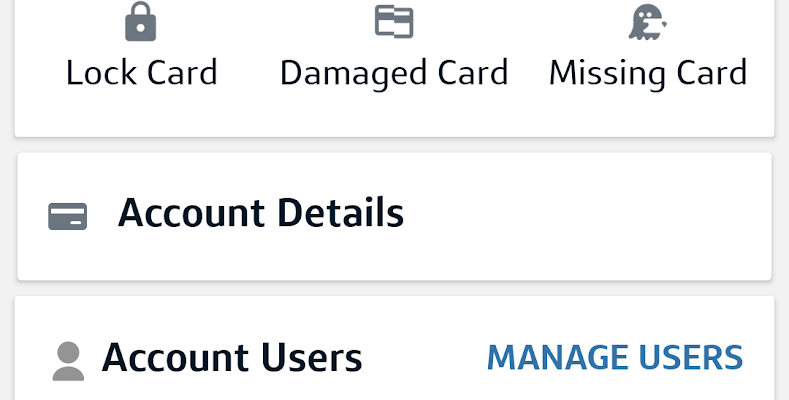

Understanding Security Features

In today’s world, keeping your financial information safe is more important than ever. With the rise of digital transactions, understanding the various protective elements designed to safeguard your sensitive details can make all the difference. These features are like a safety net, ensuring that your assets remain secure and your identity protected from potential breaches.

First and foremost, many cards utilize advanced encryption methods to transmit data. This means that any information shared during a transaction is converted into a code that is nearly impossible to decipher. Alongside this, several issuers employ two-factor authentication, adding an extra layer of protection. By requiring a secondary verification step, like a text message confirmation, it’s much harder for unauthorized users to gain access.

Additionally, technology like chip processing has revolutionized security. These microchips create a unique transaction code each time you make a purchase, making it extremely challenging for anyone to replicate. Furthermore, regular monitoring systems can detect suspicious activity almost in real-time, allowing for immediate action before any significant harm can occur.

Moreover, many providers equip their products with alerts that notify you of transactions as they happen. This immediate feedback enables you to identify any fraudulent activities quickly and take necessary measures. Understanding these protective features can empower you to use services with confidence, creating a safer experience while managing your finances.