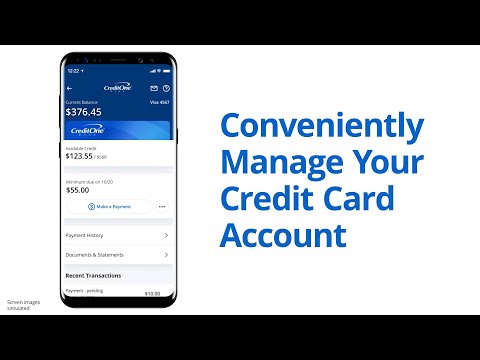

Explore the Convenience of Making Your Credit One Payments Online

In today’s fast-paced world, managing finances has become easier than ever. With the rise of digital solutions, individuals are now able to handle their accounts from the comfort of their homes. This convenience allows for quick and efficient actions, making the whole experience much more enjoyable.

Alright, let’s dive into the ways you can smoothly manage your obligations without any hassle. There are numerous platforms available that streamline the whole process, ensuring that your time is spent on what truly matters. Whether you’re a seasoned user or new to the whole concept, the various tools available can cater to your needs and preferences.

Have you ever wondered how to keep track of your finances? With the right approach, staying on top of your responsibilities is not only achievable but can also be quite simple. Explore the various options that are now at your fingertips, and discover how effortless it can be to stay connected and in control.

Understanding Credit One Online Payments

When it comes to managing your finances, having the ability to handle transactions smoothly is essential. The digital landscape makes it easier to keep track of your obligations and make sure everything is settled on time. Let’s explore how you can efficiently navigate the process of completing your financial responsibilities through an internet-based platform.

- Convenience: Access your account anytime, anywhere. No more waiting in line or dealing with paperwork.

- Speed: Quick processing means that transactions are completed faster, allowing you to focus on other important matters.

- Tracking: Keep a close eye on your history and statements. You can view what you owe, upcoming dues, and past activities with just a few clicks.

Utilizing a web-based approach provides numerous advantages, enabling you to stay organized and informed about your financial commitments. Here are a few vital components to consider:

- Registration: First, ensure you have an active account. If not, it’s simple to create one by providing the necessary details.

- Secure Access: Logging in safely is critical. Make use of strong passwords and enable two-factor authentication for added protection.

- Available Options: Knowing the various methods to settle your dues is beneficial. Choose from bank transfers, debit cards, or other accepted forms.

- Confirmation: Always confirm that your transaction was successful. Look for notification emails or check your account balance after completing the action.

In conclusion, mastering the digital landscape for settling your financial obligations can lead to a stress-free experience. Embrace these tools and enhance your financial management skills!

Benefits of Digital Payment Methods

In today’s fast-paced world, the way we manage our finances is rapidly evolving. Embracing modern solutions has become essential for convenience and efficiency. The shift towards electronic transactions offers a range of advantages that make managing finances much simpler and more accessible for everyone.

One of the standout perks is the speed with which transactions are completed. Gone are the days of waiting for checks to clear or standing in long lines. With just a few taps on a device, individuals can swiftly transfer funds or settle accounts within moments. This immediacy promotes a seamless experience for users and reduces the hassle of traditional methods.

Security is another significant factor. Advanced encryption technologies and authentication processes help safeguard sensitive information. Users can feel more at ease knowing their details are protected against unauthorized access. Moreover, tracking transactions becomes effortless, making it easier to manage budgets and monitor spending habits.

Additionally, the accessibility of various platforms allows users to engage in transactions from virtually anywhere. Whether you’re at home or on the go, having the ability to conduct business at your convenience enhances financial freedom. This flexibility is particularly beneficial in emergency situations or when time is of the essence.

Cost-effectiveness is also a big win. Many digital services come with lower fees compared to traditional banking solutions. This means individuals can save money while managing their expenses efficiently. Over time, these savings can add up, contributing to a more financially sound lifestyle.

Overall, transitioning to electronic solutions empowers users with convenience, speed, and flexibility. As technology continues to advance, embracing these methods not only simplifies day-to-day transactions but also opens up new possibilities for financial management. It’s an exciting time to explore the benefits that these modern approaches can offer!

Steps to Make a Payment Easily

In today’s fast-paced world, managing your financial transactions has never been more straightforward. Whether you’re settling a bill or transferring funds, following a few simple steps can enhance your experience and save you time.

Step 1: Begin by accessing the platform where you wish to execute the transaction. You’ll typically need to log in with your credentials to ensure the security of your account. If you haven’t registered yet, take a moment to create an account before proceeding.

Step 2: Once logged in, navigate to the section dedicated to transactions. Here, you’ll find various options tailored to your needs. Select the one that best fits your requirement, such as making a transfer or settling an invoice.

Step 3: Enter the necessary details for the transaction. This might include the amount, the recipient’s information, and any reference notes that might assist in identifying the purpose. Double-check everything to avoid any mistakes.

Step 4: After confirming the information is correct, proceed to authorize the transaction. You may need to verify your identity through a code sent to your device or use another method of authentication.

Step 5: Lastly, once the transaction is processed, you will receive a confirmation notification. Keep this for your records, as it serves as proof of the action taken.

By following these steps, you can streamline your interactions and make the entire process hassle-free. Embrace the convenience of managing your finances with just a few clicks!