Exploring the Essential Elements and Structure of a Credit Note Format

In the world of business transactions, having a reliable way to track adjustments and corrections can make all the difference. Whether you’re dealing with returns, refunds, or billing adjustments, having a standardized document that clearly communicates these changes is crucial for both parties involved. This type of documentation not only aids in maintaining transparency but also streamlines the reconciliation process.

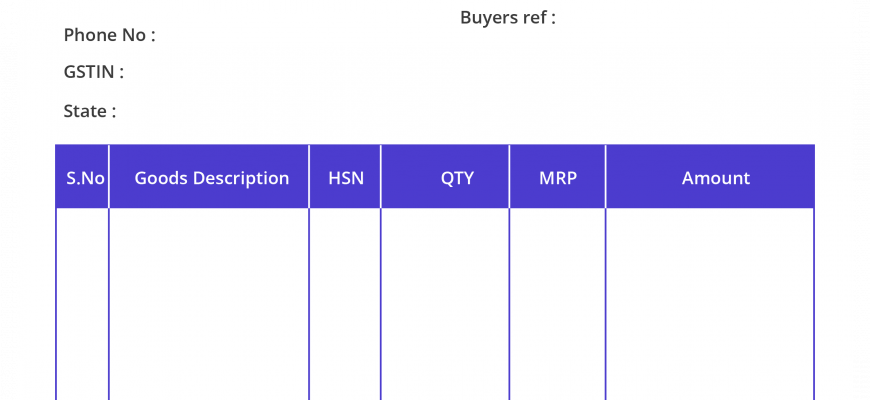

Creating an effective template for such a document should be straightforward yet comprehensive enough to cover all necessary details. It must include essential components like the date, the involved parties, and specific amounts that highlight the adjustments being made. By having a well-structured layout, you can ensure that all pertinent information is presented clearly, fostering better communication and understanding in any transaction.

Moreover, this essential paper serves as a protection mechanism for both buyers and sellers. It acts as proof of agreement and mutual understanding, thus reducing the chances of misunderstandings down the line. So, let’s delve into how to craft this important document effectively and ensure it meets professional standards while reflecting your unique business style.

Understanding Document Essentials

When dealing with finances, it’s important to grasp the key components that make up various transactional documents. These essential papers serve to clarify exchanges, track balances, and maintain accurate records, useful not only for businesses but also for customers. Having a solid understanding of these documents can streamline communication and enhance transparency in financial dealings.

One of the main purposes of such documentation is to provide a clear outline of any adjustments to previous transactions. For instance, when a purchase doesn’t meet expectations or when items are returned, this type of paperwork helps both parties reconcile their accounts. Knowing what to include, such as dates, amounts, and relevant identifiers, is crucial for effective documentation.

Moreover, clarity in such paperwork promotes trust and accountability. When all necessary details are clearly presented, it reduces the chances of misunderstandings and disputes down the line. Remember, maintaining accurate financial records not only aids in better management but also supports smoother interactions with customers or suppliers.

Ultimately, being familiar with these documents means you’re better equipped to navigate the world of transactions confidently. So, next time you find yourself encountering such paperwork, you’ll know just how essential it is to keep everything transparent and organized.

Key Components of a Credit Document

When dealing with financial adjustments, understanding what makes an effective adjustment document is crucial. This piece serves as a formal acknowledgment of a transaction alteration and plays a vital role in maintaining transparency between various parties. Let’s break down the essential elements that should be included to ensure clarity and professionalism.

1. Header Information: Every official document should start with clear identification. Include the name, address, and contact details of the issuing business, along with the recipient’s details. This creates a direct line of communication.

2. Unique Identifier: Each adjustment record should have a specific reference number. This helps in tracking and makes it easier to match with previous transactions in case any discrepancies arise.

3. Date of Issuance: The date when the document is issued is important. It not only marks the official record but also assists in chronological organization for both the issuer and recipient.

4. Reason for Adjustment: Clearly stating why the alteration is being made is essential. Whether it’s due to a return, pricing error, or a promotional discount, transparency here avoids confusion.

5. Amount Adjusted: This section should indicate the specific monetary value being adjusted. Whether it’s an increase or decrease, it’s essential for financial records and understanding the impact on future transactions.

6. Terms and Conditions: If applicable, including any necessary terms or conditions related to the adjustment ensures that both parties are aware of any stipulations that may impact this transaction.

7. Sign-off: Ensure there is a space for the issuer’s signature or a digital verification method. This final touch adds authenticity to the document.

In creating an effective adjustment document, paying attention to these components not only fulfills legal obligations but also fosters trust and clarity in business relationships.

Benefits of Using Credit Notes

When it comes to managing transactions, having a reliable way to handle adjustments is essential for maintaining smooth business operations. These valuable tools offer a structured approach to rectifying billing discrepancies, reimbursing customers, and keeping accurate financial records.

One significant advantage of utilizing these documents is the clarity they provide in communications with clients. By issuing a well-crafted document, businesses can effectively outline the reason for the adjustment, ensuring that customers understand the modifications and trust the integrity of the service provider.

Furthermore, using these adjustments can help strengthen relationships with customers. By promptly addressing issues and offering compensatory solutions, businesses demonstrate their commitment to customer satisfaction. This proactive approach can lead to increased loyalty and repeat business, as clients feel valued and respected.

On the financial side, these adjustments simplify accounting processes. They provide a clear trail of transactions, making it easier to reconcile accounts and prepare financial statements. This not only streamlines operations but also enhances transparency, which is vital for maintaining compliance with financial regulations.

Additionally, these adjustments allow businesses to manage cash flow more effectively. By accurately reflecting returns or discounts, companies can avoid potential overstatements of revenue, which could lead to complications down the line. Ultimately, leveraging these instruments can help organizations maintain healthier financial practices.