Exploring Credit Mutuel’s European Transfer Services and Their Benefits

In today’s interconnected world, moving funds across countries has become a fundamental aspect of personal and business finance. Whether you’re sending money to a friend overseas or making a payment to a supplier in another nation, the process can feel a bit daunting. However, modern financial institutions have streamlined these transactions, making them more efficient and accessible than ever before.

Exploring streamlined processes can help enhance your understanding of how to navigate international transactions with ease. From swift online transfers to mobile apps that allow for immediate transactions, the services available enable users to engage in financial activities without the typical hassles of the past.

Furthermore, getting familiar with the various options at your disposal can lead to substantial benefits. With competitive fees and favorable exchange rates, exploring different service providers can save you both time and money. Whether you’re an occasional sender or someone who regularly handles overseas payments, understanding the nuances can empower your financial decisions.

Understanding Payment Transfers

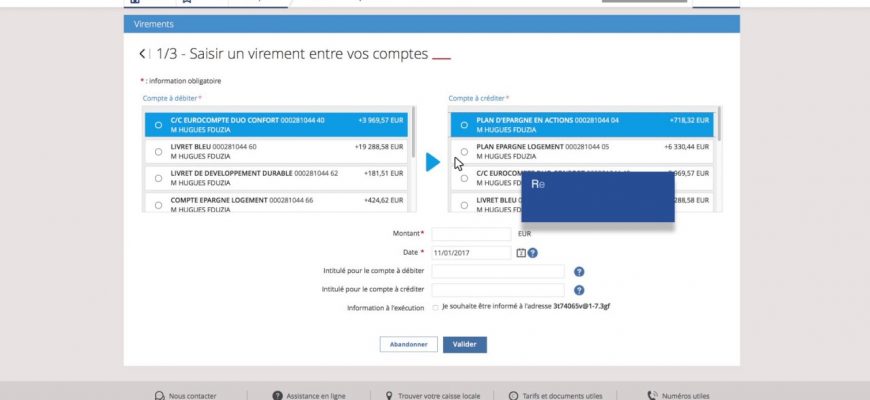

When it comes to moving funds between banks, it can often feel a bit daunting. The entire process usually involves several steps, but once you get the hang of it, it’s fairly straightforward. This type of transaction allows individuals and businesses to send money efficiently across various financial institutions, ensuring that payments are processed quickly and securely.

Different methods exist for transferring funds, each with its own set of features and benefits. Whether you opt for a traditional bank transfer or choose a modern digital solution, the main goal remains the same: to ensure your money reaches its destination safely and in a timely manner. Understanding these methods can help you make informed decisions about your financial interactions.

Fees can vary widely depending on the system you choose, so it’s worth comparing your options. Many institutions offer competitive rates and attractive features, like real-time tracking of your transactions. Utilizing these options can streamline your experience and make managing your finances much simpler.

Becoming familiar with the basics of payment transfers can empower you, especially in today’s interconnected world. You’ll find that knowing how to navigate these services opens doors to more efficient financial practices, whether you’re sending funds for personal reasons or managing business transactions.

How to Make Transfers Across Europe

Transferring funds internationally has become a simple and efficient process. With various options available to send money between countries, you can choose the method that best fits your needs. Here’s a guide to help you navigate the different ways to make cross-border payments smoothly.

- Bank Transfers: Traditional banks offer services for international transactions. Typically, you’ll need to provide the recipient’s IBAN and SWIFT code. Ensure to check the transfer fees and exchange rates beforehand.

- Online Services: Numerous online platforms allow you to send money quickly and often at lower rates. Popular options include PayPal, Wise, and Revolut. These services usually require creating an account and linking it to your bank account.

- Mobile Apps: With the rise of smartphones, transferring funds via dedicated mobile applications has gained popularity. Apps like Venmo or Cash App can facilitate quick transfers, although they may be limited based on location.

- Money Transfer Operators: Companies like Western Union and MoneyGram enable you to send cash directly. This may be a suitable option for recipients who prefer to receive funds in person.

- Cryptocurrency: For those familiar with digital currencies, sending crypto can be a fast and decentralized method of transferring value. However, consider volatility and recipient acceptance when choosing this method.

Each option has its benefits and potential drawbacks, so it’s wise to compare your choices. Taking time to review details such as transfer times and fees will ensure that you make the best decision for your needs.

The Benefits of Using Credit Mutuel Services

When it comes to managing your finances, having reliable options at your fingertips can make a world of difference. Choosing the right financial institution can enhance your experience and provide numerous advantages. Whether you’re dealing with everyday banking needs or looking for more specialized services, partnering with the right provider can lead to a smoother journey.

One of the standout advantages is the accessibility offered by these services. With user-friendly online platforms and mobile applications, customers can easily perform transactions from anywhere, at any time. This level of convenience is particularly valuable for those with busy lifestyles, allowing them to stay on top of their finances without the hassle of traditional banking hours.

Another key benefit is the variety of financial products available. From savings accounts to investment opportunities, clients have the flexibility to choose options that best meet their needs. This ensures that individuals can tailor their financial strategies according to their personal goals, whether that’s saving for a home or planning for retirement.

Additionally, many institutions place a strong emphasis on customer service. Having access to knowledgeable representatives who are ready to assist with inquiries fosters a sense of security and trust. This personal touch can make navigating financial decisions significantly less daunting.

Finally, competitive rates and fees are often a highlight. By opting for these services, clients may enjoy lower charges and better interest rates, which can ultimately lead to greater savings over time. It’s a win-win situation designed to benefit users while they manage their financial well-being.