Exploring the Truth Behind Online Credit Management Scams

In today’s digital age, the pursuit of financial assistance can often lead individuals down questionable paths. With a plethora of options promising quick fixes and easy solutions, it’s easy to get lured into a web of deception. This section aims to shed light on the darker side of seeking financial help through unverified sources.

Many unsuspecting individuals find themselves caught up in schemes that seem legitimate at first glance. With enticing offers and polished advertisements, these ventures play on people’s hopes and needs, ultimately leading them to a dead end. It’s crucial to recognize the subtle signs of these traps and to approach financial opportunities with a discerning eye.

In exploring the pitfalls associated with these misleading services, we will uncover the tactics used by unscrupulous operators. By understanding these methods, you can better protect yourself and make informed decisions when it comes to your financial wellbeing.

Understanding Online Credit Scams

In today’s digital landscape, the allure of quick funds has led many individuals down a treacherous path. It’s crucial to grasp the tactics employed by those who seek to exploit unsuspecting victims. Many people find themselves ensnared in schemes that promise easy approval with minimal requirements, only to discover too late the repercussions of their choices.

These deceptive practices often involve promises of instant cash or unsecured loans with little to no vetting process. Unsuspecting individuals may be lured in by flashy advertisements and persuasive messaging that seem too good to be true. The reality is, these offers frequently conceal hidden fees or outrageous interest rates, leaving victims in even graver financial predicaments.

It’s also common for fraudsters to employ tactics such as phishing emails or fake websites designed to mimic legitimate institutions. This creates a false sense of security, leading individuals to unwittingly share personal information or financial details that can then be misused. Awareness is key to protecting oneself against these scams and ensuring that assistance comes from reliable sources.

Ultimately, staying informed about the warning signs of deceitful practices is essential. Recognizing red flags such as unsolicited offers, pressure tactics, or requests for sensitive information can help individuals navigate the complex world of borrowing without falling victim to scams. Being savvy about these pitfalls empowers people to make safe and informed decisions about their financial needs.

Red Flags of Fraudulent Lending Services

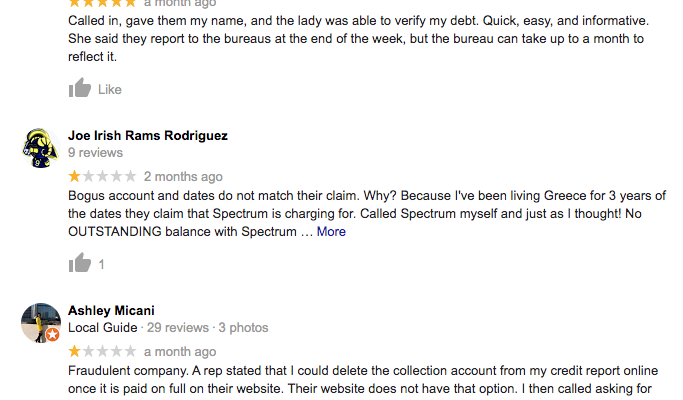

When navigating the landscape of financial offerings, it’s essential to be aware of certain warning signs that may indicate something isn’t quite right. Many individuals seeking assistance may encounter schemes that promise rapid results but often lead to disappointment or loss. It’s crucial to recognize these indicators to protect oneself from potential scams.

One of the most glaring signs is overly aggressive marketing tactics. If you come across a service bombarding you with unsolicited offers, it’s a red flag. Legitimate organizations tend to focus on building trust and typically don’t resort to high-pressure sales techniques. Additionally, beware of companies that guarantee approval regardless of your background. This kind of assurance often proves too good to be true.

Another critical aspect to watch for is the lack of transparency. If you can’t easily find contact information or if the website lacks proper credentials and regulatory disclosures, proceed with caution. Legitimate firms should be transparent about their terms, fees, and services. Furthermore, pay attention to the payment methods they accept. If a company primarily deals in cash or wire transfers, it’s time to question their integrity.

Lastly, consider the overall professionalism of the organization. Poor website design, numerous grammatical errors, and vague language can often indicate that the company isn’t reputable. A trustworthy entity will invest in a polished appearance and clear communication. Being vigilant about these signs can save you from falling prey to unscrupulous entities looking to exploit your financial needs.

Protecting Yourself Against Credit Fraud

In today’s fast-paced digital world, safeguarding your financial information has never been more critical. As technology evolves, so do the methods used by unscrupulous individuals to exploit unsuspecting victims. It’s essential to stay informed and implement strategies that can help you shield yourself from potential threats. Knowledge and vigilance are your best allies in this ongoing battle.

Start by regularly monitoring your financial statements and accounts. Look for any unfamiliar transactions or changes in your credit profile. Promptly address any discrepancies by contacting your financial institution. Setting up alerts for specific activities can provide an added layer of protection, ensuring you’re notified instantly about any unusual actions.

Next, consider taking advantage of identity verification services. These tools can help detect unauthorized uses of your personal details and provide reports on your financial standing. When choosing these services, opt for reputable providers with strong security protocols and positive reviews from other users.

It’s also crucial to use strong, unique passwords for your accounts, combining letters, numbers, and symbols. Regularly updating these passwords can further decrease your vulnerability. Additionally, enable two-factor authentication whenever possible. This extra step adds a significant barrier against intruders looking to access your accounts.

Be wary of unsolicited communications requesting your personal information. Whether it’s via email, phone, or text, always verify the source before sharing any details. Scammers often use deception to lull you into a false sense of security, so staying skeptical can keep you out of harm’s way.

Finally, educate yourself about the latest scams and tactics employed by criminals in the digital landscape. The more you know, the better prepared you’ll be to recognize red flags and respond effectively. Staying informed is a powerful tool in your arsenal against deceitful practices.