Exploring the Benefits and Convenience of Taking Out an Online Credit Loan

In today’s fast-paced world, the need for quick access to funds has grown significantly. Individuals increasingly seek solutions that allow them to secure financial assistance without the hassle of traditional banks. The convenience of borrowing money has transformed, giving rise to innovative approaches that cater to modern needs.

More and more people are turning to technology to streamline their financial experiences. With just a few clicks, you can navigate various platforms designed to provide support when you need it the most. The beauty of this process lies in its accessibility, making it easier for anyone to find the help they require in a timely manner.

From personal expenses to urgent needs, the alternatives available in the digital age offer a new level of flexibility that many find appealing. Whether you’re dealing with unexpected bills or planning for something special, understanding these modern financial tools can empower you to make informed decisions that align with your circumstances.

Understanding the Basics of Digital Financing

In today’s fast-paced world, managing your finances has become more accessible than ever. With the advent of technology, securing funds when you need them has transformed significantly. This section will explore the fundamental concepts surrounding obtaining money through digital platforms, shedding light on how it works and what you should consider before diving in.

So, what do you need to know about this type of financial assistance?

- Convenience: The ability to apply from the comfort of your home, anytime, can save you time and effort. No more waiting in long queues!

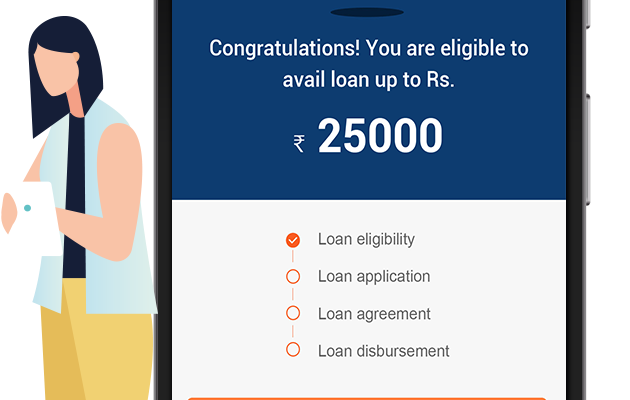

- Speed: Many platforms offer quick processing, allowing you to receive the necessary funds almost immediately.

- Flexible Options: Various types of arrangements are available to suit different needs, whether it’s for unexpected expenses or planned purchases.

- Accessibility: Individuals with varying credit histories may find options that cater to their unique circumstances, broadening the scope for many.

Before you decide, it’s essential to compare different services, rates, and terms. Always read the fine print and understand what you are agreeing to–it can make a world of difference in your financial journey.

In conclusion, embracing digital platforms for financing can be a smart choice, provided you take the necessary steps to ensure it aligns with your needs and financial goals. Happy exploring!

Benefits of Applying for Financial Assistance Online

In today’s fast-paced world, convenience is everything. When it comes to seeking financial solutions, many people prefer to explore options from the comfort of their homes. This approach not only saves time but also offers a range of advantages that traditional methods might lack. Let’s dive into what makes this way of applying for support so appealing.

First and foremost, the ease of access is unmatched. With just a few clicks, applicants can compare various offerings, check eligibility, and complete applications without navigating through long lines or extensive paperwork. This streamlined process makes it simpler to find suitable options that align with individual needs.

Additionally, flexibility plays a significant role. Applicants can engage in the process whenever it fits their schedules, whether early in the morning or late at night. This adaptability ensures that people can focus on their finances at times that are most convenient for them, reducing stress and enhancing decision-making.

Moreover, there’s an element of privacy that many appreciate. Applying for monetary support can be a sensitive matter, and the ability to do it discreetly can make individuals feel more comfortable. This aspect often encourages more honest assessments of one’s financial situation.

Finally, many online platforms offer instant feedback. This means that applicants can receive quick responses, allowing them to make informed decisions without unnecessary delays. Fast processing times help individuals take control of their situations more efficiently, moving towards their financial goals sooner.

Tips for Choosing the Right Loan Provider

Finding the ideal financial partner can make a world of difference when you need assistance. With so many options available, it’s essential to navigate the selection process wisely. Here are some thoughtful suggestions to help you make an informed decision and secure the support you need.

1. Research and Reviews: Take your time to explore various providers by examining their reputations. Look for customer feedback, testimonials, and ratings on trusted platforms. This insight will give you a clearer picture of their reliability and service quality.

2. Compare Offers: Don’t settle for the first option you encounter. Compare different proposals to understand the terms, fees, and interest rates. A little effort in this stage can lead to substantial savings over time.

3. Transparency: Opt for companies that are open about their terms and conditions. A trustworthy provider will clearly outline all fees and responsibilities upfront, ensuring you won’t face any surprises later on.

4. Customer Support: Consider the level of support available. It’s vital to have accessible assistance if you encounter any issues or have questions. A provider with excellent customer service can enhance your overall experience.

5. Flexibility: Look for options that offer flexibility in repayment plans. Life can be unpredictable, so having choices can relieve stress and make repayments more manageable.

6. Trustworthiness: Ensure the provider you choose is licensed and regulated. This adds an extra layer of security and helps you feel confident in your choice.

By keeping these tips in mind, you can confidently select a financial partner that aligns with your needs and ensures a smoother experience. Happy searching!