Exploring Business Credit Lines – Unlocking Financial Opportunities for Growth and Expansion

In the ever-evolving world of entrepreneurship, having access to extra funds when you need them can make all the difference. Whether it’s to seize a new opportunity, manage unexpected expenses, or simply maintain a steady cash flow, financial solutions designed for immediate access can serve as a valuable tool for owners. Having the right funding options at your disposal ensures that your venture remains agile and able to respond to market demands.

When considering various funding approaches, one method stands out for its versatility and ease of access. This approach allows owners to draw on available funds whenever necessary, providing a cushion for those unexpected twists that come with running a venture. The ability to tap into capital without the pressures of a traditional loan can empower entrepreneurs to make decisions that drive growth and stability.

Understanding the nuances of this flexible funding option is essential for anyone looking to navigate the complexities of financial management. Whether you’re considering it for everyday expenses or larger investments, knowing how it works and what it offers can help you make informed choices that benefit your enterprise in the long run. Additionally, being aware of the conditions and requirements can position you to take full advantage of this promising avenue.

Understanding Business Credit Lines

When it comes to managing finances, many entrepreneurs look for flexible options that can help them navigate the ups and downs of operations. These financial tools provide an opportunity to access needed funds without the pressure of a traditional loan. Instead of receiving a lump sum, you have the freedom to draw from a predetermined amount as required, making it easier to cover unexpected expenses or take advantage of new opportunities.

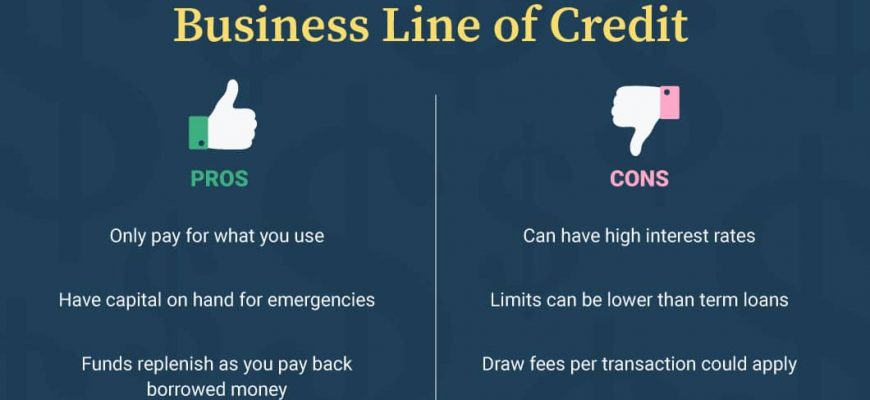

One of the main advantages of this financial arrangement is its adaptability. You can borrow what you need when you need it, and you only pay interest on the amount you actually use. This flexibility can be a game-changer, especially during periods when cash flow may be unpredictable. Additionally, it can assist in managing day-to-day expenses or investing in growth initiatives without the burden of long-term commitments.

Understanding the terms and conditions is crucial. It’s important to be aware of factors like repayment options, interest rates, and any potential fees. By familiarizing yourself with these aspects, you can make informed decisions that align with your financial strategy and goals. Utilizing such services wisely can contribute significantly to the stability and growth of your enterprise.

Advantages of Utilizing a Flexible Financing Option

When it comes to managing funds, having access to a reliable source of capital can make a world of difference. Utilizing a flexible financing option can provide a safety net, allowing you to navigate unexpected costs or seize new opportunities without missing a beat. This resource not only eases financial pressures but also enhances the overall stability of your monetary strategies.

One of the standout benefits is the versatility it offers. Whether you’re facing seasonal fluctuations or sudden project demands, having these funds readily available means you can respond swiftly. This agility is crucial in today’s fast-paced environment, where timing can significantly influence success.

Moreover, this type of financial tool often comes with lower interest rates compared to other lending methods. This helps you save money in the long run, allowing for more investments in growth and development. Additionally, the convenience of withdrawing only what you need means you maintain control over your expenses.

Another noteworthy advantage is that it can positively impact your creditworthiness. Responsible usage and timely repayments can enhance your financial credibility, making it easier to access even larger sums in the future. This can lead to better terms and conditions down the road.

In summary, leveraging a flexible financing resource not only addresses immediate financial needs but also sets the stage for long-term growth, making it a smart choice for anyone looking to secure their financial future.

How to Apply for Credit Lines

Getting access to additional funds can be a game-changer for your company. Whether you’re looking to expand, manage cash flow, or invest in new opportunities, knowing how to navigate the application process is essential. It might seem overwhelming at first, but with the right approach, you can increase your chances of receiving favorable terms.

Step 1: Evaluate Your Needs

Before jumping into applications, take a moment to assess your financial requirements. Determine how much capital you need and what you plan to use it for. This clarity will help you choose the most appropriate options available to you.

Step 2: Check Your Financial Standing

Next, review your financial health. Lenders will look at your credit history, income statements, and overall financial stability. Ensuring that your records are accurate and up-to-date can significantly impact the approval process.

Step 3: Research Your Options

Not all offers are created equal. Spend some time researching different facilities that align with your goals. Look for favorable interest rates, terms, and conditions that suit your financial strategy.

Step 4: Prepare Your Documentation

Gather necessary documents, such as tax returns, bank statements, and any business plans. Having these ready can streamline your application and demonstrate your preparedness to lenders.

Step 5: Submit Your Application

Once everything is in order, it’s time to submit your request. Fill out all forms accurately and provide any additional information the lender may require. Don’t hesitate to clarify any doubts you might have during this phase.

Step 6: Follow Up

After submitting, keep the lines of communication open. A quick follow-up can show your enthusiasm and commitment. Be prepared to answer any questions that may arise during their review process.

With these steps, you can successfully navigate the application journey and unlock the financial resources you need to propel your venture forward. Remember, each lender has its nuances, so stay adaptable and informed throughout the process.