Exploring the Pathways of Your Credit Journey

Navigating the landscape of personal finance can often feel overwhelming. From understanding the nuances of loans to managing expenses, there’s a lot to grasp. The process of building a solid foundation for your financial health is essential for achieving your goals and ensuring a stable future.

As you embark on this exciting venture, it’s important to equip yourself with knowledge and strategies. The steps you take now will shape your financial landscape, allowing you to thrive in various aspects of your life. Embracing informed decisions can empower you to take control and steer your finances in the right direction.

In this exploration, we will delve into the essential components of managing your finances effectively. By examining practical tips and insights, you’ll uncover how to enhance your financial literacy and make sound choices that align with your aspirations. Each decision you make will play a crucial role in crafting a secure and prosperous future.

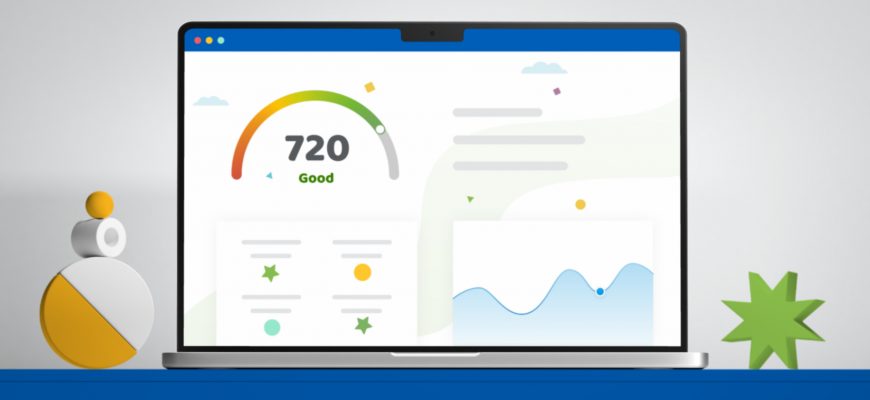

Understanding Scores and Reports

Let’s dive into the world of financial ratings and evaluations. These elements play a pivotal role in shaping your monetary life, influencing everything from loan approvals to interest rates. Getting to grips with what they are and how they work can empower you in making smarter financial choices.

Scores are numerical representations that reflect your financial behavior over time. Think of them as a snapshot of how well you manage your obligations and commitments. A higher number typically indicates lower risk to lenders, while a lower figure might raise some red flags. Understanding the factors that influence this score is key to improving it.

On the other hand, reports provide a detailed history of your financial activities. These documents outline your transactions, payment history, and the types of credit you’ve utilized. Regularly reviewing your report can help you spot inaccuracies, track your progress, and understand patterns that might affect your score.

Both elements are critical in the financial ecosystem. By taking the time to learn about them, you set yourself up for future success and better financial health. Remember, knowledge is power when it comes to navigating this landscape!

Building a Strong Financial History

Establishing a reliable financial background is crucial for unlocking various opportunities in life. It plays a significant role in determining how institutions perceive your financial responsibility. A solid record not only opens doors to better loans but also ensures a smoother experience when making significant purchases or investments.

One effective way to lay the groundwork is by consistently managing your obligations on time. Making timely payments on bills and other responsibilities shows lenders that you can be trusted. Starting with small, manageable amounts will help you build a positive reputation without overwhelming yourself. It’s all about demonstrating that you can handle what you have and progressively taking on more as you gain confidence.

Another strategy is to keep your credit utilization ratio low. This means not maxing out your available limits and working to maintain a balance that reflects healthy use of the funds at your disposal. Institutions prefer to see that you are not overly reliant on borrowed funds, which indicates responsible financial behavior.

It’s also a good idea to review your records regularly. This allows you to spot any inconsistencies or potential issues before they escalate. Keeping an eye on your progress helps you stay informed and make necessary adjustments to your financial habits.

Overall, the path to a robust history lies in responsible habits, regular monitoring, and a clear understanding of how financial practices impact your future opportunities. With the right approach, you can cultivate a strong standing that benefits you for years to come.

Strategies for Improving Financial Health

When it comes to enhancing your financial standing, there are several effective approaches you can take. Whether you’re aiming to boost your reputation in the financial world or simply want to manage your funds better, adopting a few smart tactics can make a significant difference. Let’s explore some methods to help you on this path.

First, paying your bills on time is crucial. Late payments can lead to negative marks that affect your overall status. Setting up reminders or automatic payments can help you stay on track and avoid any slips.

Next, keeping an eye on your overall usage ratio is wise. Aim to use no more than 30% of your available credit. By managing your debt relative to your limits, you’ll demonstrate responsibility and improve your overall standing.

Regular monitoring of your financial records is also important. Checking for errors and being aware of your financial activities allows you to dispute any inaccuracies, ensuring that your status reflects your true financial behavior.

Consider diversifying your financial accounts as well. Having a mix of different types of accounts, such as installment loans and revolving credit, can enhance your overall standing, showcasing your ability to manage various financial obligations.

Finally, seek professional guidance if needed. Financial experts can provide tailored advice and strategies that align with your unique situation, helping you navigate the complexities and work towards your financial goals. Being proactive and informed will set you on the right path to improving your financial health.