Exploring the Benefits of Online Payment Solutions for Credit Human Customers

In today’s fast-paced world, the landscape of financial exchanges is undergoing a transformation. More and more individuals are seeking seamless solutions that cater to their needs without the hassle of traditional methods. This evolution brings forth innovative approaches that make it easier for people to manage their resources and conduct transactions efficiently.

It’s fascinating to observe how technology has made our lives simpler, especially when it comes to handling finances. The advent of sophisticated platforms allows users to engage in various monetary activities with just a few taps on their devices, removing barriers and enhancing convenience. Consumers are increasingly favoring these inventive systems, as they promise not only speed but also a remarkable level of safety.

As we dive deeper into this fascinating topic, we will explore the various aspects and benefits of these progressive alternatives, shedding light on how they revolutionize our interactions with money. From enhanced accessibility to cutting-edge security features, there’s a lot to discover in this rapidly evolving financial ecosystem.

Understanding Credit Human Online Payment

In the digital era, facilitating transactions has transformed into a seamless experience that goes beyond traditional methods. This section aims to shed light on innovative techniques that simplify the way individuals engage in financial exchanges without the need for physical presence. The convenience offered by these approaches allows for transactions to be executed swiftly and efficiently, catering to the fast-paced lifestyle of today’s society.

Utilizing advanced technology, various platforms now enable people to send and receive funds effortlessly. These systems not only enhance accessibility but also provide enhanced security measures that protect sensitive information. Individuals can manage their finances from the comfort of their homes or on-the-go with just a few taps on their devices, making it incredibly user-friendly.

Understanding these systems involves recognizing the core components that contribute to their functionality. Users often interact with specialized tools that streamline the authorization process, allowing for instant approvals without cumbersome procedures. This results in a more enjoyable experience and promotes trust in the service being provided.

Moreover, the integration of diverse payment options caters to a wide audience, ensuring that everyone can participate in this modern approach to finance. Whether opting for direct transfers or leveraging electronic wallets, individuals can choose what works best for them.

As we delve deeper into this topic, it becomes clear that the evolution of transaction methods continues to shape our interactions with money. The ease and efficiency introduced by these digital solutions have not only revolutionized the way we handle finances but also set a new standard for customer expectations in the realm of monetary exchanges.

Benefits of Digital Payment Solutions

In today’s fast-paced world, the rise of innovative transactions has transformed the way we handle our finances. These modern solutions bring a multitude of advantages that simplify our purchasing experiences, making them faster and more convenient than ever before.

One of the standout features is the speed of transactions. Gone are the days of waiting in long lines or dealing with delays; everything can be completed with just a few taps on your device. This efficiency not only saves time but also enhances user satisfaction.

Moreover, the convenience factor cannot be overstated. With just a smartphone or computer, individuals can carry out their transactions from anywhere, anytime. This flexibility empowers users, allowing them to manage their budgets and expenses more effectively.

Additionally, security measures are continuously improving. Advanced technologies protect sensitive information, giving users peace of mind while they conduct their financial activities. The implementation of encryption and multi-factor authentication further bolsters confidence in these systems.

Another noteworthy aspect is the reduction in physical cash handling. Digital solutions minimize the need for coins and notes, supporting cleanliness and hygiene–especially pertinent in today’s health-conscious environment. Plus, it encourages responsible spending habits through detailed tracking of expenses.

Ultimately, embracing these modern transactional methods not only enhances individual experiences but also contributes to a more efficient economy. As society continues to evolve, the benefits of these systems will only become more pronounced, making them an integral part of our financial future.

How to Use Financial Services

Engaging with financial platforms has never been easier, and many individuals are discovering the wide range of tools and resources available at their fingertips. Whether it’s managing your funds, keeping track of expenses, or accessing loans, there’s a whole system designed to make your life simpler and more organized. Let’s explore how you can take full advantage of these services.

Step 1: Sign Up

First things first, you’ll need to create an account. All you have to do is visit the service provider’s website or app, provide your information, and set up your profile. Make sure to choose a strong password to protect your data, and don’t forget to verify your identity as required.

Step 2: Explore Features

Once you’re in, take some time to familiarize yourself with what’s offered. Look for user-friendly dashboards, budgeting tools, or even investment options that might catch your eye. These features can help you keep better track of your financial activities and make more informed decisions.

Step 3: Set Up Transactions

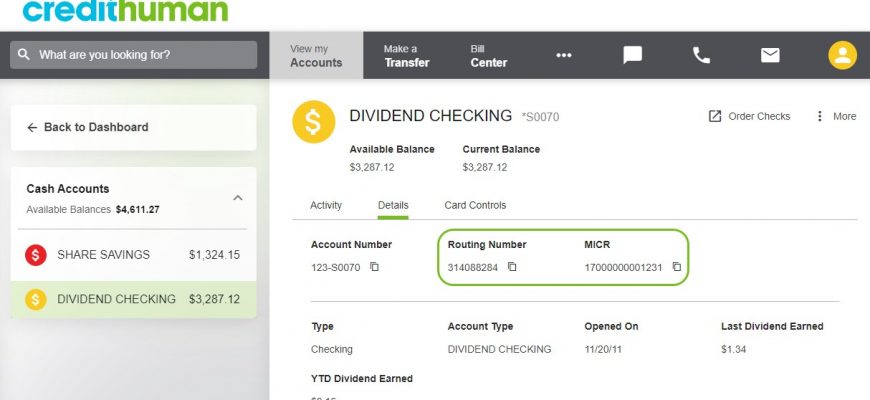

Next, it’s time to set up your transactions. Add your bank account or link any other necessary accounts. This will enable you to transfer funds seamlessly or access other financial products. Always double-check the information you provide to avoid any mishaps.

Step 4: Monitor Your Progress

Regularly check your accounts and monitor your financial health. Most platforms offer analytics that can give you insights into your spending habits. Use this information to adjust your budget, pay off debts, or save for future goals.

Step 5: Customer Support

If you run into any issues or have questions, most services come with robust customer support teams. Don’t hesitate to reach out via chat, email, or phone. They are there to help you navigate through any challenges you might face.

By following these steps, you can efficiently utilize these modern financial tools. Take control of your finances today and enjoy the convenience they bring to your daily life!