Discover the Magic of Credit Genie Online for Effortless Financial Management and Solutions

In today’s fast-paced world, many individuals find themselves in need of assistance when it comes to managing their monetary affairs. Whether it’s securing funds for an unforeseen expense or planning for future endeavors, having a reliable source of support can make all the difference. This section delves into the various ways one can access the help they need without the usual hassles associated with traditional methods.

Imagine having a resource that not only offers you options when times get tough but also empowers you to make informed decisions. It’s all about simplifying the process, enhancing your grasp on personal finance, and ultimately guiding you toward greater financial health. We’re here to explore the innovative approaches available for obtaining necessary backing with ease and confidence.

So, if you’re curious about the possibilities that modern solutions can offer in the realm of finances, you’ve come to the right place. Get ready to uncover tools and strategies that can lighten your burden and open doors to new opportunities, all at your fingertips.

Understanding Financial Assistance Services

When it comes to navigating the world of loans and credit, many people find themselves facing a mountain of questions and uncertainties. That’s where specialized support comes into play. These services are designed to help individuals make informed decisions about their financial options, ensuring they have access to the resources they need to improve their monetary standing.

One of the primary offerings includes personalized guidance tailored to individual circumstances. Whether you’re looking to consolidate debts or secure a loan for a major purchase, these providers analyze your financial profile and present available solutions that match your needs. This targeted approach can significantly streamline the process and eliminate frustration.

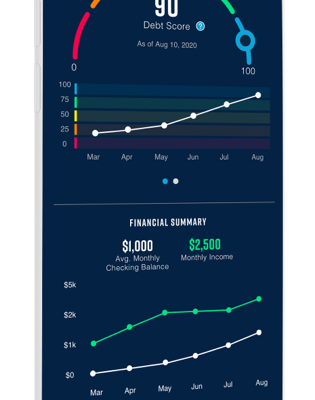

Moreover, many of these services provide educational resources to enhance your understanding of credit scores, loans, and financial management. Becoming well-versed in these areas empowers individuals to take charge of their financial lives, ultimately promoting better financial health and stability.

In addition, some platforms offer tools that allow users to assess their eligibility for various funding options. By inputting relevant information, you can get a clearer picture of what is attainable, making the entire experience more transparent and user-friendly.

The emphasis on customer support is another key aspect. Professionals in this field are ready to address concerns, guide you through each step, and ensure that you feel confident in your choices. This level of assistance can make a world of difference, especially for those who are new to the financial landscape.

Overall, utilizing these services can provide a clearer path through the often confusing terrain of financing, helping individuals achieve their monetary goals with greater ease and confidence.

How to Sign Up for Your Financial Assistant

Getting started with your virtual financial helper is a breeze! This process is designed to be user-friendly, making it accessible to everyone, regardless of their experience. Whether you’re looking to manage your finances better or keep track of your progress, the sign-up journey is straightforward and quick.

Step 1: Visit the official website of your future financial guide. Once you’re there, look for the registration section. It’s usually prominently displayed to catch your attention.

Step 2: Fill out the required information, such as your name, email address, and a secure password. Make sure to choose a strong password to protect your account. Tip: Use a mix of letters, numbers, and symbols for added security!

Step 3: After completing the form, you’ll likely receive a confirmation email. Be sure to check your inbox (and spam folder, just in case) to verify your account. Click the link provided in the email to activate your profile.

Step 4: Once your account is activated, you can log in and start exploring all the amazing features available to you. Take your time to become familiar with the tools and resources offered.

By following these simple steps, you’ll be well on your way to utilizing your new financial companion in no time!

Benefits of Using a Financial Wizard

Exploring various financial tools can significantly enhance your money management strategies. One of the standout options available today simplifies the process of obtaining monetary assistance and helps you make informed decisions. This service brings a wealth of advantages, making it a popular choice for many seeking financial solutions.

First and foremost, convenience plays a crucial role. Accessing assistance through a user-friendly platform allows you to handle your financial queries anytime and anywhere. No more long lines or wait times; everything is just a few clicks away.

Additionally, you gain access to a wide range of resources and personalized recommendations tailored to your unique needs. This way, you can explore various options that fit your financial situation and goals. It’s like having a personal advisor right at your fingertips.

Moreover, transparency is a key feature. The platform provides clear information about terms, rates, and potential outcomes, empowering you to make decisions based on trustworthy data. No hidden fees or confusing jargon here–just straightforward guidance.

Finally, the level of security offered ensures that your personal information remains protected. This peace of mind allows you to focus on your financial well-being without worrying about the safety of your data.