Acknowledging the Significance of Credit in Understanding Meaning

Understanding the nuances of what we perceive is essential to our interactions and relationships. When we delve into the layers of significance behind our actions and words, we uncover a richer tapestry of experiences. This exploration invites us to consider how context shapes our perceptions and influences our decisions.

Every gesture, statement, or interaction carries weight beyond its surface. It opens a door to deeper connections and fosters empathy. By examining these layers, we can appreciate the subtleties that define our communication. In essence, grasping this concept can transform the way we relate to others and ourselves, enhancing our lives in numerous ways.

In this discussion, we will navigate through various aspects related to perception and interpretation. We’ll explore how our understanding evolves, influenced by culture, experience, and individual perspective. This journey into comprehension encourages us to think critically and compassionately, enriching our interactions and creating a more connected world.

The Importance of Trustworthiness in Modern Society

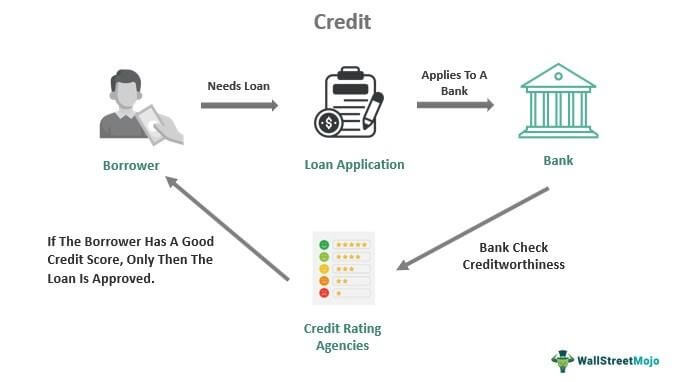

In today’s world, the ability to rely on individuals and institutions plays a critical role in the functioning of our daily lives. Whether we are making big purchases, borrowing funds, or engaging in various transactions, having a solid foundation of assurance shapes our interactions and decisions. This fundamental aspect influences not only personal relationships but also business dealings and economic growth.

When individuals possess a good standing, it opens up opportunities for them. From securing loans to gaining access to better housing options, a reliable reputation can significantly impact one’s quality of life. In a society where financial engagement is essential, this assurance acts as a bridge, enabling smoother collaborations and boosting overall confidence among participants.

Furthermore, the significance of trustworthiness extends to organizations as well. Companies that demonstrate sound financial practices tend to attract more clients and investors, leading to a thriving ecosystem. A firm with a strong standing is often viewed more favorably, creating an environment where innovation and growth can flourish. Thus, maintaining a trustworthy image becomes vital for all parties involved, paving the way for mutual success.

Understanding Scores and Their Impact

When it comes to financing and personal borrowing, there’s a numerical assessment that plays a crucial role in shaping your opportunities. This number reflects your financial behavior and influences how lenders view you. It’s more than just a figure; it can open doors or close them, depending on how well you’ve managed your financial responsibilities in the past.

These assessments are based on various factors, including payment history, amounts owed, length of credit history, and new credit inquiries. Each of these elements weaves together to create a holistic picture of your financial habits. Understanding how they work can empower you to make informed decisions that align with your goals.

The implications of these assessments extend beyond loan approvals. They can affect rental applications, insurance premiums, and even employment opportunities in some cases. Therefore, maintaining a favorable score is essential for achieving long-term financial security and flexibility. As you navigate through financial responsibilities, being aware of how your actions contribute to this number can help you steer your choices effectively.

How to Build and Maintain Good Credit

Establishing and nurturing a solid financial reputation can open many doors in life. Whether you’re eyeing a new home, a car, or simply want to secure better loan terms, having a trustworthy standing can make all the difference. It’s all about understanding the steps to take and the habits to embrace for long-lasting success.

Start with Your Payment History. One of the easiest ways to build a positive reputation is by making timely payments. Prioritize all your bills, including utilities and loans. Setting up reminders or automatic payments can help ensure you never miss a deadline.

Diversify Your Accounts. Having a mix of different types of accounts, such as credit cards and installment loans, can demonstrate your ability to manage various financial responsibilities. Just ensure that you only take on what you can handle, as too many accounts may lead to potential pitfalls.

Keep Balances Low. Aim to utilize a small percentage of your available limits on revolving accounts. This shows lenders that you aren’t overly reliant on borrowed funds, which can positively impact your financial impression.

Regularly Review Your Reports. Monitoring your financial records allows you to catch any errors that could affect your standing. If you spot anything suspicious, address it immediately. This proactive approach can safeguard your status.

Avoid Unnecessary Inquiries. Each time you apply for new financing, a check is conducted. Limit the number of applications you submit within a short timeframe, as excessive inquiries can raise concerns among potential lenders.

Staying informed and practicing good habits can greatly enhance your financial reputation. Remember, it’s the small, consistent efforts that accumulate to build a strong foundation for your financial future.