Exploring Credit Options Available for Paypal Transactions

In today’s fast-paced world, managing expenses and making purchases can sometimes feel overwhelming. This is especially true when unexpected bills or last-minute decisions arise. Having options to navigate these situations can provide valuable peace of mind, allowing individuals to take charge of their finances without the stress.

With a variety of financial solutions available, users can explore alternatives that offer convenience and ease. These services often empower people to make immediate transactions while also providing a safety net for those times when cash flow may be tight. What if you could enhance your buying power and have more control over your spending habits? It’s all about optimizing your financial strategy.

As technology continues to evolve, new opportunities emerge that cater to the diverse needs of modern consumers. By embracing these advancements, individuals can not only streamline their payment processes but also gain greater financial independence. Let’s delve into the exciting possibilities that allow for smarter financial decisions today.

Understanding PayPal Credit Features

When it comes to managing your finances online, having a flexible payment option can make a world of difference. This alternative payment solution offers unique benefits that can help you navigate your purchases with greater ease. It’s designed to provide you with the spending power you need while allowing you to pay in a way that suits your financial situation.

One of the standout aspects of this service is its ability to offer promotional financing. You might find enticing offers such as no interest for a certain period on qualifying purchases. This can be incredibly advantageous when you need to make a larger investment but prefer to spread out your payments over time without incurring extra charges.

Another notable feature is the seamless integration with your online shopping experience. With just a few clicks, you can opt for this payment method at checkout, enhancing convenience. Plus, it’s accessible for a broad range of transactions, making it a versatile choice for various types of purchases.

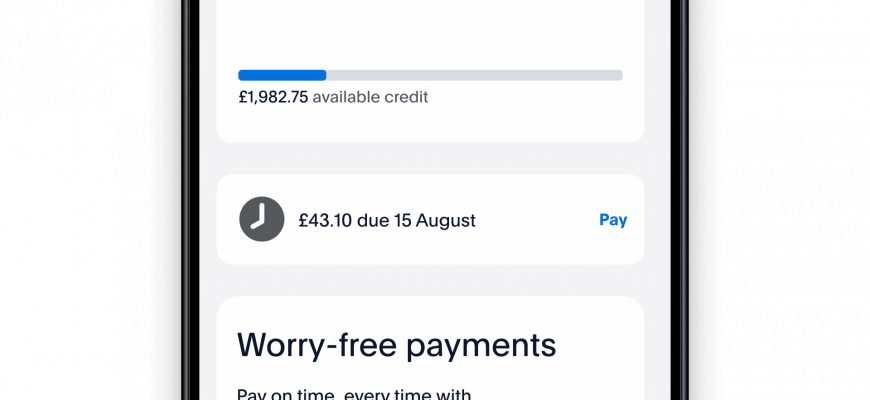

Additionally, this service often comes with a user-friendly mobile app, allowing you to track your spending and manage payments on the go. You can easily view your account balance, upcoming payments, and transaction history, giving you complete control over your financial activities.

Lastly, responsible usage of this service can help in building your purchasing power over time. By making on-time payments and managing your balance effectively, you can create a positive track record that may prove beneficial for your future financial plans.

How to Apply for PayPal Credit

If you’re looking to make purchases or manage your finances a bit more flexibly, there are options available that can help you achieve your goals. One of the simplest ways to go about this is by exploring an application process that provides you with access to a financial solution tailored to your needs. Let’s break down the steps involved in getting started.

-

Visit the Official Website

Navigate to the official site where you’ll find a dedicated section for applications. Make sure you’re on the right page to avoid any confusion.

-

Create or Log In to Your Account

If you don’t already have an account, you’ll need to register. It’s a straightforward process, just follow the prompts. Existing users can simply log in.

-

Fill Out the Application Form

You’ll encounter an application form that needs your personal details. Be prepared to provide information such as:

- Name

- Email Address

- Phone Number

- Social Security Number

- Income Details

-

Review Your Information

Take a moment to double-check everything you’ve entered. This step is crucial to avoid any potential issues later on. Make sure all your details are accurate!

-

Submit Your Application

Once you’re confident that everything is in order, go ahead and submit your application. After submitting, you may receive a decision quickly, so keep an eye on your inbox!

By following these steps, you can access the financial options that suit your purchasing needs. Remember, it’s always a good idea to read the terms and conditions beforehand, ensuring you fully understand what you’re signing up for.

Benefits of Using Financing Options

When it comes to making purchases online, having flexible financial choices can greatly enhance your shopping experience. By providing alternative funding methods, users can enjoy their favorite items without the immediate burden of a substantial payment. It’s all about making life easier and smoother while ensuring you have access to what you want.

One significant advantage is the ability to manage your expenses across multiple payments. This allows shoppers to invest in larger products or services while maintaining control over their budget. Spreading the cost over time can make high-ticket items more accessible and less daunting.

Another perk is often the availability of promotional offers, such as interest-free periods. These enticing deals can present a golden opportunity to acquire desired products without incurring extra charges if you pay off the balance within a specified timeframe. It’s a win-win for those looking to optimize their spending!

Additionally, using these financing services can help build a positive financial history. Establishing a good track record can be incredibly beneficial for future transactions or loans. Consistently making timely payments demonstrates responsibility and can open doors to even more advantageous options down the road.

Lastly, the convenience factor cannot be overstated. Whether you’re buying that new gadget or booking a getaway, having diverse payment methods at your fingertips means less hassle and more enjoyment. Simplifying transactions ensures you can focus on the excitement of your purchases instead of worrying about how to fund them.